Intro

Discover 4 ways to get a 4th stimulus, including tax credits, economic impact payments, and government relief programs, to help individuals and families navigate financial assistance and stimulus packages.

The COVID-19 pandemic has brought about unprecedented economic challenges, affecting individuals and families worldwide. As governments continue to navigate the complexities of the crisis, many people are seeking additional financial support to help them cope with the ongoing difficulties. In the United States, for instance, there have been several stimulus packages aimed at mitigating the economic impact of the pandemic. While the fourth stimulus check is not universally available, there are ways individuals might qualify for additional financial assistance. Understanding these options can provide hope and practical help for those struggling financially.

The need for a fourth stimulus check is rooted in the ongoing economic instability faced by many Americans. Despite the rollout of vaccines and the gradual reopening of businesses, the economic recovery has been uneven, with some sectors and individuals facing significant challenges. The previous stimulus checks have provided vital support, but for many, the assistance has been insufficient or has expired, leaving them in a precarious financial situation. As such, exploring alternative avenues for financial aid is crucial for those seeking to stabilize their economic situation.

The economic landscape continues to evolve, with new challenges emerging as the pandemic persists. Inflation, job market fluctuations, and supply chain disruptions are among the issues that have complicated the recovery process. For individuals and families, these challenges translate into real-world difficulties, such as affording basic necessities, managing debt, and planning for the future. In this context, the possibility of a fourth stimulus check or alternative forms of financial support is not just a matter of economic policy but a lifeline for those struggling to make ends meet.

Understanding the Fourth Stimulus Check

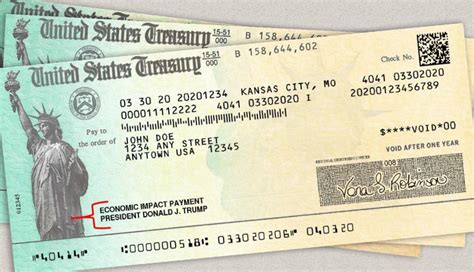

The concept of a fourth stimulus check is straightforward: it refers to an additional round of direct financial payments from the government to eligible citizens. The aim is to provide a quick influx of cash to help individuals cover essential expenses, thus supporting economic activity and alleviating financial stress. However, the implementation and eligibility criteria for such payments can be complex, involving factors like income level, family size, and employment status.

Eligibility Criteria

To qualify for a fourth stimulus check, individuals typically need to meet specific eligibility criteria. These criteria often include income thresholds, with lower-income individuals and families being prioritized. For example, in previous stimulus packages, single filers with incomes up to $75,000 and joint filers with incomes up to $150,000 were eligible for the full payment amount, with the amount phasing out at higher income levels. Additionally, eligibility might depend on whether one has dependents, as the presence of children or other dependents can increase the amount of the stimulus payment.Alternative Forms of Financial Assistance

Given the uncertainty surrounding a fourth stimulus check, it's essential to explore alternative forms of financial assistance. These can include state-specific programs, non-profit organization aid, and employer-offered support. Some states have initiated their own stimulus programs, providing direct payments or other forms of relief to residents. Non-profit organizations may offer financial assistance for specific needs, such as rent, utilities, or food. Employers, too, might provide temporary support, such as hazard pay or flexible leave options, to help employees navigate financial challenges.

State and Local Initiatives

State and local governments have been at the forefront of initiating programs to support residents financially. These initiatives can vary widely, from direct cash payments to subsidies for essential services. For instance, some states have provided stimulus checks to certain groups, like low-income families or frontline workers, recognizing the disproportionate impact of the pandemic on these populations. Additionally, local initiatives might focus on specific areas of need, such as housing assistance or small business support, to bolster community resilience.Applying for Financial Assistance

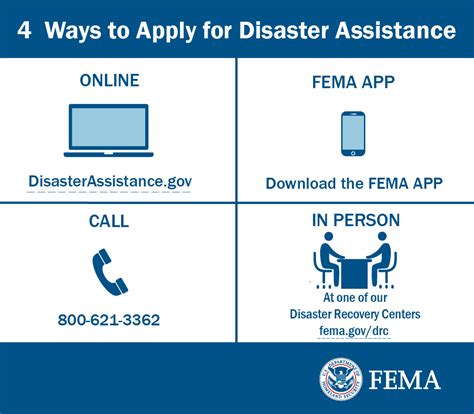

For those seeking financial assistance, whether through a potential fourth stimulus check or alternative programs, understanding the application process is crucial. This typically involves gathering required documents, such as proof of income, identification, and residency, and submitting an application through the designated channel, which could be online, by mail, or in-person. It's also important to be aware of deadlines and to follow up on the status of the application to ensure timely consideration.

Documentation and Follow-Up

The application process for financial assistance often requires careful preparation and follow-through. Applicants must ensure they have all necessary documents, which can include tax returns, pay stubs, and Social Security cards. Submitting a complete application is essential to avoid delays. After applying, it's advisable to keep track of the application's status, as additional information may be requested, or there might be opportunities to appeal a decision if the application is denied.Financial Planning and Budgeting

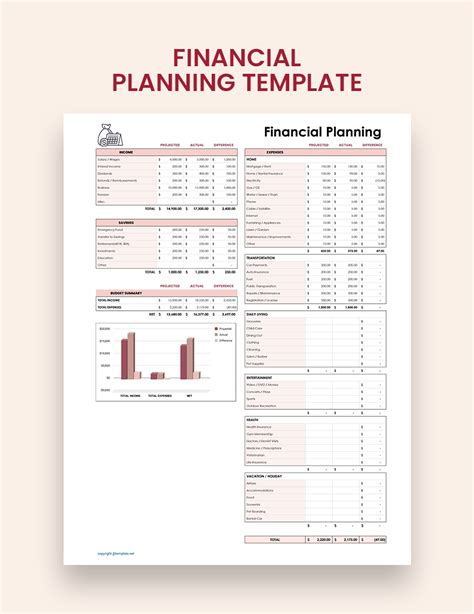

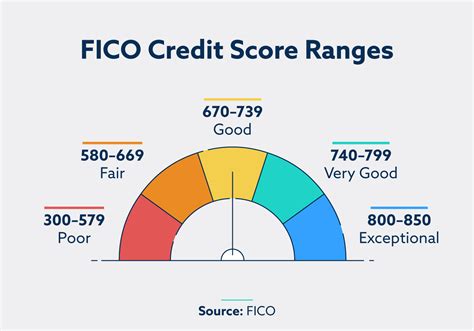

Beyond seeking external financial assistance, individuals can take proactive steps to manage their finances effectively. This includes creating a budget, prioritizing essential expenses, and exploring ways to reduce debt. Financial planning is not just about managing current expenses but also about building resilience for the future. By setting aside savings, investing wisely, and maintaining a good credit score, individuals can better navigate economic uncertainties.

Building Financial Resilience

Building financial resilience involves a combination of short-term strategies, such as budgeting and debt management, and long-term planning, including saving for emergencies and retirement. It's also important to stay informed about economic trends and policy changes that could impact one's financial situation. By being proactive and adaptable, individuals can reduce their vulnerability to economic shocks and improve their overall financial well-being.Conclusion and Next Steps

As the economic landscape continues to evolve, it's clear that financial stability will require a multifaceted approach. For those awaiting a fourth stimulus check or exploring alternative forms of financial assistance, staying informed and being proactive are key. This includes understanding eligibility criteria, applying for available programs, and engaging in effective financial planning. By taking these steps, individuals can better navigate the challenges posed by the pandemic and work towards a more secure financial future.

Final Considerations

In final consideration, the path to financial stability is not solely dependent on external assistance but also on individual actions. By combining available financial aid with prudent financial management and planning, individuals can mitigate the effects of economic uncertainty. As policies and programs continue to develop, staying engaged with financial news and updates will be crucial for making informed decisions about one's financial situation.Financial Assistance Image Gallery

We invite you to share your thoughts and experiences regarding the fourth stimulus check and alternative forms of financial assistance. Your insights can help others navigate these challenging times. Please consider commenting below or sharing this article with someone who might find it helpful. Together, we can foster a community that supports and informs one another as we work towards financial stability and security.