Intro

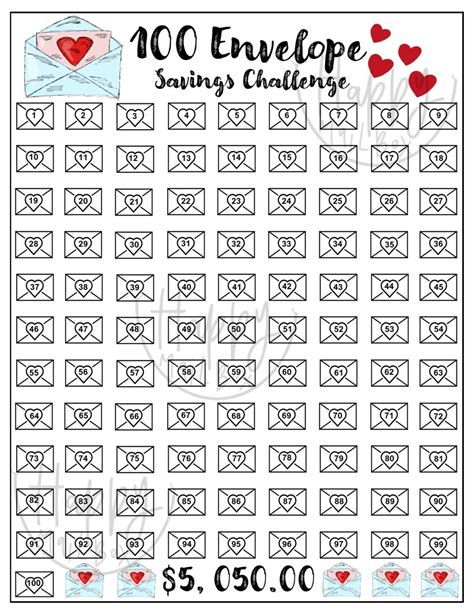

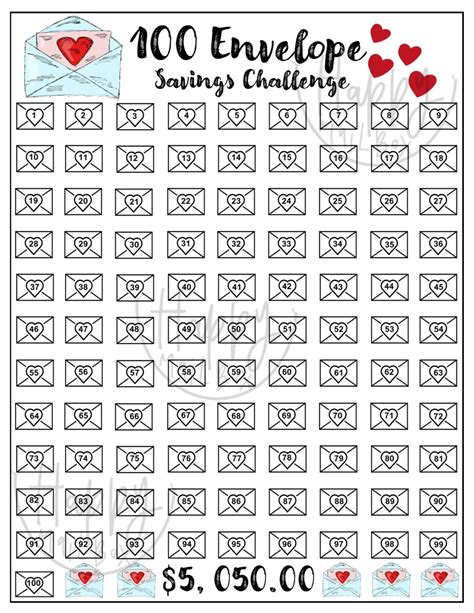

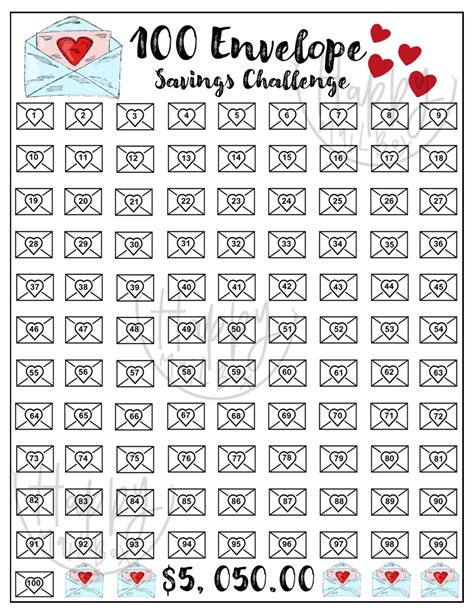

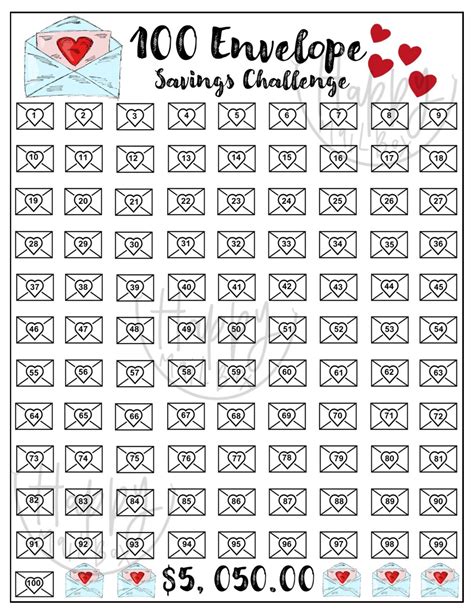

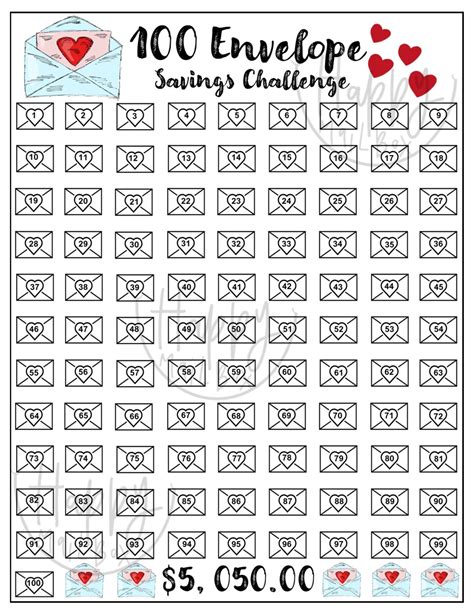

Boost your savings with the 100 Envelope Savings Challenge! This free printable template helps you save $5,050 in 100 days. Learn how to create a savings plan, track progress, and stay motivated. Ideal for budgeting, financial planning, and debt reduction. Get started with this fun and rewarding savings challenge today!

Saving money can be a daunting task, especially when you're trying to make ends meet. However, having a clear plan and a fun approach can make all the difference. That's where the 100 Envelope Savings Challenge comes in – a creative and interactive way to save money over time. In this article, we'll explore the benefits of this challenge, how it works, and provide a free printable template to get you started.

The 100 Envelope Savings Challenge is a simple yet effective way to save money by filling 100 envelopes with an increasing amount of cash each week. This challenge is perfect for those who struggle with saving money or need a fresh start. By following this challenge, you'll be able to save a significant amount of money in just a few months, which can be used for emergencies, big purchases, or long-term investments.

How the 100 Envelope Savings Challenge Works

The challenge is straightforward: you'll need 100 envelopes, a pen, and a commitment to saving money. Here's a step-by-step guide to get you started:

- Number the envelopes from 1 to 100.

- Each week, fill the corresponding envelope with the same number of dollars as the envelope number. For example, in week 1, you'll put $1 in envelope #1, in week 2, you'll put $2 in envelope #2, and so on.

- Seal the envelope and store it in a safe place.

- Repeat the process for 100 weeks, and you'll have saved a significant amount of money.

Budgeting Tips to Help You Succeed

While the 100 Envelope Savings Challenge is a fun and interactive way to save money, it's essential to have a solid budget in place to ensure you can afford to set aside the required amount each week. Here are some budgeting tips to help you succeed:

- Track your expenses to understand where your money is going.

- Create a budget plan that accounts for all your necessary expenses.

- Prioritize your expenses, focusing on essential spending such as rent/mortgage, utilities, and groceries.

- Cut back on unnecessary expenses, such as dining out or subscription services.

- Use the 50/30/20 rule: 50% of your income for necessary expenses, 30% for discretionary spending, and 20% for saving and debt repayment.

Benefits of the 100 Envelope Savings Challenge

The 100 Envelope Savings Challenge offers several benefits that can help you achieve your financial goals. Here are some of the advantages of this challenge:

- Develops a savings habit: By committing to save a specific amount each week, you'll develop a savings habit that can help you achieve long-term financial success.

- Visual progress: Seeing the envelopes fill up with cash can be a powerful motivator, helping you stay on track with your savings goals.

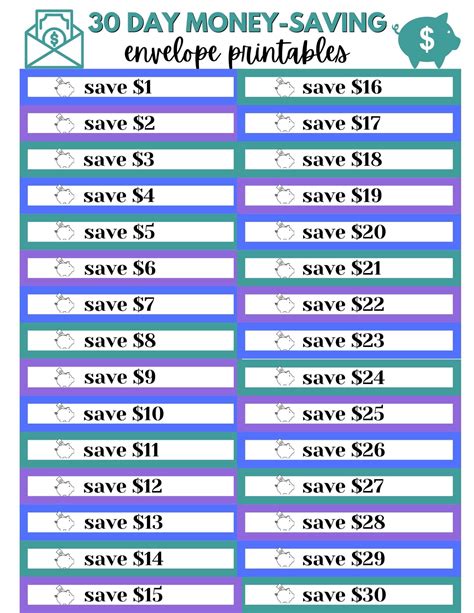

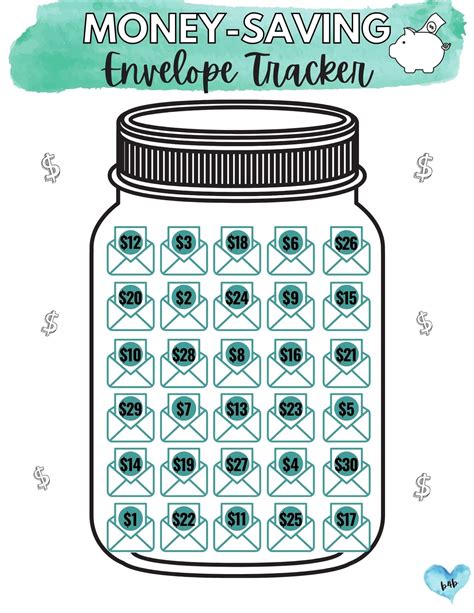

- Flexibility: You can adjust the challenge to fit your needs and budget. For example, you can use fewer envelopes or reduce the amount you save each week.

- Emergency fund: The money you save during the challenge can be used as an emergency fund, providing a safety net in case of unexpected expenses or financial setbacks.

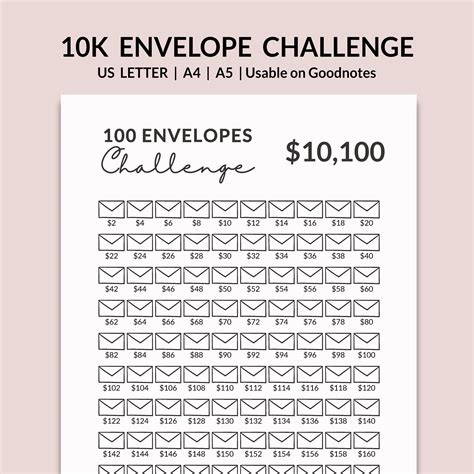

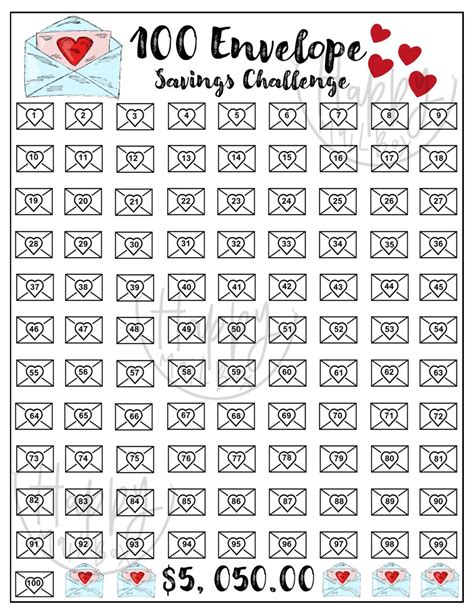

Free Printable Template

To help you get started with the 100 Envelope Savings Challenge, we've created a free printable template. This template includes 100 numbered envelopes, a savings tracker, and a budgeting worksheet. You can download and print the template to begin your savings journey.

Conclusion and Next Steps

The 100 Envelope Savings Challenge is a fun and interactive way to save money over time. By following this challenge, you'll develop a savings habit, create an emergency fund, and make progress towards your financial goals. Remember to stay committed, track your progress, and adjust the challenge as needed to ensure your success.

Now it's your turn to take the challenge! Download the free printable template, gather your envelopes, and start saving money today.

100 Envelope Savings Challenge Gallery