Intro

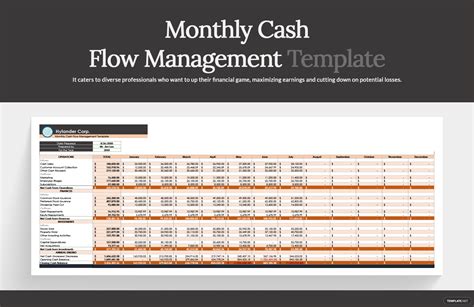

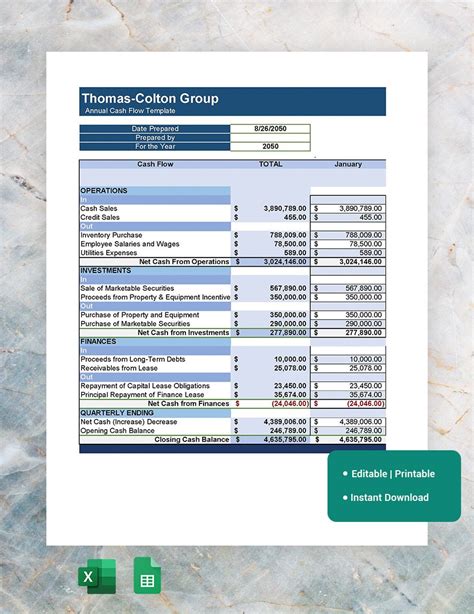

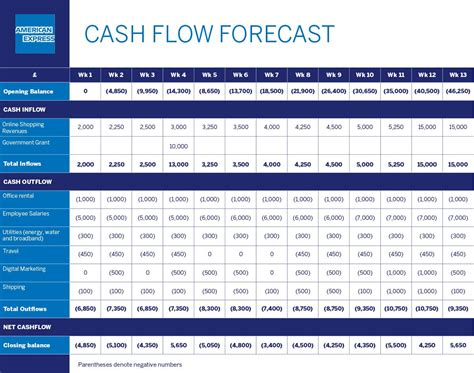

Create a comprehensive 12-month cash flow forecast with our free Excel template. Easily track income, expenses, and cash balances to make informed financial decisions. Ideal for small businesses and entrepreneurs, this template helps manage cash flow, identify trends, and make data-driven projections for a stable financial future.

Managing your company's finances effectively is crucial for its success. A vital tool in achieving this is a cash flow statement, which provides a clear picture of the inflows and outflows of cash and cash equivalents. One of the most effective ways to maintain this overview is by using a 12-month cash flow statement template in Excel.

Understanding the Importance of Cash Flow Management

Effective cash flow management is the backbone of any successful business. It helps in understanding where your money is coming from, where it is going, and when. This insight is crucial for making informed decisions, planning for the future, and ensuring that your business remains solvent.

Benefits of Using a 12-Month Cash Flow Statement Template

A 12-month cash flow statement template in Excel offers several benefits, including:

- Simplified Budgeting: It helps in planning your finances by giving a clear picture of your income and expenses over a year.

- Improved Cash Flow Management: By tracking your cash inflows and outflows, you can manage your cash more effectively.

- Better Decision Making: It provides valuable insights that can guide your business decisions, helping you avoid cash shortages and make the most of your financial resources.

- Enhanced Forecasting: It allows you to forecast your cash position in the future, enabling you to prepare for any financial challenges that might arise.

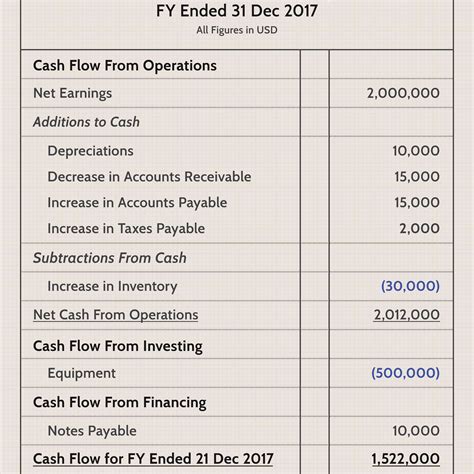

Components of a 12-Month Cash Flow Statement Template

A comprehensive 12-month cash flow statement template typically includes the following components:

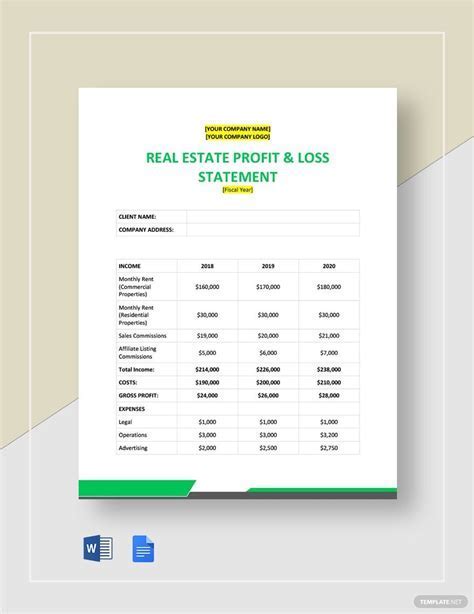

Income Section

- Monthly Sales: This section outlines your expected sales for each month.

- Other Income: Any other income sources, such as interest on savings or investments, should be included here.

Fixed Expenses Section

- Rent: Monthly rent for your business premises.

- Utilities: Costs for electricity, water, gas, and internet.

- Salaries and Wages: Monthly payroll expenses.

- Insurance: Premiums for business insurance policies.

Variable Expenses Section

- Raw Materials: Costs of materials used in production.

- Marketing Expenses: Spending on advertising, promotions, and marketing campaigns.

- Travel Expenses: Costs associated with business travel.

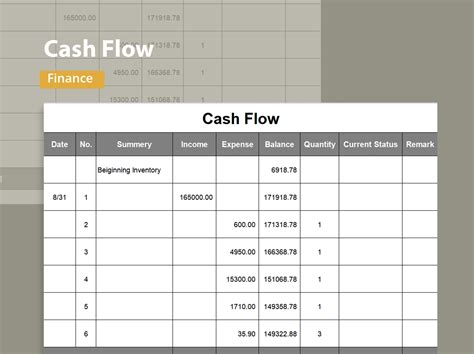

Cash Inflows and Outflows Section

- Beginning Cash Balance: The starting cash balance for each month.

- Total Cash Inflows: Sum of all cash received during the month.

- Total Cash Outflows: Sum of all cash paid out during the month.

- Ending Cash Balance: The cash balance at the end of each month.

How to Use a 12-Month Cash Flow Statement Template in Excel

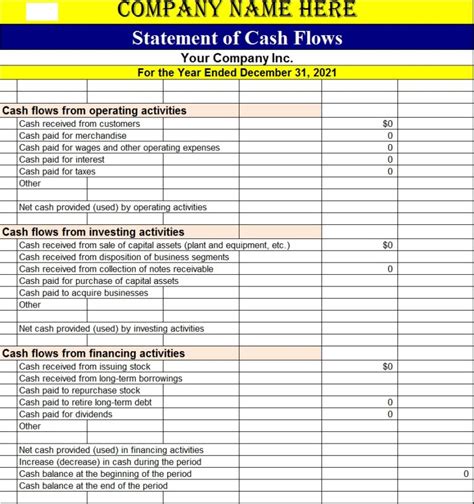

- Download and Customize: Download a template that suits your business needs and customize it by adding your company's details.

- Enter Data: Start by entering your financial data into the template, ensuring to include all income and expenses.

- Calculate Cash Flows: Use Excel formulas to calculate your total cash inflows and outflows for each month.

- Analyze and Adjust: Regularly review your cash flow statement to identify areas where you can improve your cash management.

Free 12-Month Cash Flow Statement Templates

Several websites offer free downloadable 12-month cash flow statement templates in Excel. These templates can be customized to fit your business needs, saving you time and effort.

Advantages of Free Templates

- Cost-Effective: They are free, reducing your business expenses.

- Easy to Use: Most templates are designed to be user-friendly, even for those with limited Excel skills.

- Customizable: They can be tailored to meet the specific needs of your business.

Gallery of Cash Flow Statement Templates

Cash Flow Statement Template Gallery

Conclusion: Enhance Your Financial Management with a 12-Month Cash Flow Statement Template

A 12-month cash flow statement template in Excel is a powerful tool for managing your business's finances. By providing a clear overview of your cash inflows and outflows, it helps in making informed decisions, improving cash management, and ensuring the financial stability of your business. Take the first step towards better financial management by downloading and customizing a template that suits your needs.