Are you tired of manually filling out the 1099 NEC template for your business? Do you struggle with accurately formatting the data and ensuring compliance with IRS regulations? Look no further! In this article, we will explore five ways to fill out the 1099 NEC template in Excel, making it easier for you to manage your tax obligations.

What is the 1099 NEC Template?

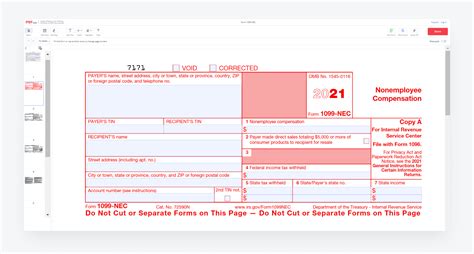

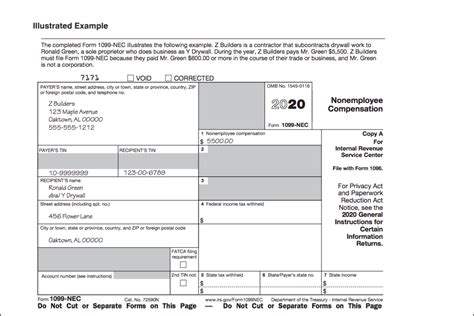

The 1099 NEC (Non-Employee Compensation) template is a form used by businesses to report non-employee compensation, such as freelance work, independent contractor payments, and other miscellaneous income. The form is used to report payments made to individuals and businesses that are not employees, but rather independent contractors or freelancers.

Why Use Excel to Fill Out the 1099 NEC Template?

Using Excel to fill out the 1099 NEC template can save you time and reduce errors. Excel allows you to easily import data, perform calculations, and format the data to meet IRS requirements. Additionally, Excel can help you to identify and correct errors, ensuring that your forms are accurate and complete.

Method 1: Manual Data Entry

The most basic way to fill out the 1099 NEC template in Excel is to manually enter the data. This method requires you to enter each piece of information, including the payer's name and address, the recipient's name and address, and the payment details.

To manually enter data, follow these steps:

- Open a new Excel spreadsheet and create a new worksheet.

- Set up the columns to match the 1099 NEC template, including the payer's name and address, recipient's name and address, and payment details.

- Enter the data manually, using the IRS instructions as a guide.

- Use Excel formulas to calculate the total payments and perform any necessary calculations.

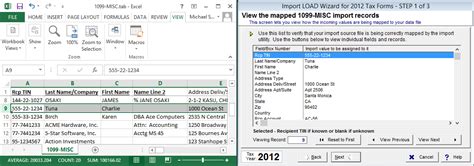

Method 2: Importing Data from Accounting Software

If you use accounting software, such as QuickBooks or Xero, you can import the data directly into Excel. This method saves time and reduces errors, as the data is already formatted and accurate.

To import data from accounting software, follow these steps:

- Export the data from your accounting software, using the software's reporting features.

- Save the exported data as a CSV or Excel file.

- Open the file in Excel and set up the columns to match the 1099 NEC template.

- Use Excel formulas to calculate the total payments and perform any necessary calculations.

Method 3: Using an Excel Template

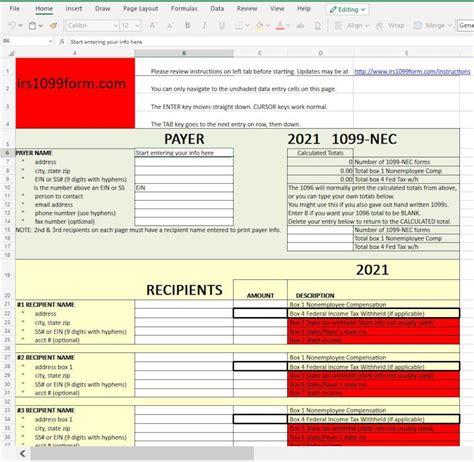

Another way to fill out the 1099 NEC template in Excel is to use a pre-built template. These templates are designed to match the IRS requirements and can save you time and effort.

To use an Excel template, follow these steps:

- Search for a 1099 NEC template online, using keywords such as "1099 NEC template Excel" or "1099 NEC form Excel".

- Download the template and open it in Excel.

- Enter the data into the template, using the pre-built columns and formulas.

- Review the template to ensure accuracy and completeness.

Method 4: Using an Add-In or Plugin

If you have a large number of 1099 NEC forms to complete, you may want to consider using an add-in or plugin. These tools can automate the process of filling out the forms and can help to reduce errors.

To use an add-in or plugin, follow these steps:

- Search for a 1099 NEC add-in or plugin online, using keywords such as "1099 NEC add-in" or "1099 NEC plugin".

- Download and install the add-in or plugin.

- Follow the instructions to set up the add-in or plugin.

- Use the add-in or plugin to automate the process of filling out the 1099 NEC forms.

Method 5: Outsourcing to a Tax Professional

Finally, if you are not comfortable filling out the 1099 NEC template yourself, you may want to consider outsourcing to a tax professional. This method can save you time and ensure that your forms are accurate and complete.

To outsource to a tax professional, follow these steps:

- Search for a tax professional online, using keywords such as "tax professional 1099 NEC" or "tax consultant 1099 NEC".

- Contact the tax professional and provide them with the necessary information.

- Review the completed forms to ensure accuracy and completeness.

- File the forms with the IRS, following the tax professional's instructions.

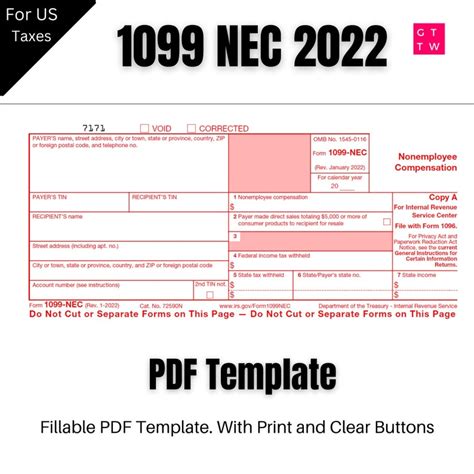

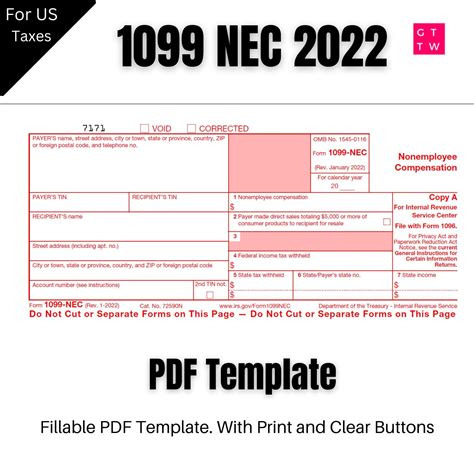

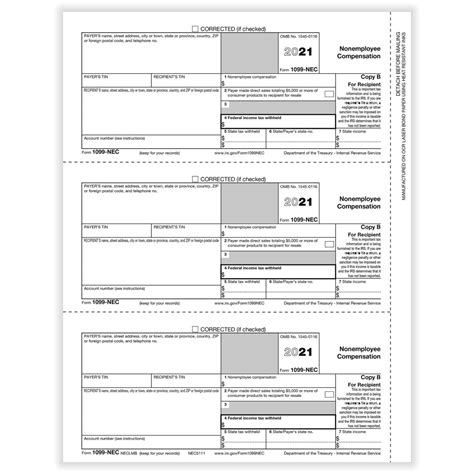

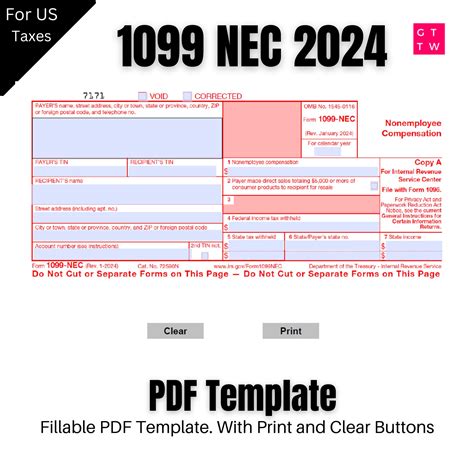

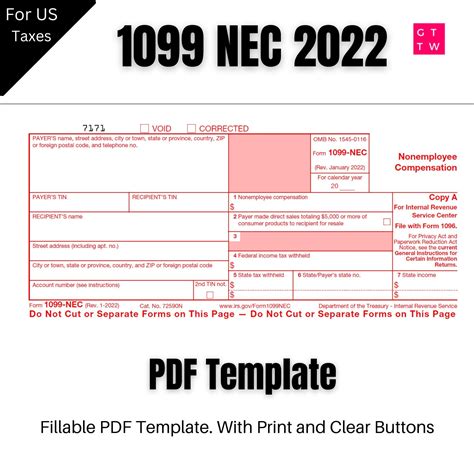

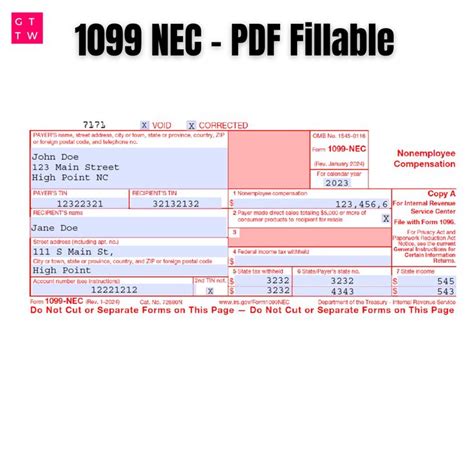

Gallery of 1099 NEC Templates

1099 NEC Template Gallery

We hope this article has provided you with the information you need to fill out the 1099 NEC template in Excel. Whether you choose to use manual data entry, import data from accounting software, use an Excel template, use an add-in or plugin, or outsource to a tax professional, we are confident that you will be able to complete the forms accurately and efficiently. Remember to always follow IRS instructions and guidelines to ensure compliance and avoid penalties.