Intro

Master the 50/30/20 budget rule template to optimize your finances. Allocate 50% for necessities, 30% for discretionary spending, and 20% for savings and debt repayment. Learn how to create a personalized budget plan, prioritize expenses, and achieve financial stability with this simple yet effective budgeting framework.

Managing your finances effectively is crucial for achieving financial stability and security. One popular and simple method for allocating your income is the 50/30/20 budget rule. This rule provides a straightforward framework for dividing your income into three categories: essential expenses, discretionary spending, and savings.

Understanding the 50/30/20 Budget Rule

The 50/30/20 budget rule suggests that you allocate:

- 50% of your income towards essential expenses, such as rent/mortgage, utilities, groceries, transportation, and minimum payments on debts.

- 30% towards discretionary spending, including entertainment, hobbies, travel, and lifestyle upgrades.

- 20% towards savings and debt repayment, such as emergency funds, retirement savings, and paying off high-interest debts.

Benefits of the 50/30/20 Budget Rule

Using the 50/30/20 budget rule can help you:

- Prioritize essential expenses and ensure you have enough for necessities.

- Enjoy some flexibility for discretionary spending and lifestyle choices.

- Build savings and reduce debt over time, improving your financial stability.

How to Implement the 50/30/20 Budget Rule

Implementing the 50/30/20 budget rule involves a few simple steps:

- Calculate your net income: Start by determining your take-home pay, which is your income after taxes and deductions.

- Track your expenses: For one month, write down every single expense, including small purchases, to get a clear picture of where your money is going.

- Categorize expenses: Divide your expenses into essential, discretionary, and savings categories.

- Adjust proportions: Based on your income and expenses, adjust the proportions to fit the 50/30/20 rule.

- Automate savings: Set up automatic transfers to your savings and debt repayment accounts to make saving easier and less prone to being neglected.

Common Challenges and Solutions

- Essential expenses are too high: Consider reducing expenses by finding a roommate, downsizing your home, or negotiating a lower rate with service providers.

- Discretionary spending is too tempting: Implement a "waiting period" for non-essential purchases to ensure they align with your financial goals.

- Savings rate is too low: Increase your income by taking on a side job, selling items you no longer need, or asking for a raise.

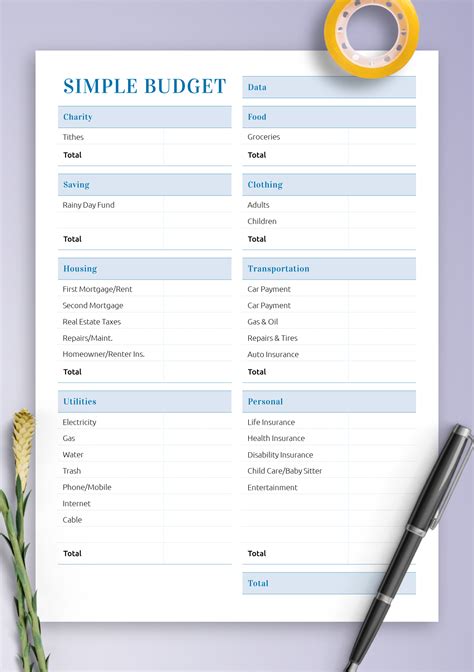

50/30/20 Budget Rule Template

Here's a basic template to help you get started:

| Category | Allocation |

|---|---|

| Essential Expenses (50%) | $______ |

| Discretionary Spending (30%) | $______ |

| Savings and Debt Repayment (20%) | $______ |

Example:

| Category | Allocation |

|---|---|

| Essential Expenses (50%) | $2,500 |

| Discretionary Spending (30%) | $1,500 |

| Savings and Debt Repayment (20%) | $1,000 |

Conclusion

The 50/30/20 budget rule provides a straightforward and effective framework for managing your finances. By allocating your income into essential expenses, discretionary spending, and savings, you can prioritize your financial goals and make progress towards a more stable financial future.

50/30/20 Budget Rule Image Gallery