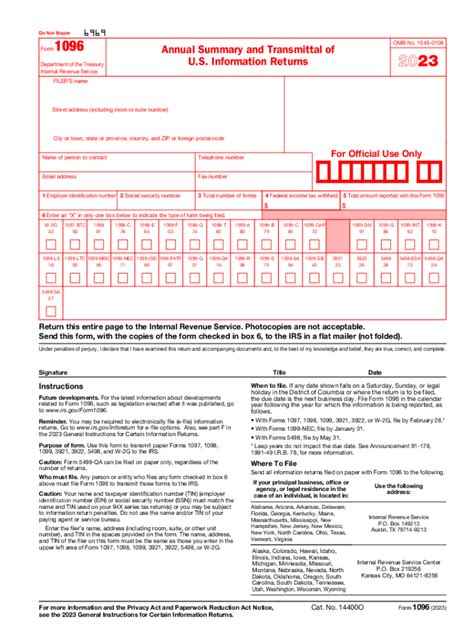

The 1096 template is a crucial document for employers and businesses to report information to the Internal Revenue Service (IRS) about the various types of miscellaneous income they've paid to recipients throughout the year. Creating and using a 1096 template in Word can be a convenient way to prepare and submit this form. Here are five easy ways to use a 1096 template in Word:

Understanding the Importance of the 1096 Template

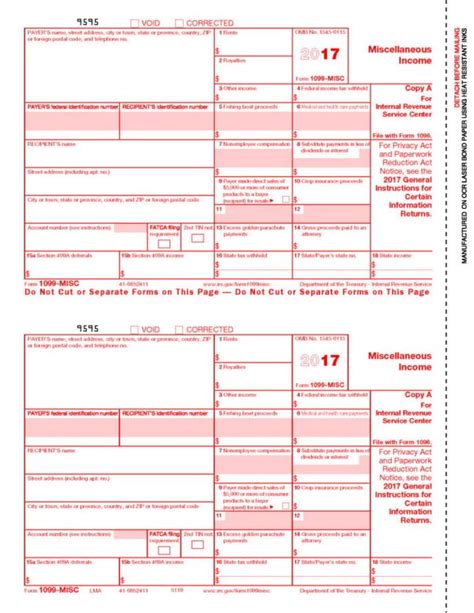

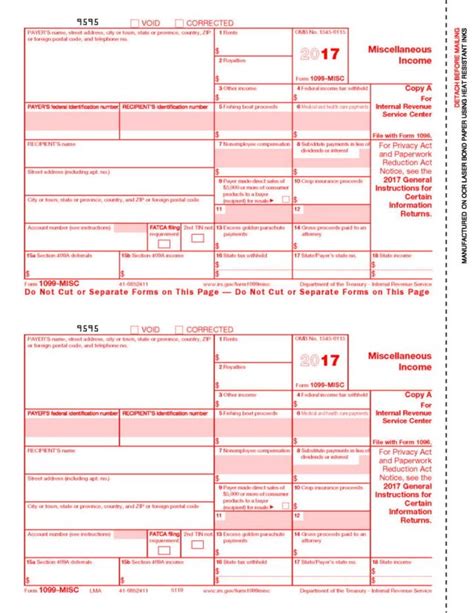

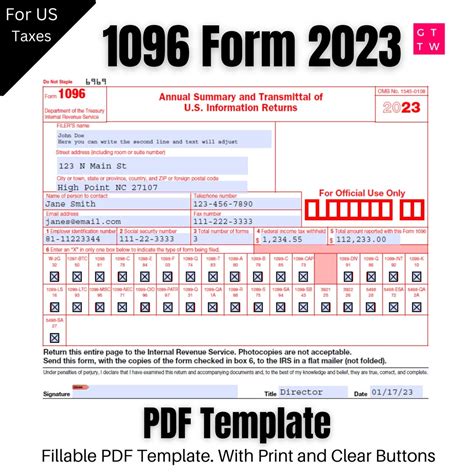

Before we dive into the methods of using a 1096 template in Word, it's essential to understand the significance of this document. The 1096 template is used to summarize and transmit information reported on various forms, such as the 1099-MISC, 1099-INT, 1099-DIV, and others. Employers and businesses use this template to report miscellaneous income, interest, dividends, and other types of income to the IRS.

Method 1: Download a Pre-Designed 1096 Template from Microsoft

Microsoft offers a range of pre-designed templates, including the 1096 template, which can be easily downloaded and used in Word. To access the template, follow these steps:

- Open Microsoft Word and click on the "File" tab.

- Select "New" and then "Search for Online Templates."

- Type "1096 template" in the search box and press Enter.

- Select the desired template from the search results.

- Click "Download" to save the template to your computer.

Method 2: Create a 1096 Template from Scratch

If you prefer to create a 1096 template from scratch, you can do so using Word's built-in features. Here's a step-by-step guide:

- Open a new document in Word.

- Set the page layout to " Landscape" to accommodate the template's width.

- Create a table with the required columns and rows for the 1096 template.

- Add headers and footers to the table to match the IRS's guidelines.

- Customize the template by adding your company's information and other required details.

Method 3: Use an Online Template Generator

There are several online template generators that can help you create a 1096 template in Word. These tools often provide pre-designed templates and a user-friendly interface to customize the template. Here's how to use an online template generator:

- Search for online template generators that offer 1096 templates.

- Select a template generator and follow the prompts to create a new template.

- Customize the template by adding your company's information and other required details.

- Download the template in Word format.

Method 4: Use a 1096 Template Add-In

Microsoft offers a range of add-ins that can help you create and manage 1096 templates in Word. These add-ins often provide pre-designed templates and features to automate the process. Here's how to use a 1096 template add-in:

- Open the Microsoft Office Store and search for 1096 template add-ins.

- Select an add-in and follow the prompts to install it.

- Launch the add-in and follow the prompts to create a new 1096 template.

- Customize the template by adding your company's information and other required details.

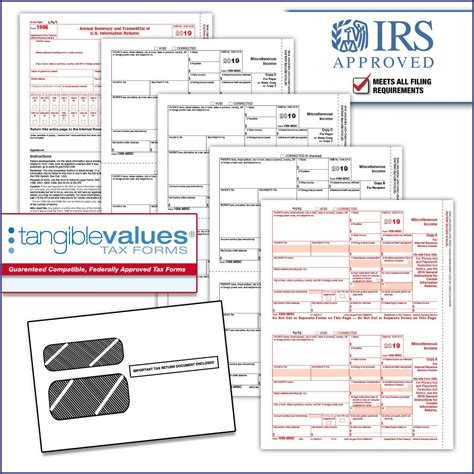

Method 5: Use a Third-Party 1096 Template Software

There are several third-party software solutions that can help you create and manage 1096 templates in Word. These software solutions often provide pre-designed templates and features to automate the process. Here's how to use a third-party 1096 template software:

- Search for third-party software solutions that offer 1096 template creation.

- Select a software solution and follow the prompts to download and install it.

- Launch the software and follow the prompts to create a new 1096 template.

- Customize the template by adding your company's information and other required details.

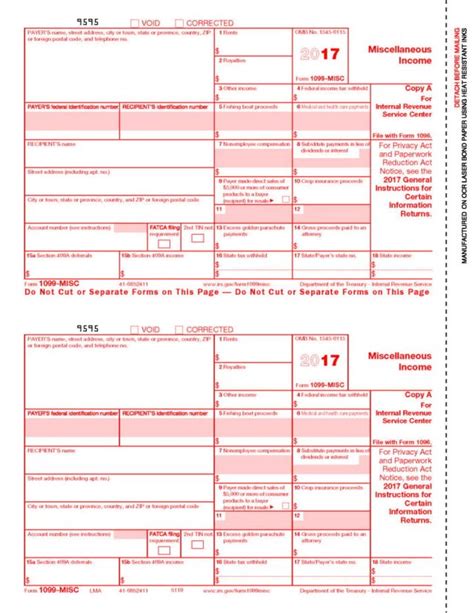

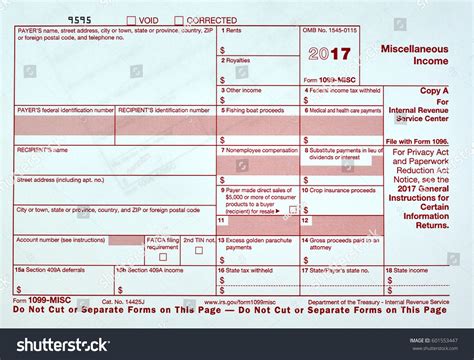

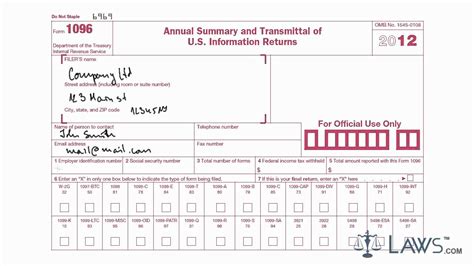

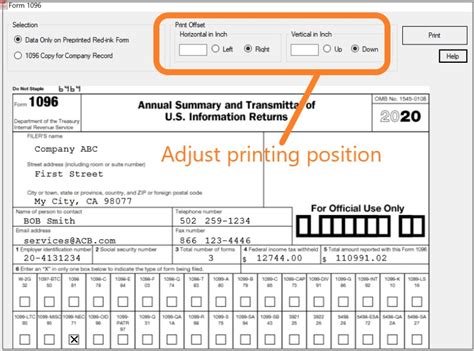

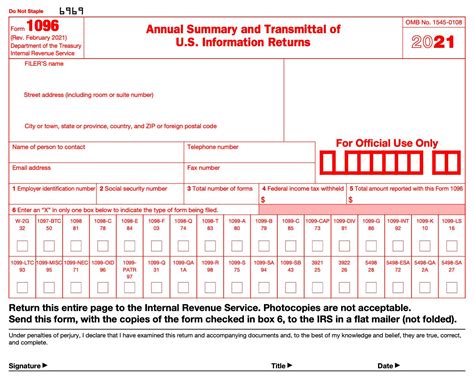

1096 Template Image Gallery

1096 Template Gallery

Conclusion

Creating and using a 1096 template in Word can be a convenient way to prepare and submit this form to the IRS. By following the methods outlined in this article, you can easily create a 1096 template and customize it to meet your business needs. Remember to always follow the IRS's guidelines and regulations when creating and submitting the 1096 template.

Call to Action

If you have any questions or need further assistance with creating a 1096 template in Word, please leave a comment below. We're here to help you navigate the process and ensure you're compliant with the IRS's regulations.