Intro

Get the latest 40 USD to CAD exchange rate and convert US dollars to Canadian dollars with ease. Understand the current market trends and fluctuations in the 40 American dollars to Canadian exchange rate, including historical rates, forecasts, and expert insights to make informed decisions.

The exchange rate between the US dollar and the Canadian dollar is a crucial aspect of international trade and finance. With the current economic climate, understanding the exchange rate between the two currencies can help individuals and businesses make informed decisions.

For travelers, investors, and businesses, knowing the exchange rate between the US dollar and the Canadian dollar is essential. A slight change in the exchange rate can significantly impact the cost of goods and services, investment returns, and profit margins. In this article, we will delve into the current exchange rate of 40 American dollars to Canadian dollars, explore the factors that influence exchange rates, and provide tips on how to get the best exchange rate.

Current Exchange Rate: 40 USD to CAD

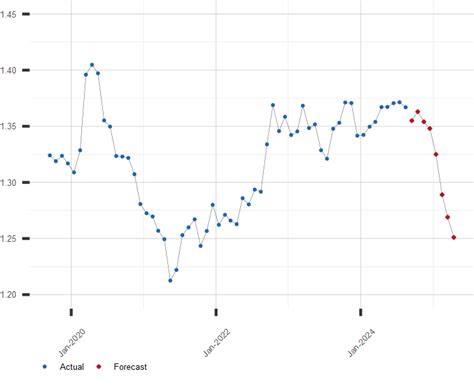

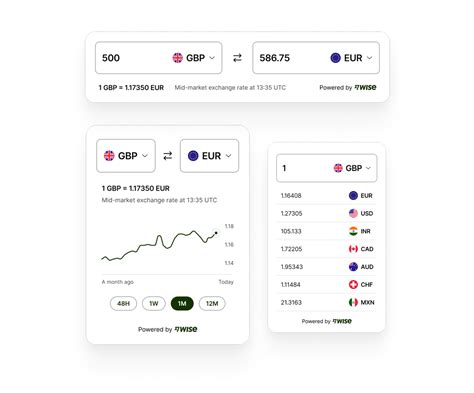

As of the current market rate, 40 American dollars is equivalent to approximately 52.40 Canadian dollars. However, please note that exchange rates can fluctuate constantly due to market forces and economic indicators. To get the most up-to-date exchange rate, it's best to check with a reliable currency conversion tool or service.

Factors That Influence Exchange Rates

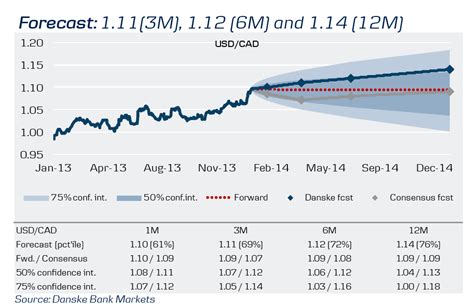

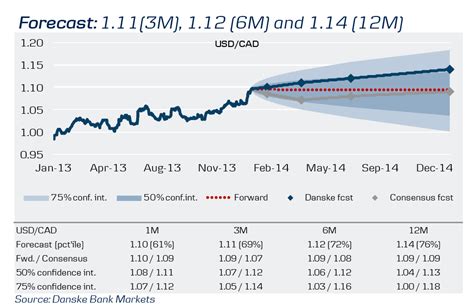

Exchange rates are influenced by a complex array of economic, political, and social factors. Some of the key factors that can impact the exchange rate between the US dollar and the Canadian dollar include:

- Interest Rates: Changes in interest rates can affect the value of a currency. Higher interest rates in the US can attract foreign investors, causing the US dollar to appreciate, while lower interest rates in Canada can lead to a depreciation of the Canadian dollar.

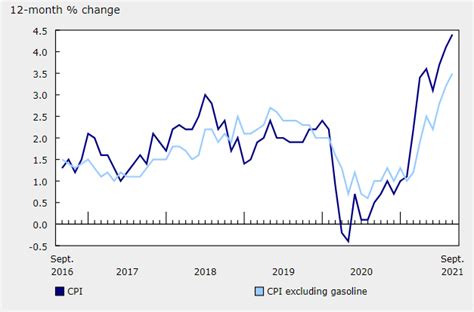

- Inflation: Differences in inflation rates between the two countries can also impact the exchange rate. Higher inflation in Canada can lead to a decrease in the value of the Canadian dollar, making imports more expensive and exports cheaper.

- Trade Balance: The trade balance between the US and Canada can also influence the exchange rate. A trade deficit in Canada can lead to a decrease in the value of the Canadian dollar, as the country needs to import more goods and services.

- Economic Indicators: Economic indicators such as GDP growth, employment rates, and consumer spending can also impact the exchange rate. A strong US economy can lead to an appreciation of the US dollar, while a weak Canadian economy can lead to a depreciation of the Canadian dollar.

Tips for Getting the Best Exchange Rate

Whether you're traveling, investing, or conducting business across the border, getting the best exchange rate is crucial. Here are some tips to help you get the best exchange rate:

- Compare Exchange Rates: Compare exchange rates from different banks, currency exchange services, and online platforms to find the best rate.

- Avoid Airport Exchange Offices: Airport exchange offices often have poor exchange rates and high fees. It's best to exchange your money at a bank or currency exchange service before your trip.

- Use ATMs: Withdrawing cash from an ATM can often provide a better exchange rate than exchanging cash at a bank or currency exchange service.

- Avoid Credit Card Fees: Be aware of credit card fees, such as foreign transaction fees, which can range from 1-3% of the transaction amount.

Understanding the Canadian Dollar

The Canadian dollar is the official currency of Canada and is widely traded on the foreign exchange market. The Canadian dollar is also known as the "loonie" due to the common loon bird that appears on the one-dollar coin.

The Canadian dollar is divided into 100 cents and is available in various denominations, including coins and banknotes. The Canadian dollar is managed by the Bank of Canada, which is responsible for setting monetary policy and maintaining the stability of the financial system.

Benefits of a Strong Canadian Dollar

A strong Canadian dollar can have several benefits, including:

- Increased Purchasing Power: A strong Canadian dollar can increase the purchasing power of Canadians, making imports cheaper and more affordable.

- Improved Standard of Living: A strong Canadian dollar can also lead to an improvement in the standard of living, as Canadians can afford more goods and services.

- Increased Confidence: A strong Canadian dollar can also increase confidence in the Canadian economy, attracting foreign investment and promoting economic growth.

Frequently Asked Questions

Here are some frequently asked questions about the exchange rate between the US dollar and the Canadian dollar:

- Q: What is the current exchange rate between the US dollar and the Canadian dollar? A: The current exchange rate is approximately 1 USD = 1.31 CAD.

- Q: How often do exchange rates change? A: Exchange rates can change constantly due to market forces and economic indicators.

- Q: What are the factors that influence exchange rates? A: Exchange rates are influenced by a complex array of economic, political, and social factors, including interest rates, inflation, trade balance, and economic indicators.

Gallery of Canadian Dollar Exchange Rate

Final Thoughts

Understanding the exchange rate between the US dollar and the Canadian dollar is crucial for individuals and businesses that conduct cross-border transactions. By knowing the current exchange rate and the factors that influence it, you can make informed decisions that can impact your financial situation. Whether you're traveling, investing, or conducting business, getting the best exchange rate can make a significant difference.