Are you tired of dealing with the negative impact of late payments on your credit score? Do you want to take control of your financial reputation and start fresh? A well-crafted 609 letter can be a powerful tool in your quest for credit repair.

Late payments can significantly lower your credit score, making it harder to secure loans, credit cards, or even an apartment. But with a 609 letter, you can dispute these errors and potentially have them removed from your credit report. In this article, we'll delve into the world of 609 letters, exploring what they are, how they work, and providing a step-by-step guide on how to write an effective one.

What is a 609 Letter?

A 609 letter is a type of dispute letter that is specifically designed to target errors on your credit report. It is named after Section 609 of the Fair Credit Reporting Act (FCRA), which states that consumers have the right to dispute inaccurate or incomplete information on their credit report. This letter is a formal request to the credit bureau to verify the accuracy of the information in question.

Why is a 609 Letter Effective?

A 609 letter is effective because it puts the burden of proof on the credit bureau. When you dispute an error, the credit bureau must investigate and verify the information. If they cannot provide proof that the information is accurate, they must remove it from your credit report. This can lead to a significant improvement in your credit score.

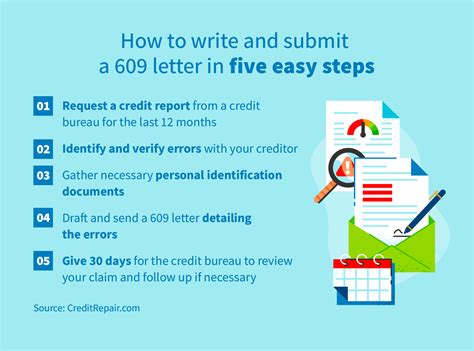

How to Write a 609 Letter

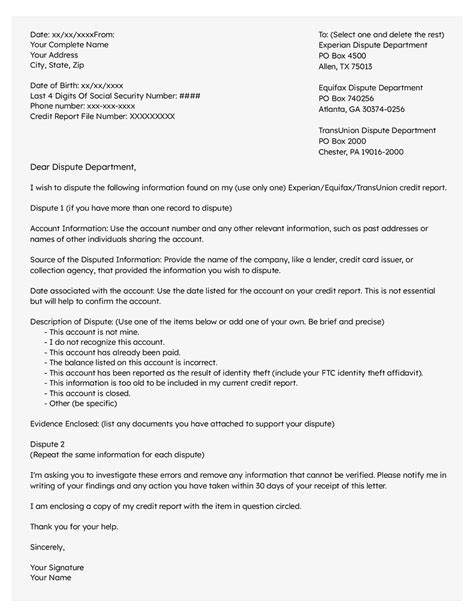

Writing a 609 letter is a straightforward process. Here are the steps to follow:

- Identify the Error: Review your credit report and identify the errors that you want to dispute. Make sure to note the account number, date, and amount of the error.

- Choose the Correct Credit Bureau: Determine which credit bureau is reporting the error. You can request a copy of your credit report from each of the three major credit bureaus (Experian, TransUnion, and Equifax).

- Use a Formal Tone: Use a formal tone and avoid using aggressive language. Remember, the goal is to dispute the error, not to accuse the credit bureau of wrongdoing.

- Include Your Information: Include your name, address, and social security number (or ITIN).

- Specify the Error: Clearly specify the error that you are disputing, including the account number, date, and amount.

- Request Verification: Request that the credit bureau verify the accuracy of the information.

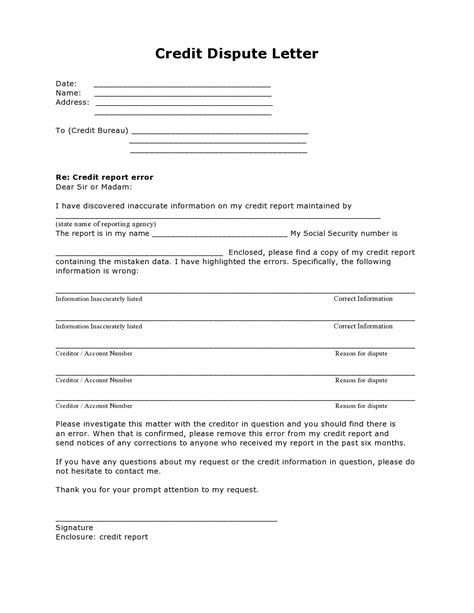

Here is a sample template to get you started:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Date]

[Credit Bureau Name] [Credit Bureau Address] [City, State, ZIP]

Dear [Credit Bureau Representative],

I am writing to dispute the following error on my credit report:

- Account Number: [Account Number]

- Date: [Date]

- Amount: [Amount]

I request that you verify the accuracy of this information. If you cannot provide proof that this information is accurate, I request that you remove it from my credit report.

Please investigate this matter and take the necessary steps to correct my credit report.

Sincerely,

[Your Name]

What to Expect After Sending a 609 Letter

After sending a 609 letter, you can expect the credit bureau to investigate your dispute. They may request additional information or documentation to support your claim. If they find that the error is indeed inaccurate, they will remove it from your credit report.

Gallery of 609 Letter Templates and Credit Repair Strategies

609 Letter Templates and Credit Repair Strategies

We hope this article has provided you with a comprehensive understanding of 609 letters and how they can help you fix late payment credit scores. Remember to always keep a record of your correspondence with the credit bureau and to follow up on your dispute. With persistence and the right strategy, you can improve your credit score and achieve financial freedom.

Share your experiences with 609 letters in the comments below. Have you successfully disputed errors on your credit report using a 609 letter? What tips can you share with our readers?