Intro

Creating a budget can be a daunting task, but having a clear template can make the process much easier. One of the most popular budgeting templates is the 70/20/10 rule. This simple and straightforward template helps individuals allocate their income into different categories, ensuring they have enough for necessary expenses, savings, and discretionary spending.

The 70/20/10 template is an excellent starting point for those who are new to budgeting or need a refresher. By following these three simple steps, you can create a budget that works for you and helps you achieve your financial goals.

Step 1: Calculate Your Income

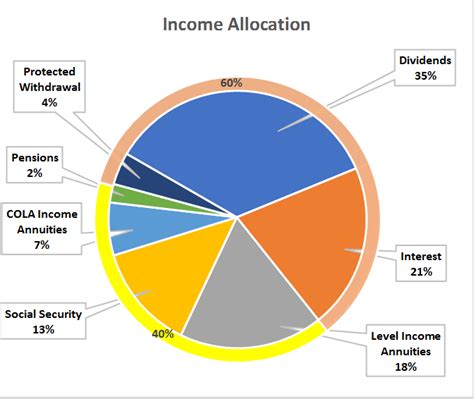

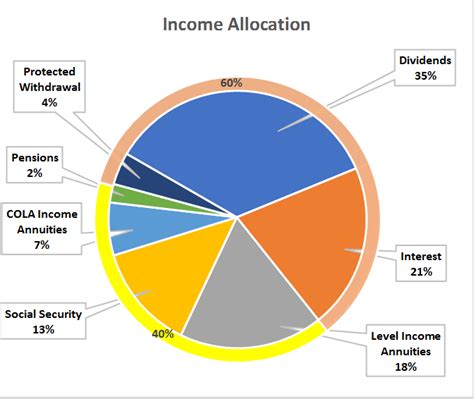

Before you can start allocating your income, you need to know how much you have coming in. Start by calculating your total monthly income from all sources, including your salary, investments, and any side hustles. Be sure to include any irregular income, such as bonuses or freelance work, to get an accurate picture of your financial situation.

Tips for Calculating Income:

- Include all sources of income, including investments and side hustles

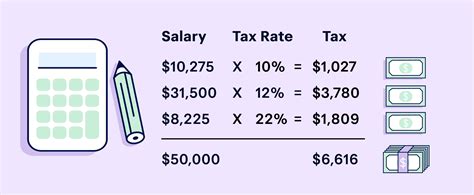

- Use your net income (after taxes) to get an accurate picture of your take-home pay

- Consider any irregular income, such as bonuses or freelance work, to avoid underestimating your income

Step 2: Allocate Your Income

Now that you know your total monthly income, it's time to allocate it into different categories. The 70/20/10 template is a great starting point, but feel free to adjust the proportions based on your individual needs.

- 70% of your income should go towards necessary expenses, such as:

- Rent/mortgage

- Utilities

- Groceries

- Transportation

- Minimum debt payments

- 20% of your income should go towards savings and debt repayment, such as:

- Emergency fund

- Retirement savings

- Debt repayment (above minimum payments)

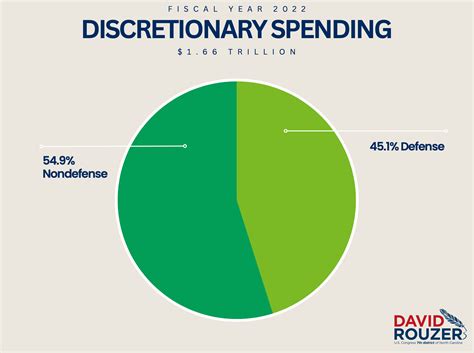

- 10% of your income should go towards discretionary spending, such as:

- Entertainment

- Hobbies

- Travel

Tips for Allocating Income:

- Adjust the proportions based on your individual needs and financial goals

- Prioritize necessary expenses, such as rent/mortgage and utilities

- Make sure to include savings and debt repayment in your budget

Step 3: Track and Adjust Your Budget

Creating a budget is just the first step. To make sure you're staying on track, it's essential to regularly track your spending and adjust your budget as needed.

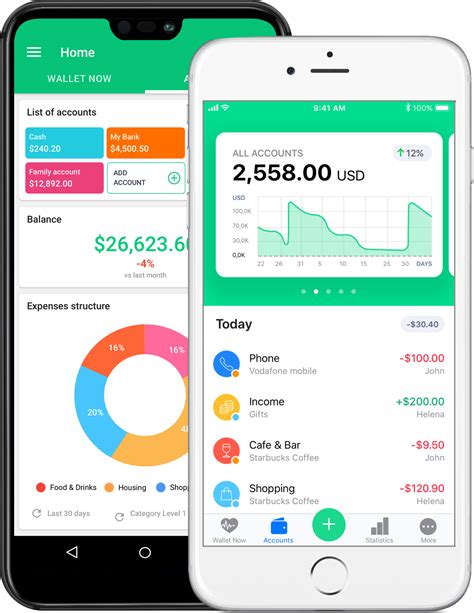

- Use a budgeting app or spreadsheet to track your spending

- Review your budget regularly to ensure you're staying on track

- Adjust your budget as needed to reflect changes in your income or expenses

Tips for Tracking and Adjusting Your Budget:

- Use a budgeting app or spreadsheet to make tracking easier

- Review your budget regularly to catch any mistakes or areas for improvement

- Don't be afraid to adjust your budget as needed to reflect changes in your income or expenses

By following these three simple steps, you can create a budget that works for you and helps you achieve your financial goals. Remember to regularly track and adjust your budget to ensure you're staying on track.

70/20/10 Budgeting Template Image Gallery

We hope this article has helped you create a budget that works for you. Remember to regularly track and adjust your budget to ensure you're staying on track. If you have any questions or need further guidance, please leave a comment below. Don't forget to share this article with your friends and family who may be struggling with budgeting.