Intro

As a business owner, managing your company's finances is crucial for its success. One essential tool to help you keep track of your finances is the Accounts Payable Aging Report. This report provides a snapshot of your outstanding bills and invoices, helping you identify potential cash flow problems and make informed decisions about your business.

Accounts Payable Aging Report is a critical tool for businesses of all sizes, as it enables them to manage their debt and maintain a healthy cash flow. In this article, we will discuss the importance of Accounts Payable Aging Report, its components, and provide a template for you to use. We will also analyze the report and provide tips on how to use it to improve your business's financial health.

What is an Accounts Payable Aging Report?

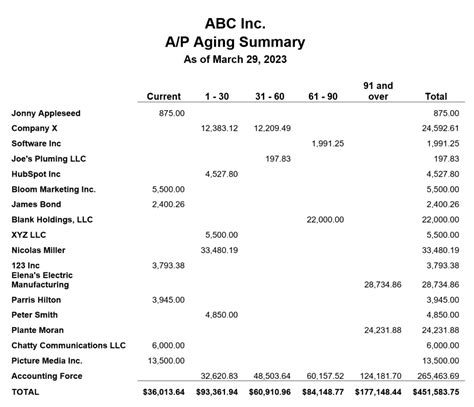

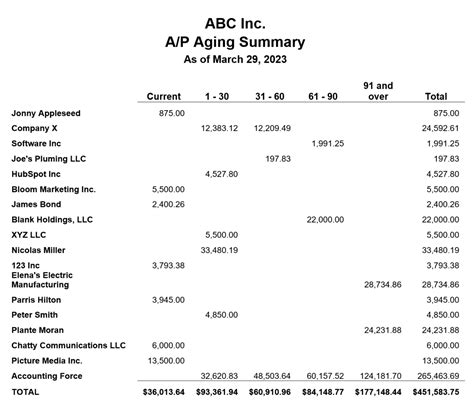

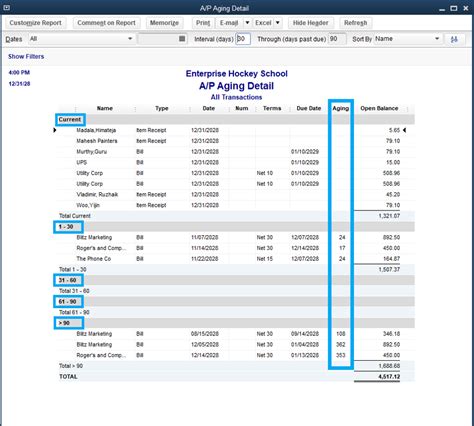

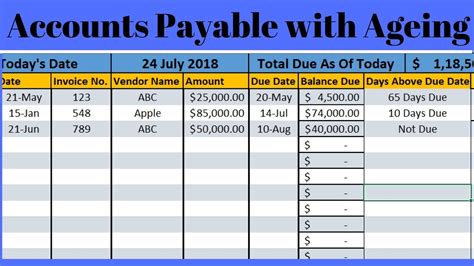

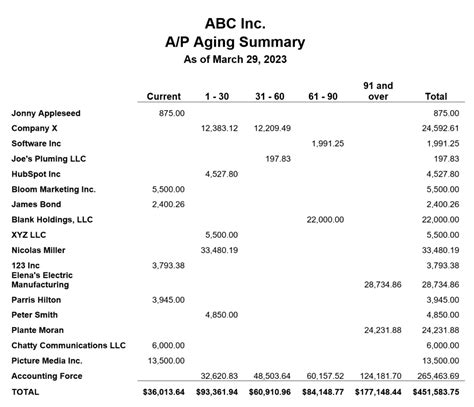

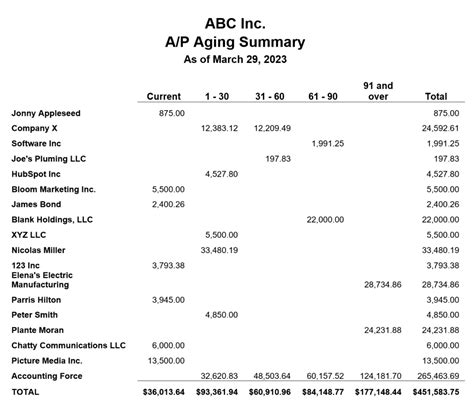

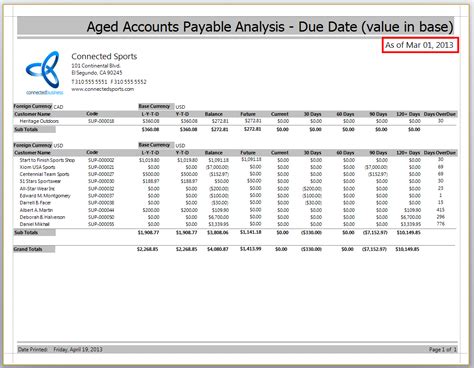

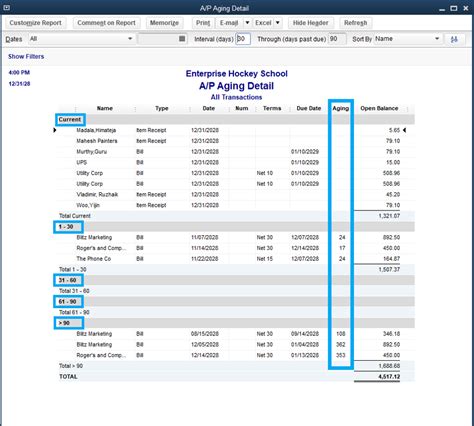

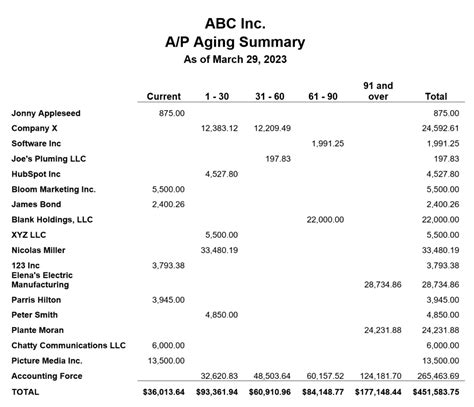

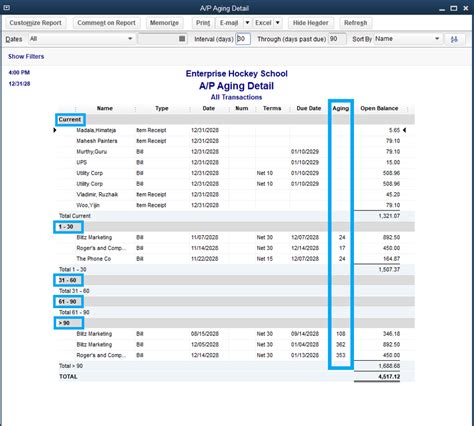

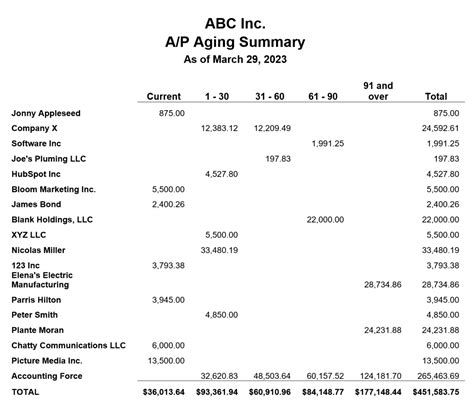

An Accounts Payable Aging Report is a financial report that lists all outstanding invoices and bills that a business owes to its suppliers, vendors, or creditors. The report categorizes these invoices by their age, typically in 30-day increments (0-30 days, 31-60 days, 61-90 days, and over 90 days). This report helps businesses identify which invoices are overdue and need immediate attention.

Components of an Accounts Payable Aging Report

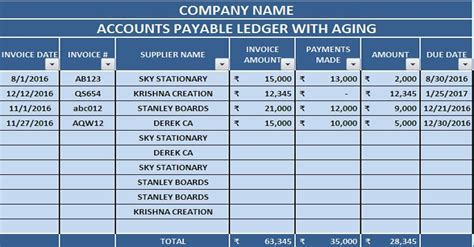

A standard Accounts Payable Aging Report includes the following components:

- Vendor name and invoice number

- Invoice date and due date

- Original amount and current balance

- Aging category (0-30 days, 31-60 days, 61-90 days, and over 90 days)

Accounts Payable Aging Report Template

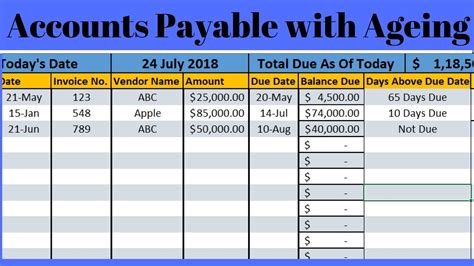

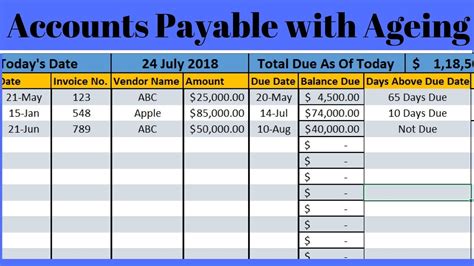

Here is a basic template for an Accounts Payable Aging Report:

| Vendor Name | Invoice Number | Invoice Date | Due Date | Original Amount | Current Balance | Aging Category |

|---|---|---|---|---|---|---|

You can customize this template to suit your business's needs and include additional columns or rows as necessary.

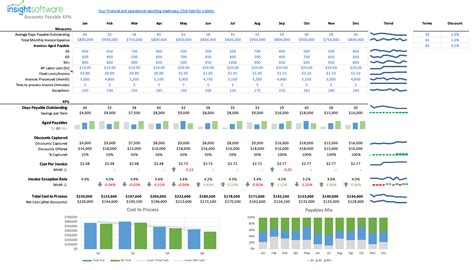

Analysis of Accounts Payable Aging Report

Analyzing your Accounts Payable Aging Report helps you identify potential cash flow problems and make informed decisions about your business. Here are some key things to look for:

- Overdue invoices: Identify invoices that are overdue and prioritize their payment.

- Aging categories: Review the aging categories to see which invoices are nearing or have exceeded their due dates.

- Vendor relationships: Use the report to identify vendors with whom you have a good payment history and negotiate better terms or discounts.

- Cash flow: Use the report to forecast your cash flow and make informed decisions about your business.

Tips for Using Accounts Payable Aging Report

Here are some tips for using your Accounts Payable Aging Report:

- Review the report regularly: Regularly review your Accounts Payable Aging Report to stay on top of your outstanding invoices.

- Prioritize payments: Prioritize payments based on the aging categories and due dates.

- Communicate with vendors: Communicate with vendors about any payment issues or concerns.

- Use the report for forecasting: Use the report to forecast your cash flow and make informed decisions about your business.

Accounts Payable Aging Report Image Gallery

We hope this article has provided you with a comprehensive understanding of Accounts Payable Aging Report and its importance in managing your business's finances. By regularly reviewing your Accounts Payable Aging Report, you can identify potential cash flow problems, prioritize payments, and make informed decisions about your business.

We encourage you to share your thoughts and experiences with Accounts Payable Aging Report in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask.