Intro

Create accurate pay stubs for independent contractors with our 1099 pay stub template. Easily track payments, deductions, and taxes with this customizable template. Perfect for freelancers, consultants, and small business owners, it simplifies payroll processing and ensures compliance with IRS regulations, reducing errors and saving time.

As a business owner, it's essential to provide your independent contractors with accurate and timely payment information. One way to achieve this is by using a 1099 pay stub template. In this article, we'll explore the importance of using a 1099 pay stub template, its benefits, and provide a comprehensive guide on how to create one.

Why Use a 1099 Pay Stub Template?

A 1099 pay stub template is a document that outlines the payment details for an independent contractor. It's essential to use a template to ensure accuracy and compliance with tax regulations. Here are some reasons why you should use a 1099 pay stub template:

- Accuracy: A template helps ensure that you provide accurate payment information, reducing errors and disputes with contractors.

- Compliance: The IRS requires businesses to report payments made to independent contractors on a 1099-MISC form. A template helps you meet this requirement.

- Professionalism: Providing a professional-looking pay stub shows that you value your contractors' time and effort.

Benefits of Using a 1099 Pay Stub Template

Using a 1099 pay stub template offers several benefits, including:

- Streamlined payment process: A template saves time and effort in creating pay stubs, allowing you to focus on other aspects of your business.

- Improved record-keeping: A template helps you keep accurate records of payments made to contractors, making it easier to track expenses and comply with tax regulations.

- Enhanced contractor satisfaction: Providing clear and accurate payment information can improve contractor satisfaction and reduce disputes.

What to Include in a 1099 Pay Stub Template

A 1099 pay stub template should include the following information:

- Contractor's name and address: Include the contractor's name and address to ensure accurate payment information.

- Payment date: Specify the payment date to help contractors track their income.

- Payment amount: Include the payment amount, including any deductions or withholdings.

- Payment method: Specify the payment method, such as direct deposit or check.

- Gross income: Include the contractor's gross income, which is the total amount earned before deductions.

- Net income: Specify the contractor's net income, which is the amount earned after deductions.

Creating a 1099 Pay Stub Template

To create a 1099 pay stub template, follow these steps:

- Choose a template design: Select a template design that meets your business needs. You can use a spreadsheet program like Microsoft Excel or Google Sheets.

- Add necessary fields: Include the necessary fields, such as contractor's name and address, payment date, payment amount, and payment method.

- Customize the template: Customize the template to fit your business needs. You can add or remove fields as necessary.

- Test the template: Test the template to ensure it meets your needs and is accurate.

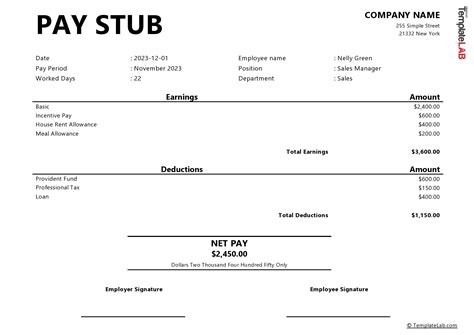

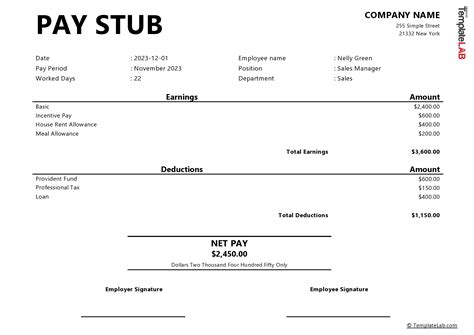

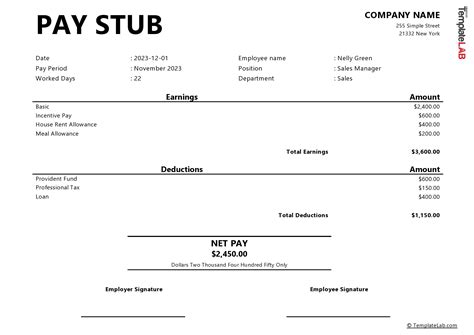

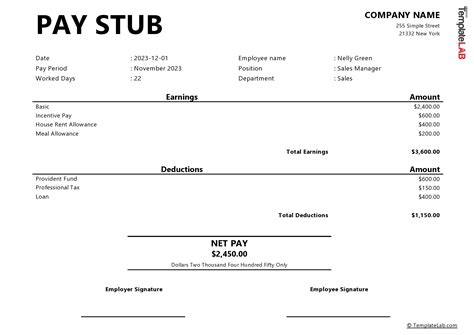

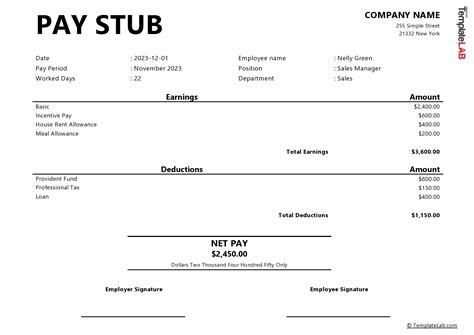

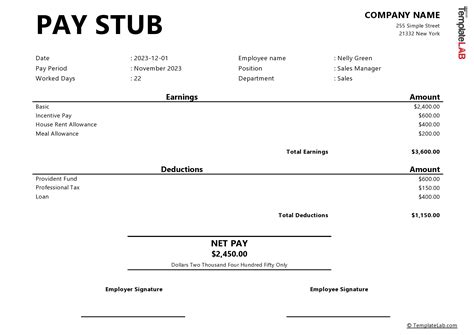

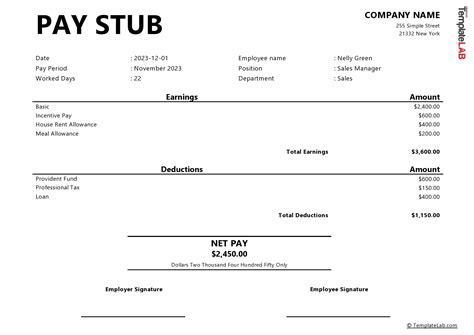

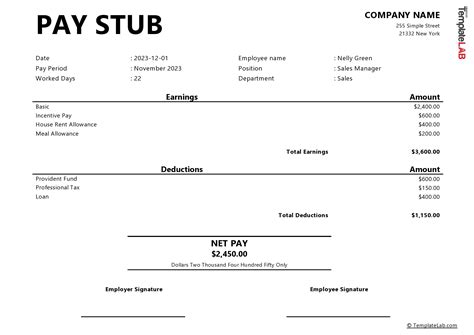

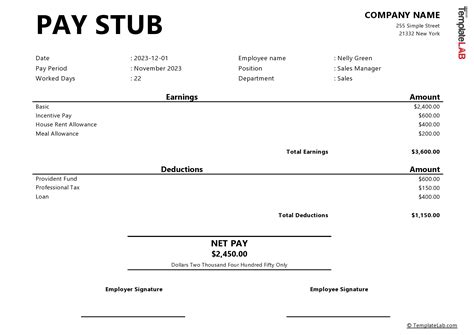

1099 Pay Stub Template Example

Here's an example of a 1099 pay stub template:

| Field | Description |

|---|---|

| Contractor's Name | John Doe |

| Contractor's Address | 123 Main St, Anytown, USA |

| Payment Date | 2023-02-15 |

| Payment Amount | $1,000.00 |

| Payment Method | Direct Deposit |

| Gross Income | $1,200.00 |

| Net Income | $1,000.00 |

FAQs

- What is a 1099 pay stub template?: A 1099 pay stub template is a document that outlines the payment details for an independent contractor.

- Why do I need a 1099 pay stub template?: You need a 1099 pay stub template to ensure accuracy and compliance with tax regulations.

- How do I create a 1099 pay stub template?: You can create a 1099 pay stub template using a spreadsheet program like Microsoft Excel or Google Sheets.

1099 Pay Stub Template Image Gallery

Conclusion

Using a 1099 pay stub template is essential for businesses that work with independent contractors. It ensures accuracy and compliance with tax regulations, streamlines the payment process, and improves record-keeping. By creating a 1099 pay stub template, you can provide clear and accurate payment information to your contractors, reducing disputes and improving satisfaction.

If you have any questions or need help creating a 1099 pay stub template, leave a comment below or share this article with your network.