Intro

Fix errors on your credit report with a 609 dispute letter template. Learn how to write an effective dispute letter to remove negative marks and improve your credit score. Download our free template and guide to dispute inaccurate information and take control of your credit report. Improve your credit health today!

As a consumer, it's essential to know your rights when dealing with creditors, collection agencies, and credit reporting agencies. One of the most effective ways to dispute errors on your credit report or unfair debt collection practices is by using a dispute letter. In this article, we will provide you with a comprehensive guide on how to write a dispute letter, including a free downloadable template.

Understanding the Importance of Dispute Letters

A dispute letter is a formal document that allows you to challenge inaccurate information on your credit report or dispute unfair debt collection practices. By writing a dispute letter, you can:

- Correct errors on your credit report

- Remove negative marks from your credit history

- Stop debt collectors from harassing you

- Protect your credit score

What is a 609 Dispute Letter?

A 609 dispute letter is a type of dispute letter that specifically targets errors on your credit report under Section 609 of the Fair Credit Reporting Act (FCRA). This section requires credit reporting agencies to investigate and correct errors on your credit report within 30 days of receiving a dispute letter.

How to Write a 609 Dispute Letter

Writing a 609 dispute letter requires specific information and formatting. Here are the steps to follow:

- Identify the error: Clearly identify the error on your credit report, including the account name, account number, and the specific error.

- Provide personal information: Include your full name, address, and social security number or Individual Taxpayer Identification Number (ITIN).

- Explain the dispute: Clearly explain why you are disputing the error, including any supporting documentation or evidence.

- Request an investigation: Request that the credit reporting agency investigate the error and correct it within 30 days.

- Include a deadline: Specify a deadline for the credit reporting agency to respond, typically 30 days.

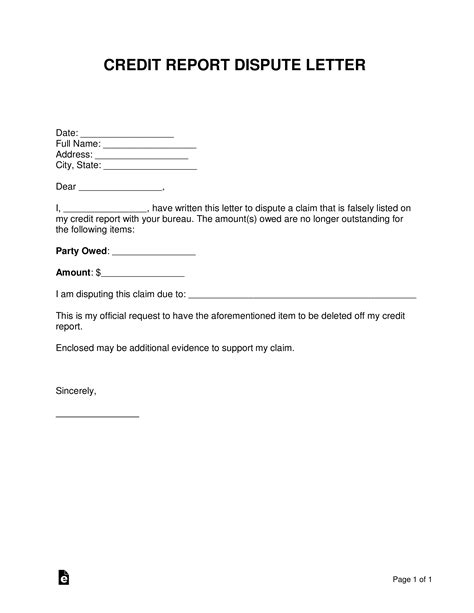

609 Dispute Letter Template Free Download

Here is a free downloadable template for a 609 dispute letter:

[Insert Image: 609 Dispute Letter Template Image]

Tips for Writing an Effective Dispute Letter

- Use a formal tone and business letter format.

- Clearly identify the error and provide supporting documentation.

- Keep the letter concise and to the point.

- Proofread the letter for errors and typos.

- Send the letter via certified mail with return receipt requested.

What to Expect After Sending a Dispute Letter

After sending a dispute letter, you can expect the following:

- Investigation: The credit reporting agency will investigate the error and verify the information.

- Response: The credit reporting agency will respond to your dispute letter within 30 days, either correcting the error or explaining why the information is accurate.

- Correction: If the error is corrected, the credit reporting agency will update your credit report and notify you.

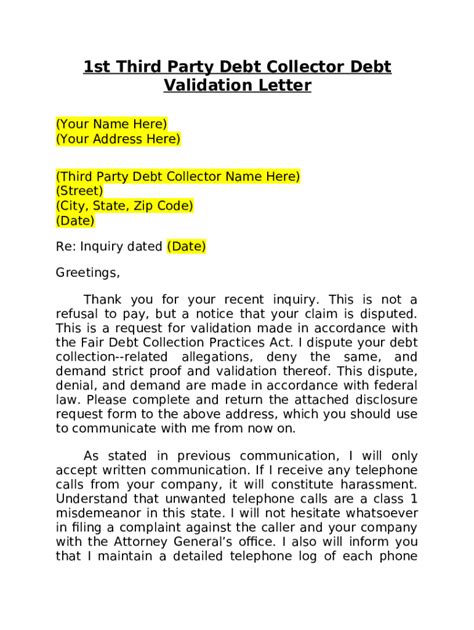

Gallery of Dispute Letter Templates

Dispute Letter Templates Gallery

Conclusion

Writing a dispute letter is an effective way to correct errors on your credit report or dispute unfair debt collection practices. By using a 609 dispute letter template, you can ensure that your dispute letter is formatted correctly and includes all the necessary information. Remember to keep the letter concise, clear, and formal, and to send it via certified mail with return receipt requested.