Intro

Managing your finances effectively is crucial for achieving financial stability and security. One of the key components of financial management is maintaining a healthy cash flow. In this article, we will delve into the world of cash flow management and provide you with a comprehensive guide on how to create a 13-week cash flow Excel template to master your finances.

The Importance of Cash Flow Management

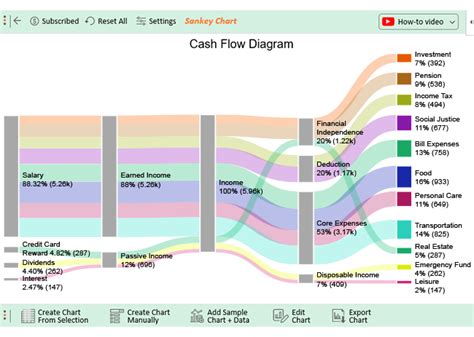

Cash flow management is the process of tracking and managing the inflows and outflows of cash within a business or personal finance setting. It involves monitoring and controlling the movement of cash to ensure that there is always enough liquidity to meet financial obligations. Effective cash flow management is critical for:

- Maintaining financial stability and security

- Meeting financial obligations, such as paying bills and debts

- Making informed financial decisions, such as investing or borrowing

- Identifying and addressing potential financial problems before they arise

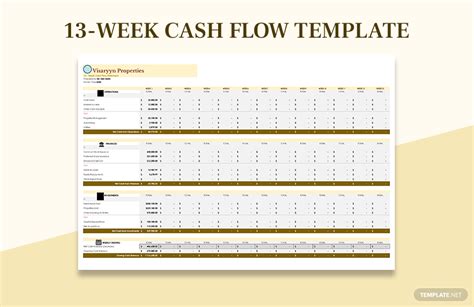

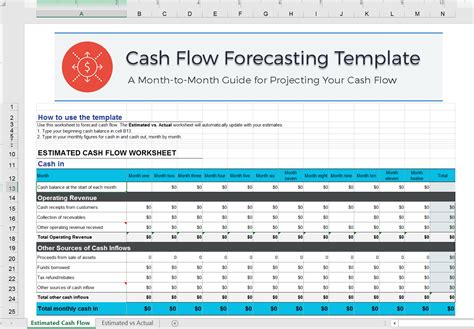

Understanding the 13-Week Cash Flow Template

The 13-week cash flow template is a financial planning tool that helps you manage your cash flow over a 13-week period. It provides a detailed breakdown of your expected income and expenses, allowing you to anticipate and prepare for any potential cash flow shortages.

The template typically includes the following components:

- Week: A column to identify each week of the 13-week period

- Income: A column to record expected income for each week

- Fixed Expenses: A column to record fixed expenses, such as rent or mortgage payments

- Variable Expenses: A column to record variable expenses, such as utilities or groceries

- Cash Inflow: A column to record any additional cash inflows, such as loan proceeds or investment income

- Cash Outflow: A column to record any additional cash outflows, such as loan payments or investments

- Beginning Balance: A column to record the beginning cash balance for each week

- Ending Balance: A column to record the ending cash balance for each week

Benefits of Using a 13-Week Cash Flow Template

Using a 13-week cash flow template can provide numerous benefits, including:

- Improved financial planning and budgeting

- Enhanced cash flow management and forecasting

- Reduced financial stress and anxiety

- Increased ability to make informed financial decisions

- Better identification and management of financial risks

Creating a 13-Week Cash Flow Excel Template

Creating a 13-week cash flow Excel template is a straightforward process that can be completed in a few steps.

Step 1: Set up a new Excel spreadsheet

- Open a new Excel spreadsheet and give it a title, such as "13-Week Cash Flow Template".

- Set up the columns and rows to accommodate the components listed above.

Step 2: Enter your income and expenses

- Enter your expected income and expenses for each week of the 13-week period.

- Use formulas to calculate the cash inflow and outflow for each week.

Step 3: Calculate the beginning and ending balances

- Use formulas to calculate the beginning and ending cash balances for each week.

- Use conditional formatting to highlight any potential cash flow shortages.

Step 4: Review and refine the template

- Review the template to ensure that it accurately reflects your financial situation.

- Refine the template as needed to make it more accurate and effective.

Tips for Using the 13-Week Cash Flow Template

Here are some tips for using the 13-week cash flow template effectively:

- Regularly update the template to reflect changes in your income and expenses.

- Use the template to identify and address potential cash flow shortages.

- Use the template to make informed financial decisions, such as investing or borrowing.

- Review the template regularly to ensure that it remains accurate and effective.

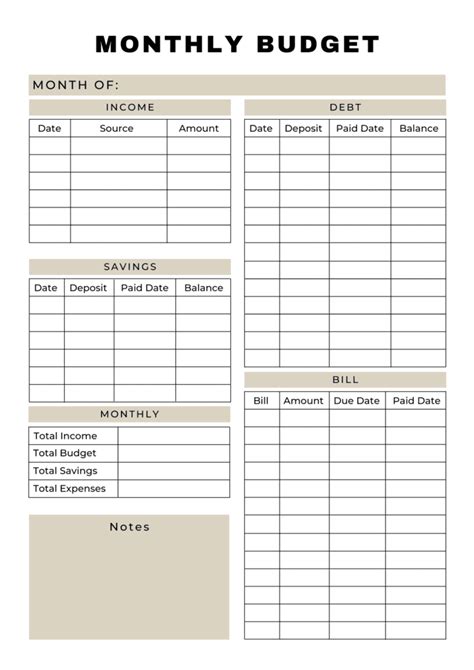

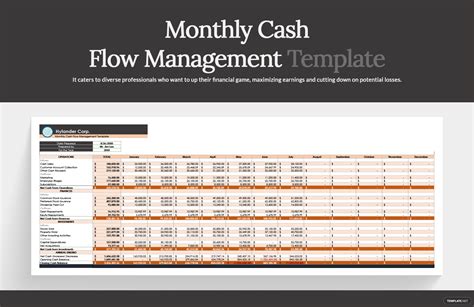

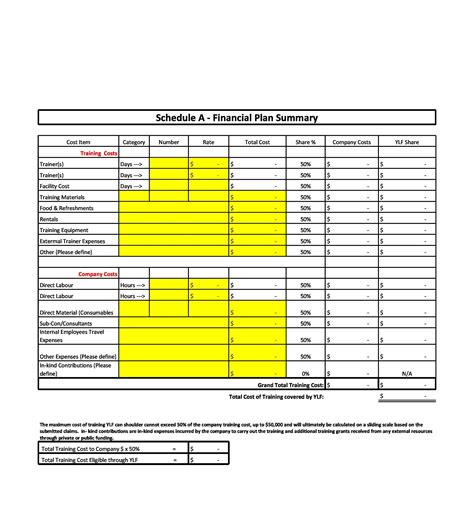

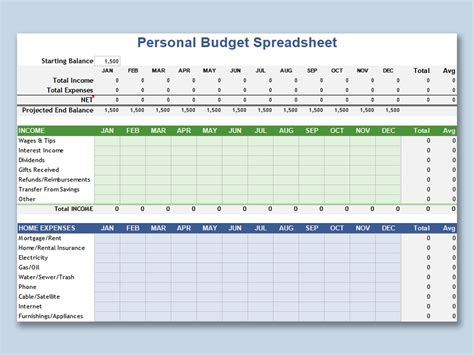

13-Week Cash Flow Template Image Gallery

Conclusion

Mastering your finances requires effective cash flow management. The 13-week cash flow template is a valuable tool that can help you manage your cash flow and achieve financial stability. By following the steps outlined in this article, you can create a 13-week cash flow Excel template that meets your financial needs. Remember to regularly update and refine the template to ensure that it remains accurate and effective.