Intro

Effective cash flow management is crucial for the success of any business. A cash flow forecast is a vital tool that helps you predict the inflows and outflows of cash in your business, enabling you to make informed decisions and mitigate potential financial risks. In this article, we will explore the importance of cash flow forecasting, its benefits, and provide you with 13-week cash flow forecast templates in Excel.

Why is Cash Flow Forecasting Important?

Cash flow forecasting is essential for businesses of all sizes, as it helps you:

- Predict cash shortages and surpluses

- Make informed decisions about investments, funding, and resource allocation

- Identify potential financial risks and opportunities

- Develop strategies to manage cash flow and maintain liquidity

- Improve relationships with suppliers, creditors, and investors

Benefits of Cash Flow Forecasting

Cash flow forecasting offers numerous benefits, including:

- Improved financial planning and decision-making

- Enhanced cash management and reduced cash shortages

- Increased confidence in financial performance and future prospects

- Better relationships with stakeholders, including suppliers, creditors, and investors

- Reduced risk of insolvency and financial distress

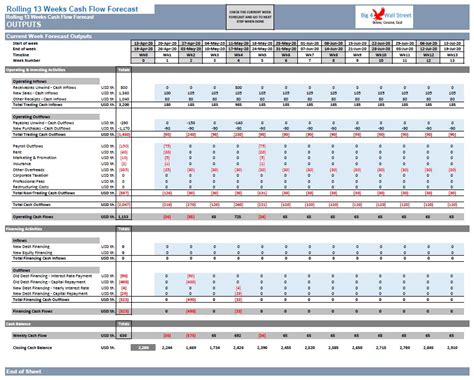

Understanding the 13-Week Cash Flow Forecast

A 13-week cash flow forecast is a short-term forecast that provides a detailed picture of your business's cash inflows and outflows over a 13-week period. This forecast is particularly useful for businesses that experience fluctuating cash flows or those that need to manage cash closely.

Components of a 13-Week Cash Flow Forecast

A typical 13-week cash flow forecast includes the following components:

- Cash receipts (inflows)

- Cash payments (outflows)

- Net cash flow (inflows minus outflows)

- Beginning and ending cash balances

Creating a 13-Week Cash Flow Forecast Template in Excel

To create a 13-week cash flow forecast template in Excel, follow these steps:

- Set up a table with the following columns:

- Week (1-13)

- Cash Receipts (inflows)

- Cash Payments (outflows)

- Net Cash Flow (inflows minus outflows)

- Beginning Cash Balance

- Ending Cash Balance

- Enter your historical cash flow data or estimates for the next 13 weeks

- Use formulas to calculate the net cash flow and ending cash balance for each week

- Use charts and graphs to visualize your cash flow forecast

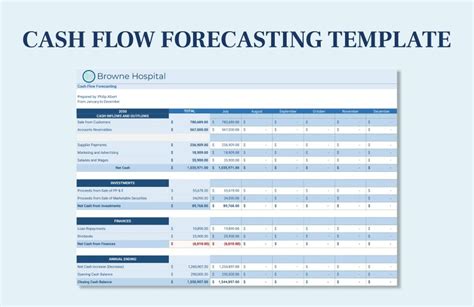

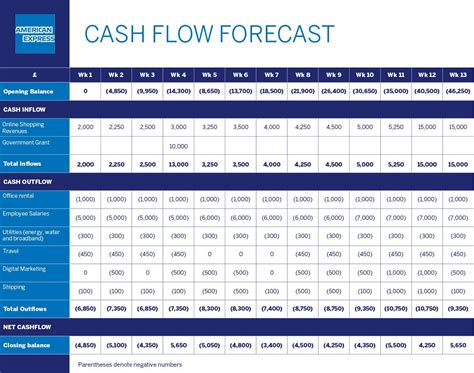

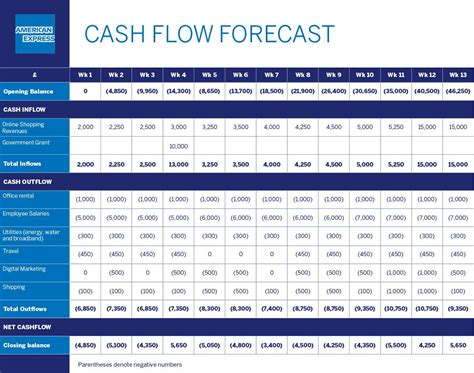

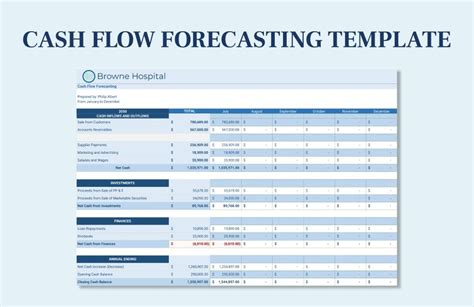

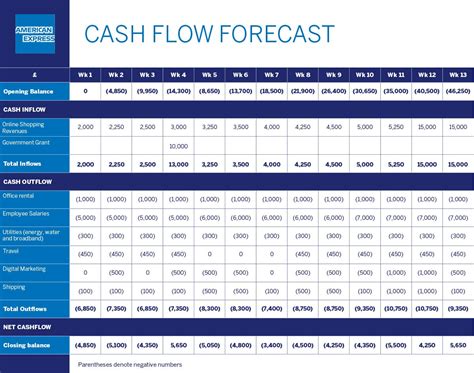

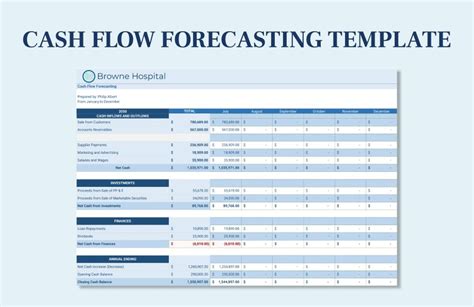

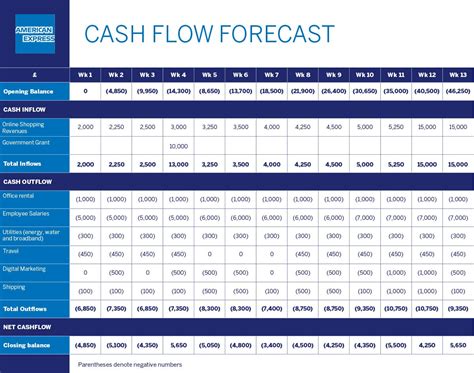

Example of a 13-Week Cash Flow Forecast Template in Excel

Here is an example of a 13-week cash flow forecast template in Excel:

Template 1: Simple 13-Week Cash Flow Forecast

| Week | Cash Receipts | Cash Payments | Net Cash Flow | Beginning Cash Balance | Ending Cash Balance |

|---|---|---|---|---|---|

| 1 | $10,000 | $8,000 | $2,000 | $5,000 | $7,000 |

| 2 | $12,000 | $9,000 | $3,000 | $7,000 | $10,000 |

| 3 | $11,000 | $8,500 | $2,500 | $10,000 | $12,500 |

| ... | ... | ... | ... | ... | ... |

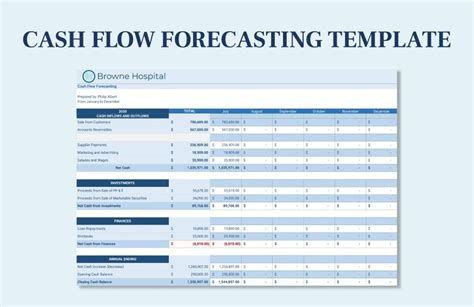

Template 2: Detailed 13-Week Cash Flow Forecast

| Week | Cash Receipts | Cash Payments | Net Cash Flow | Beginning Cash Balance | Ending Cash Balance | Accounts Receivable | Accounts Payable |

|---|---|---|---|---|---|---|---|

| 1 | $10,000 | $8,000 | $2,000 | $5,000 | $7,000 | $20,000 | $15,000 |

| 2 | $12,000 | $9,000 | $3,000 | $7,000 | $10,000 | $25,000 | $18,000 |

| 3 | $11,000 | $8,500 | $2,500 | $10,000 | $12,500 | $22,000 | $16,000 |

| ... | ... | ... | ... | ... | ... | ... | ... |

Tips for Creating an Accurate 13-Week Cash Flow Forecast

To create an accurate 13-week cash flow forecast, follow these tips:

- Use historical data to inform your forecast

- Consider seasonal fluctuations and trends

- Account for one-time events and irregularities

- Review and update your forecast regularly

Conclusion

A 13-week cash flow forecast is a valuable tool for businesses of all sizes. By creating a forecast template in Excel, you can predict cash inflows and outflows, make informed decisions, and mitigate potential financial risks. Remember to regularly review and update your forecast to ensure accuracy and relevance.

FAQs

Q: What is a cash flow forecast? A: A cash flow forecast is a prediction of a business's cash inflows and outflows over a specific period.

Q: Why is cash flow forecasting important? A: Cash flow forecasting is important because it helps businesses make informed decisions, manage cash flow, and mitigate potential financial risks.

Q: How do I create a 13-week cash flow forecast template in Excel? A: To create a 13-week cash flow forecast template in Excel, set up a table with columns for cash receipts, cash payments, net cash flow, and beginning and ending cash balances. Enter your historical data or estimates and use formulas to calculate the net cash flow and ending cash balance.

Gallery of 13-Week Cash Flow Forecast Templates

13-Week Cash Flow Forecast Templates