Creating a budget is one of the most effective ways to manage your finances, and using a budget template can make the process much easier. One popular budgeting method is the 50/30/20 rule, which involves dividing your income into three categories: essential expenses, discretionary spending, and saving. In this article, we'll show you how to create a 50/30/20 budget template in Google Sheets and provide tips on how to use it to manage your finances effectively.

Why Use a Budget Template?

A budget template is a powerful tool for managing your finances because it allows you to track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your money. By using a template, you can save time and avoid the hassle of creating a budget from scratch.

What is the 50/30/20 Rule?

The 50/30/20 rule is a simple and effective way to allocate your income. Here's how it works:

- 50% of your income goes towards essential expenses, such as rent, utilities, and groceries.

- 30% towards discretionary spending, such as entertainment, hobbies, and travel.

- 20% towards saving and debt repayment.

This rule provides a framework for allocating your income in a way that ensures you're covering your essential expenses, enjoying some discretionary spending, and building savings and wealth over time.

Creating a 50/30/20 Budget Template in Google Sheets

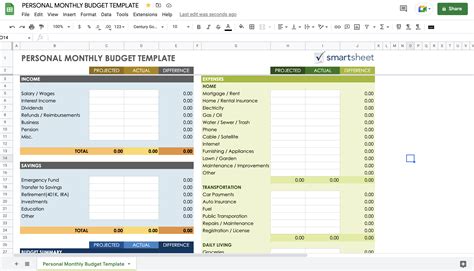

Creating a budget template in Google Sheets is easy. Here's a step-by-step guide:

- Open Google Sheets and create a new spreadsheet.

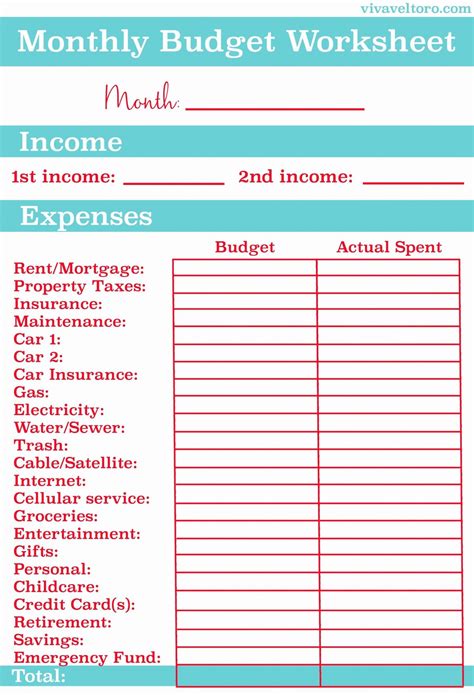

- Set up the following columns: Income, Essential Expenses, Discretionary Spending, Saving, and Total.

- In the Income column, enter your monthly income.

- In the Essential Expenses column, list your essential expenses, such as rent, utilities, and groceries. Enter the monthly amount for each expense.

- In the Discretionary Spending column, list your discretionary expenses, such as entertainment, hobbies, and travel. Enter the monthly amount for each expense.

- In the Saving column, enter your savings goals, such as emergency fund, retirement savings, or debt repayment.

- Use formulas to calculate the total amount for each category and the total income.

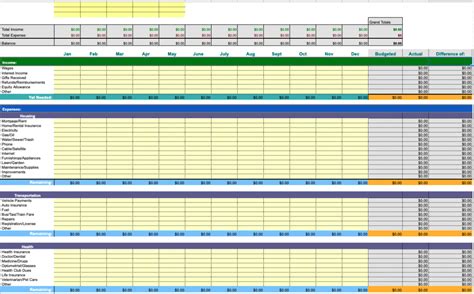

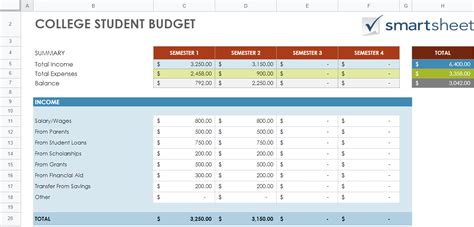

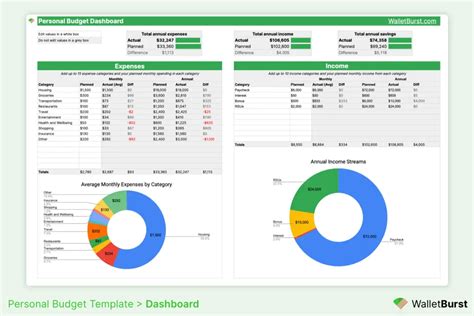

Here's an example of what your budget template might look like:

Tips for Using the 50/30/20 Budget Template

Here are some tips for using the 50/30/20 budget template effectively:

- Track your expenses: Use the template to track your expenses throughout the month. This will help you stay on top of your spending and ensure you're staying within your budget.

- Adjust as needed: The 50/30/20 rule is just a guideline. You may need to adjust the proportions based on your individual circumstances.

- Prioritize needs over wants: Be honest with yourself about what you need versus what you want. Prioritize essential expenses over discretionary spending.

- Automate your savings: Set up automatic transfers from your checking account to your savings or investment accounts to make saving easier and less prone to being neglected.

Benefits of Using the 50/30/20 Budget Template

Using the 50/30/20 budget template can have numerous benefits, including:

- Reduced financial stress: By creating a budget and tracking your expenses, you'll feel more in control of your finances and reduce financial stress.

- Increased savings: The 50/30/20 rule ensures that you're saving a significant portion of your income, which can help you build wealth over time.

- Improved financial discipline: Using a budget template helps you develop financial discipline and makes it easier to stick to your financial goals.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using the 50/30/20 budget template:

- Not tracking expenses: Failing to track your expenses can lead to overspending and make it difficult to stay within your budget.

- Not adjusting the proportions: Failing to adjust the proportions based on your individual circumstances can lead to unrealistic expectations and disappointment.

- Not prioritizing needs over wants: Failing to prioritize essential expenses over discretionary spending can lead to financial stress and difficulty achieving financial goals.

Conclusion

Creating a 50/30/20 budget template in Google Sheets is a simple and effective way to manage your finances. By following the steps outlined in this article, you can create a budget that helps you allocate your income effectively and achieve your financial goals. Remember to track your expenses, adjust the proportions as needed, and prioritize essential expenses over discretionary spending.

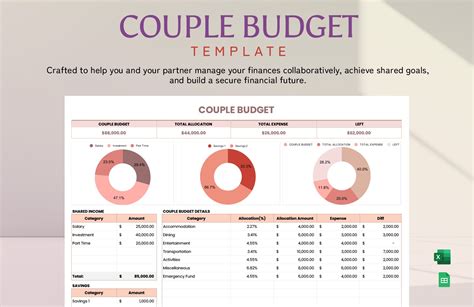

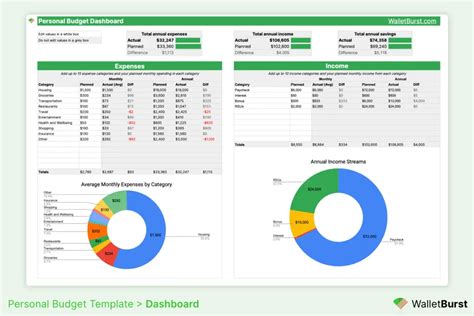

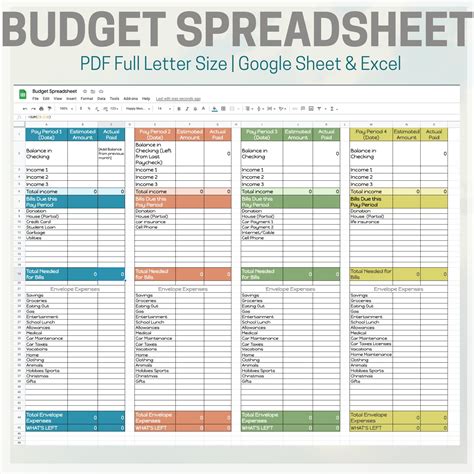

50/30/20 Budget Template Gallery