Discover 5 key factors affecting rates, including market trends, economic conditions, and regulatory changes, to understand how interest rates, exchange rates, and insurance rates are influenced by external factors.

The world of finance and economics is complex and multifaceted, with numerous factors influencing the rates that affect our daily lives. From interest rates to exchange rates, these fluctuations can have a significant impact on our financial decisions and the overall economy. Understanding the factors that affect rates is crucial for making informed decisions and navigating the ever-changing financial landscape. In this article, we will delve into the 5 key factors that influence rates, providing valuable insights and practical examples to help readers make sense of this complex topic.

The importance of understanding rates cannot be overstated. Whether you're a business owner, investor, or simply a consumer, rates play a significant role in determining the cost of borrowing, the return on investments, and the overall health of the economy. By grasping the factors that affect rates, individuals and businesses can make more informed decisions, mitigate risks, and capitalize on opportunities. In the following sections, we will explore the 5 key factors that influence rates, including economic indicators, monetary policy, global events, market sentiment, and regulatory environment.

Introduction to Rates

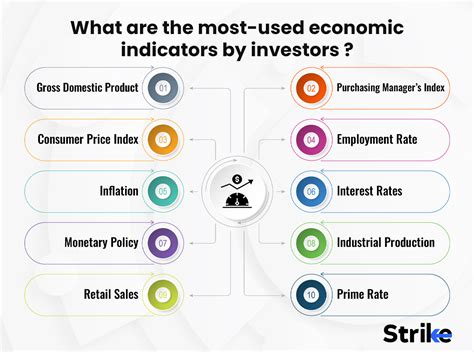

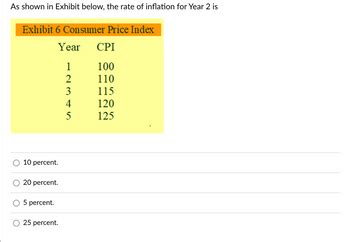

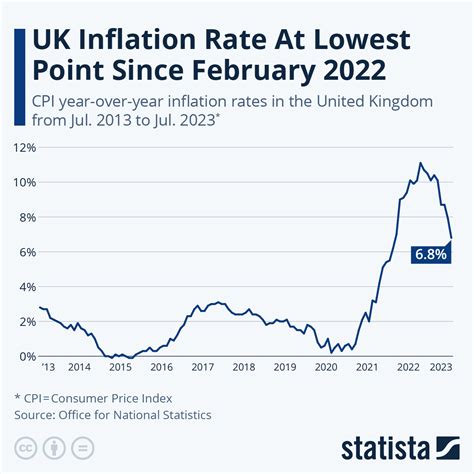

Economic Indicators

Key Economic Indicators

Some of the key economic indicators that affect rates include: * Inflation rates * GDP growth * Unemployment rates * Consumer spending * Business confidenceThese indicators provide valuable insights into the state of the economy and can help predict future rate changes. By monitoring these indicators, individuals and businesses can make more informed decisions and adjust their strategies accordingly.

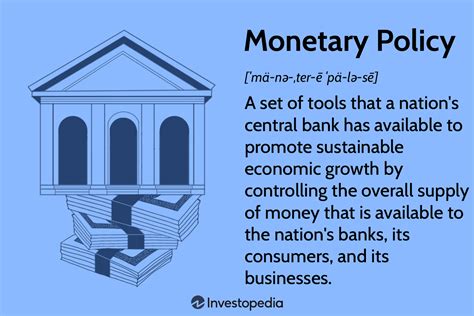

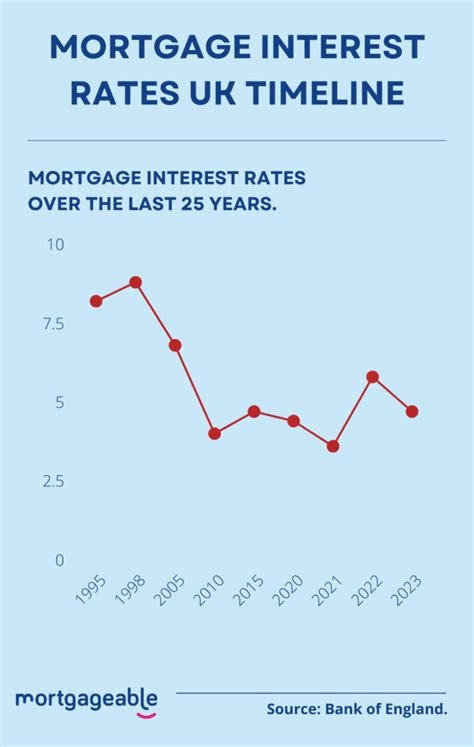

Monetary Policy

Tools of Monetary Policy

Some of the key tools of monetary policy include: * Interest rates * Quantitative easing * Reserve requirements * Forward guidance * Open market operationsThese tools allow central banks to influence the money supply and borrowing costs, ultimately affecting rates. By understanding how these tools work, individuals and businesses can better navigate the financial landscape and make more informed decisions.

Global Events

Types of Global Events

Some of the key types of global events that affect rates include: * Wars and conflicts * Natural disasters * Political instability * Economic downturns * Trade warsThese events can have a profound impact on rates, making it essential to stay informed and adapt to changing circumstances. By understanding the potential impact of global events on rates, individuals and businesses can make more informed decisions and mitigate risks.

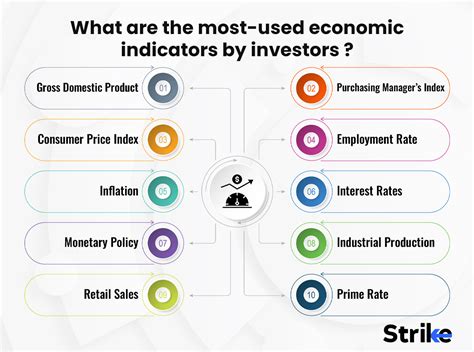

Market Sentiment

Factors Influencing Market Sentiment

Some of the key factors that influence market sentiment include: * Economic indicators * Monetary policy * Global events * Corporate earnings * Investor confidenceThese factors can impact market sentiment, ultimately affecting rates. By understanding the factors that influence market sentiment, individuals and businesses can make more informed decisions and adapt to changing circumstances.

Regulatory Environment

Key Regulatory Bodies

Some of the key regulatory bodies that influence rates include: * Central banks * Financial regulatory agencies * Government agencies * International organizations * Industry associationsThese bodies play a crucial role in shaping the regulatory environment, ultimately affecting rates. By understanding the regulatory environment and its impact on rates, individuals and businesses can make more informed decisions and adapt to changing circumstances.

Factors Affecting Rates Image Gallery

In conclusion, the 5 factors that affect rates are complex and interconnected, making it essential to understand their interactions and implications. By grasping the impact of economic indicators, monetary policy, global events, market sentiment, and regulatory environment on rates, individuals and businesses can make more informed decisions and navigate the ever-changing financial landscape. We invite readers to share their thoughts and experiences on this topic, and to explore the resources and tools available to help them make sense of the complex world of finance. Whether you're a seasoned investor or just starting to learn about rates, we encourage you to engage with this topic and take control of your financial future.