Intro

Simplify your accounts payable process with these 5 expert-approved strategies for optimizing aging reports. Discover how to streamline your AP workflow, reduce manual errors, and gain real-time visibility into outstanding invoices, payment terms, and vendor relationships. Say goodbye to AP headaches and hello to improved cash flow management and financial clarity.

Accounts payable aging reports are a crucial tool for businesses to manage their financial obligations and maintain a healthy cash flow. However, creating and interpreting these reports can be a daunting task, especially for small and medium-sized enterprises with limited resources. In this article, we will explore five ways to simplify accounts payable aging reports and make them more effective for your business.

Understanding Accounts Payable Aging Reports

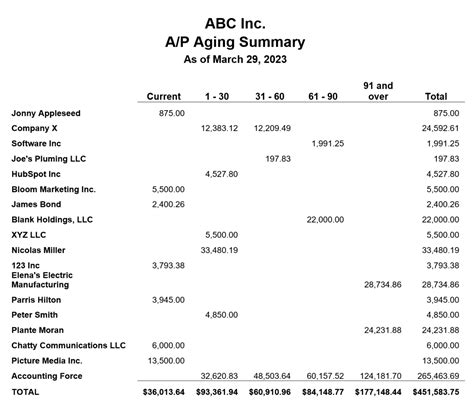

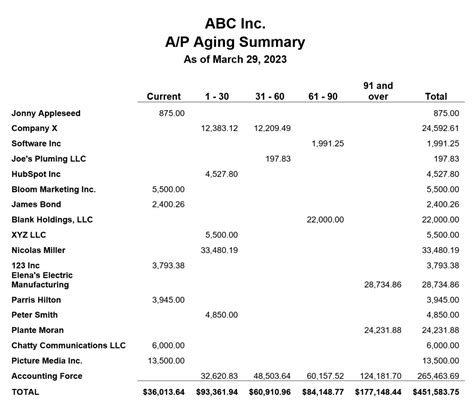

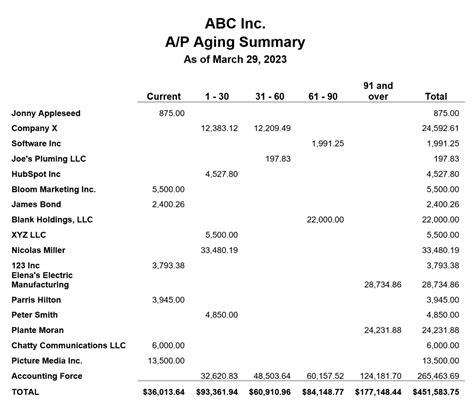

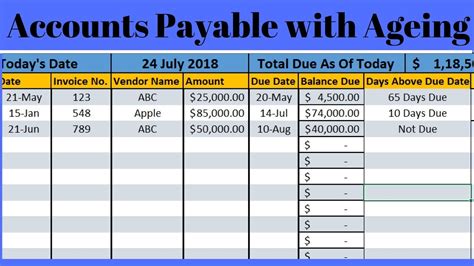

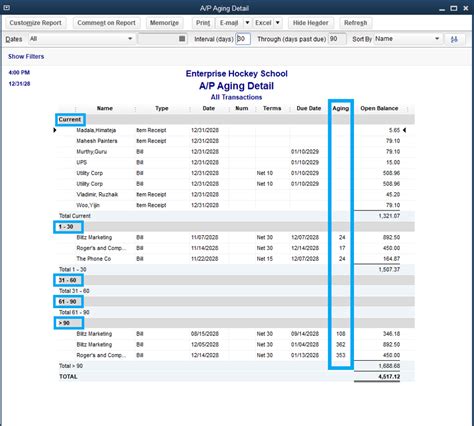

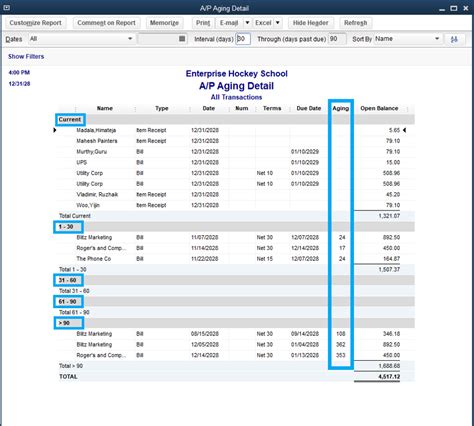

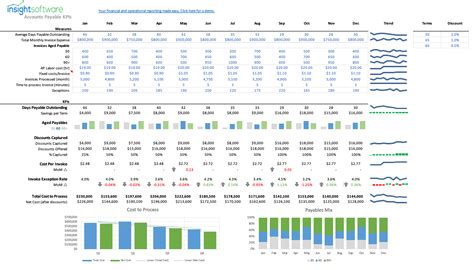

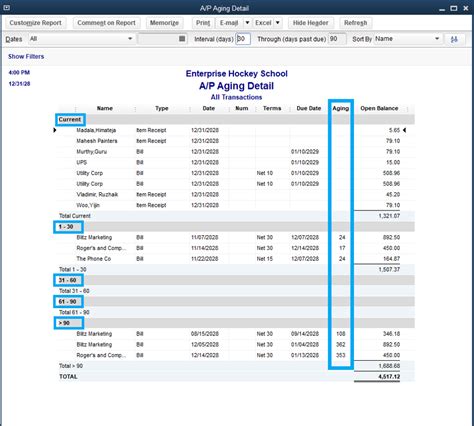

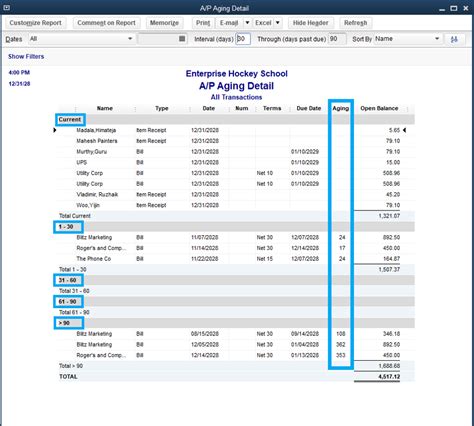

Before we dive into the ways to simplify accounts payable aging reports, let's take a brief look at what they are and why they are important. An accounts payable aging report is a document that shows the outstanding balances owed to suppliers and vendors, categorized by the age of the invoices. This report helps businesses to identify which invoices are overdue, which ones are pending, and which ones are still within the payment terms.

The Challenges of Accounts Payable Aging Reports

Creating an accounts payable aging report can be a complex task, especially if you are dealing with a large number of invoices and suppliers. Some of the common challenges businesses face when creating these reports include:

- Manual data entry errors

- Inconsistent formatting and categorization

- Difficulty in identifying and prioritizing overdue invoices

- Limited visibility into payment terms and due dates

- Inefficient use of time and resources

5 Ways to Simplify Accounts Payable Aging Reports

Here are five ways to simplify accounts payable aging reports and make them more effective for your business:

Automate Data Entry with Accounting Software

One of the most effective ways to simplify accounts payable aging reports is to automate data entry using accounting software. By integrating your accounting system with your suppliers' invoices, you can eliminate manual data entry errors and ensure that your reports are accurate and up-to-date.

Benefits of Automation

- Reduced manual errors and inconsistencies

- Increased efficiency and productivity

- Improved accuracy and reliability of reports

- Enhanced visibility into payment terms and due dates

Use Standardized Templates and Formatting

Using standardized templates and formatting can help to simplify accounts payable aging reports and make them easier to understand. By creating a consistent layout and design, you can ensure that your reports are easy to read and interpret, and that you can quickly identify areas that require attention.

Benefits of Standardization

- Improved readability and clarity of reports

- Enhanced consistency and comparability of data

- Reduced errors and inconsistencies

- Increased efficiency and productivity

Implement a Prioritization System

Implementing a prioritization system can help to simplify accounts payable aging reports and ensure that you are focusing on the most critical invoices first. By categorizing invoices based on their age, amount, and priority, you can quickly identify which ones require immediate attention and which ones can be paid later.

Benefits of Prioritization

- Improved focus on critical invoices

- Enhanced cash flow management

- Reduced late payment fees and penalties

- Increased efficiency and productivity

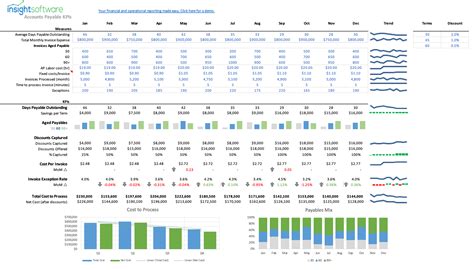

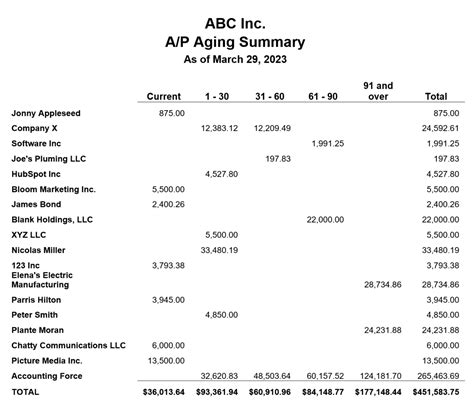

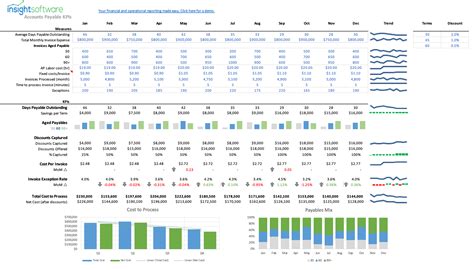

Use Visualization Tools and Dashboards

Using visualization tools and dashboards can help to simplify accounts payable aging reports and make them more engaging and interactive. By creating charts, graphs, and tables, you can quickly visualize your data and identify trends and patterns that require attention.

Benefits of Visualization

- Improved visibility into payment terms and due dates

- Enhanced understanding of cash flow and liquidity

- Increased efficiency and productivity

- Better decision-making and planning

Outsource Accounts Payable Aging Reports

Finally, outsourcing accounts payable aging reports can be a viable option for businesses that lack the resources or expertise to create and manage these reports in-house. By partnering with a reputable accounting firm or outsourcing provider, you can ensure that your reports are accurate, reliable, and up-to-date, without having to invest in additional staff or training.

Benefits of Outsourcing

- Reduced costs and increased efficiency

- Improved accuracy and reliability of reports

- Enhanced expertise and knowledge

- Increased scalability and flexibility

Gallery of Accounts Payable Aging Reports

Accounts Payable Aging Report Image Gallery

Conclusion

In conclusion, simplifying accounts payable aging reports requires a combination of automation, standardization, prioritization, visualization, and outsourcing. By implementing these strategies, businesses can improve the accuracy, reliability, and efficiency of their reports, and make better decisions about their cash flow and liquidity. Whether you are a small business or a large enterprise, simplifying accounts payable aging reports can have a significant impact on your bottom line and help you achieve your financial goals.

We hope this article has provided you with valuable insights and practical tips on how to simplify accounts payable aging reports. If you have any questions or comments, please feel free to share them below.