Intro

Streamline your freelance finances with our expert guide to 1099 check stub templates. Learn how to create accurate pay stubs, simplify tax season, and stay organized with our top 5 tips. Say goodbye to paperwork headaches and hello to stress-free financial management with our comprehensive tutorial on 1099 check stub templates.

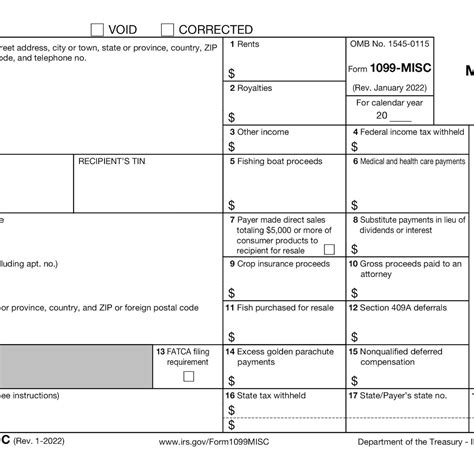

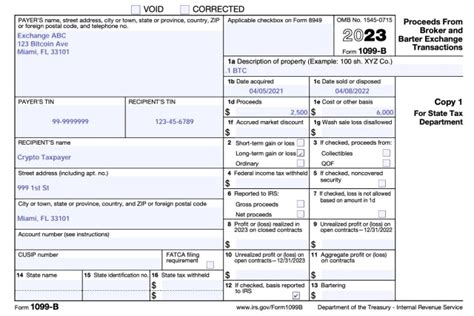

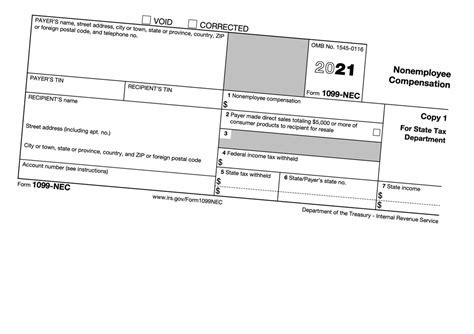

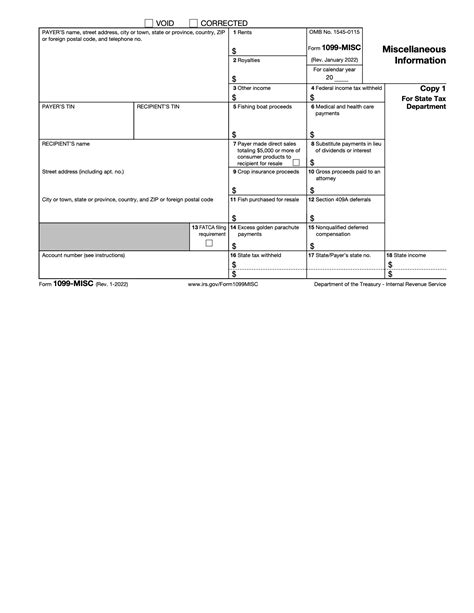

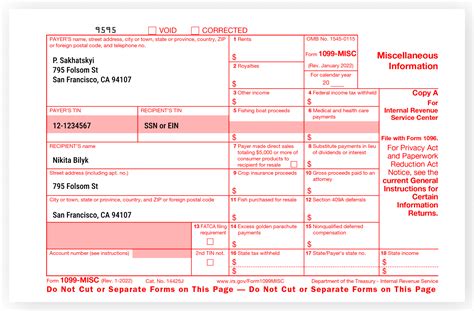

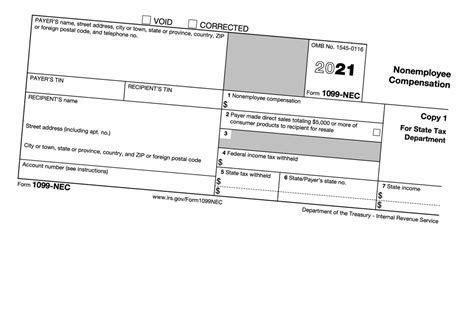

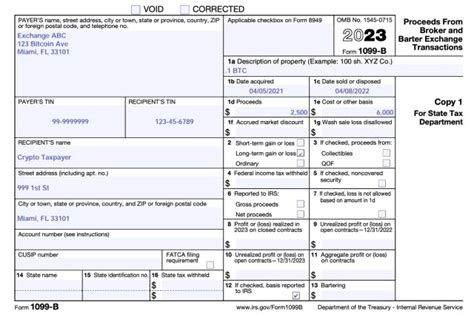

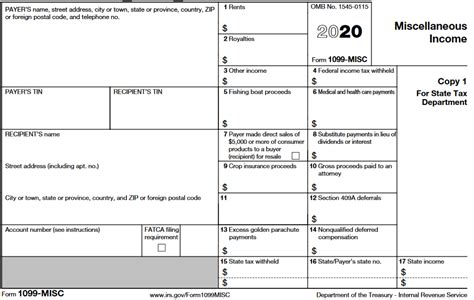

As a freelancer, independent contractor, or small business owner, managing your finances can be a daunting task. One essential document that helps you stay organized is a 1099 check stub template. A 1099 check stub template is a valuable tool that provides a clear and concise record of your income and deductions. In this article, we'll explore the importance of a 1099 check stub template and provide 5 tips on how to create an effective one.

The importance of a 1099 check stub template cannot be overstated. As a self-employed individual, you're responsible for reporting your income and expenses to the IRS. A 1099 check stub template helps you keep track of your income, deductions, and taxes owed, making it easier to file your taxes accurately. Moreover, a well-designed template can help you identify areas where you can optimize your finances and make informed decisions about your business.

Here are 5 tips for creating an effective 1099 check stub template:

Tip 1: Choose the Right Template Format

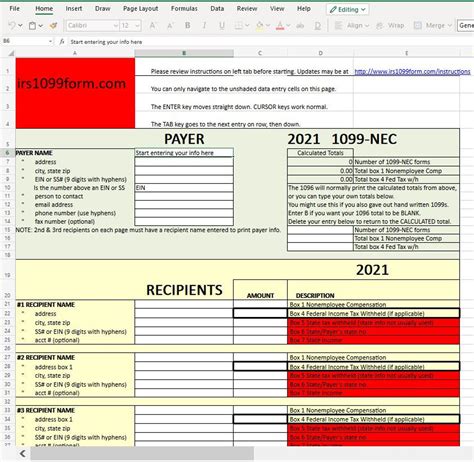

When selecting a 1099 check stub template, you have two primary options: a physical template or a digital template. Physical templates are available in paper or PDF formats, while digital templates can be found in spreadsheet software like Microsoft Excel or Google Sheets. Consider your personal preferences and the level of complexity you're comfortable with when choosing a template format.

For example, if you're familiar with spreadsheet software, a digital template may be the best option for you. On the other hand, if you prefer a more traditional approach, a physical template may be the way to go.

Benefits of Digital Templates

- Easy to edit and update

- Automatically calculates totals and deductions

- Can be easily shared with accountants or bookkeepers

Benefits of Physical Templates

- Provides a tangible record of your income and expenses

- Easy to use for those who are less tech-savvy

- Can be stored in a physical file for easy access

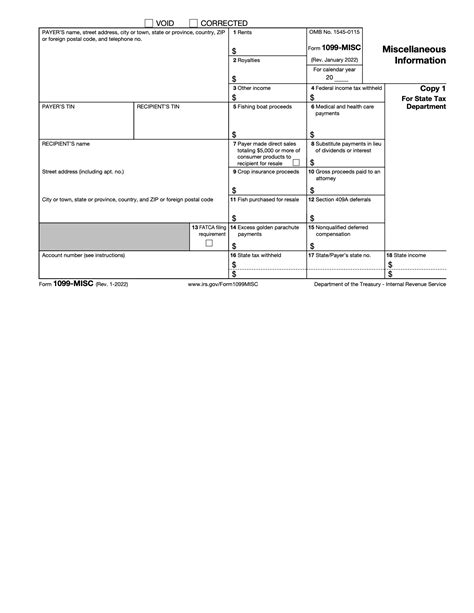

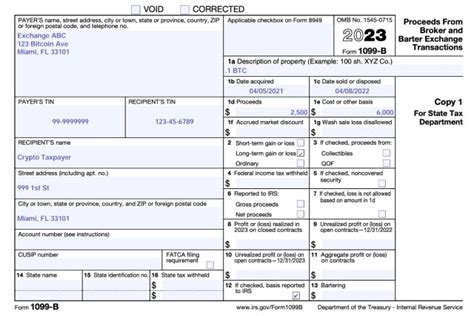

Tip 2: Include Essential Information

A 1099 check stub template should include essential information about your income and deductions. This includes:

- Your name and business name

- Your address and contact information

- The payer's name and address

- The payment date and amount

- A breakdown of deductions, such as taxes withheld and benefits

Consider the following example:

| Payee Information | Payer Information |

|---|---|

| John Doe | XYZ Corporation |

| 123 Main St | 456 Elm St |

| Anytown, USA | Othertown, USA |

Tip 3: Use a Clear and Concise Format

A well-designed 1099 check stub template should be easy to read and understand. Use a clear and concise format that includes:

- A header section with your name and business name

- A table or chart to display income and deductions

- A footer section with your address and contact information

Avoid using too much jargon or technical terms that may confuse you or others who may need to review your template.

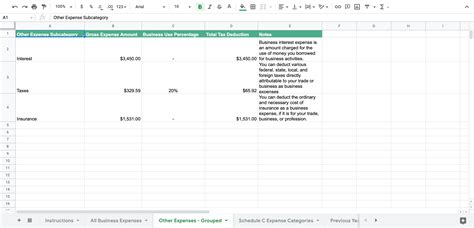

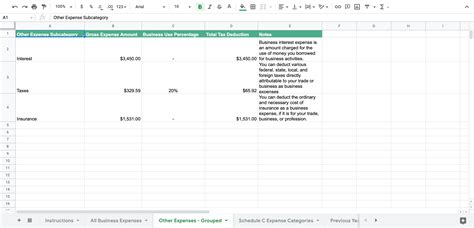

Tip 4: Automate Calculations

A 1099 check stub template should include formulas to automate calculations, such as totals and deductions. This saves you time and reduces the risk of errors.

Consider using a spreadsheet software that allows you to create formulas and automate calculations. For example, you can use the following formula to calculate the total income:

=SUM(B2:B10)

Where B2:B10 represents the range of cells containing income information.

Tip 5: Review and Update Regularly

A 1099 check stub template is only effective if it's regularly reviewed and updated. Set aside time each month or quarter to review your template and update it as needed.

Consider the following best practices:

- Review your template for accuracy and completeness

- Update your template to reflect changes in income or deductions

- Use your template to identify areas where you can optimize your finances

By following these 5 tips, you can create an effective 1099 check stub template that helps you manage your finances and stay organized.

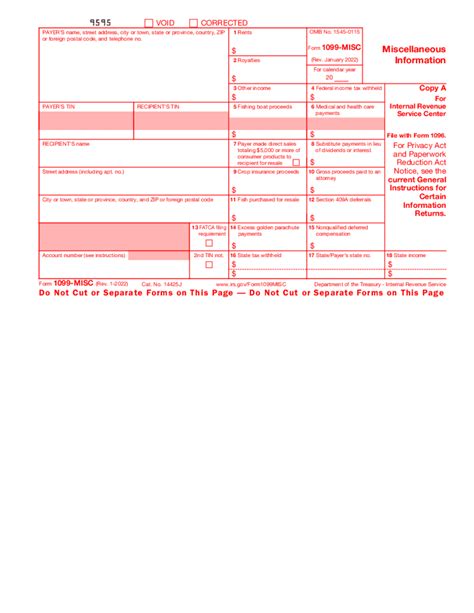

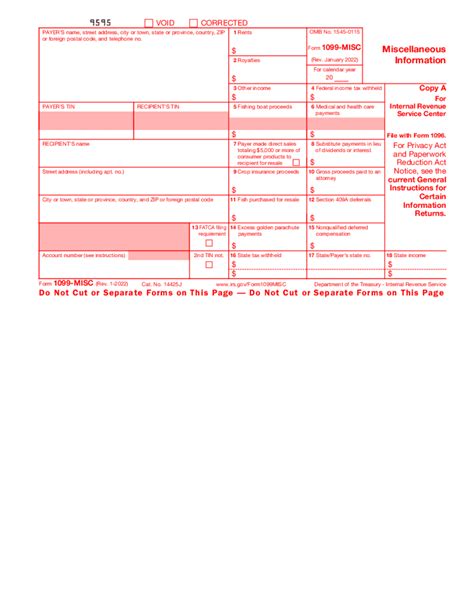

Gallery of 1099 Check Stub Templates

1099 Check Stub Template Image Gallery

By following these tips and using a well-designed 1099 check stub template, you can stay organized and ensure accurate financial reporting. Remember to review and update your template regularly to ensure it continues to meet your needs.