Effective financial management is crucial for the success of any business, and one of the key tools in achieving this is the accounts receivable aging report. This report provides a snapshot of the outstanding invoices and payments owed to the company, categorized by the length of time they have been outstanding. In this article, we will explore the importance of accounts receivable aging reports, how to create a template in Excel, and provide tips for using this report to improve cash flow and reduce bad debt.

The Importance of Accounts Receivable Aging Reports

Accounts receivable aging reports are essential for businesses to manage their cash flow effectively. This report helps to identify:

- Which customers are behind on payments

- How much money is owed to the company

- How long payments have been outstanding

By analyzing this data, businesses can take proactive steps to collect overdue payments, reduce bad debt, and improve cash flow.

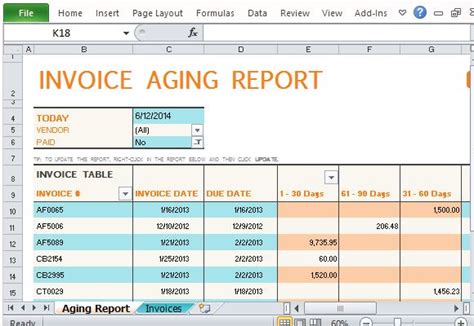

Creating an Accounts Receivable Aging Report Template in Excel

Creating an accounts receivable aging report template in Excel is a straightforward process. Here's a step-by-step guide:

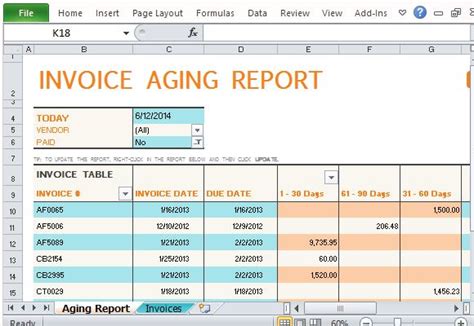

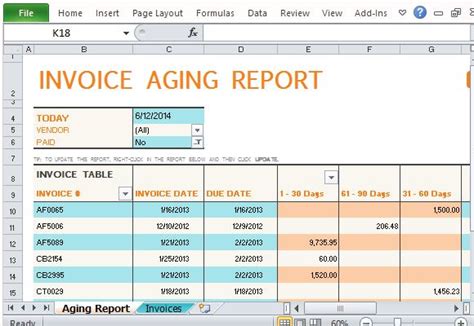

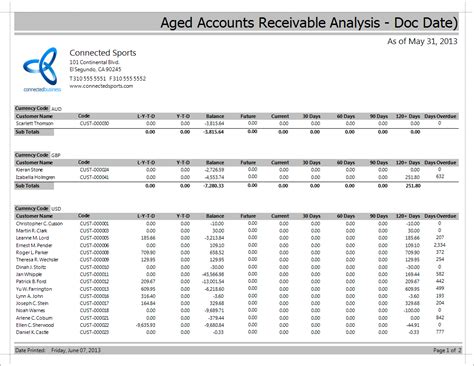

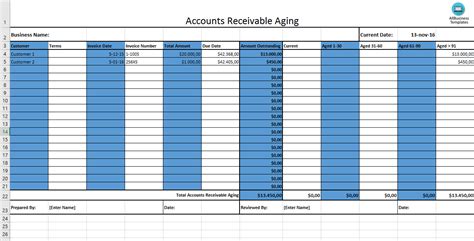

- Set up a table with the following columns:

- Customer Name

- Invoice Number

- Invoice Date

- Due Date

- Outstanding Balance

- Aging Category (e.g., 0-30 days, 31-60 days, 61-90 days, etc.)

- Use formulas to calculate the aging category based on the due date and current date.

- Use conditional formatting to highlight overdue payments.

- Use pivot tables to summarize the data by aging category and customer.

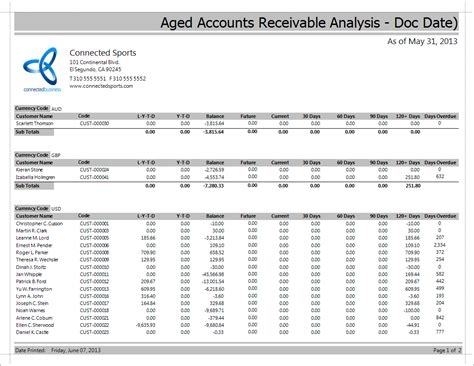

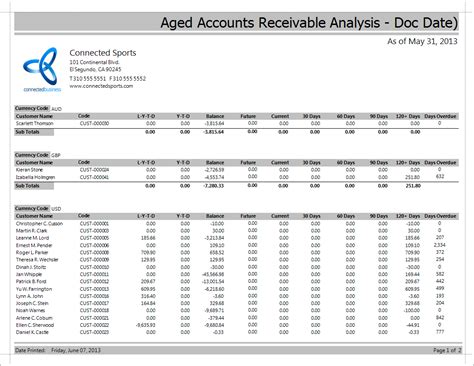

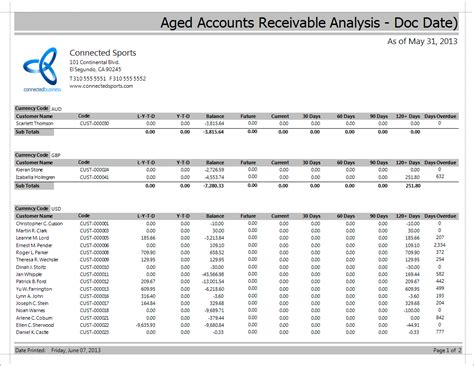

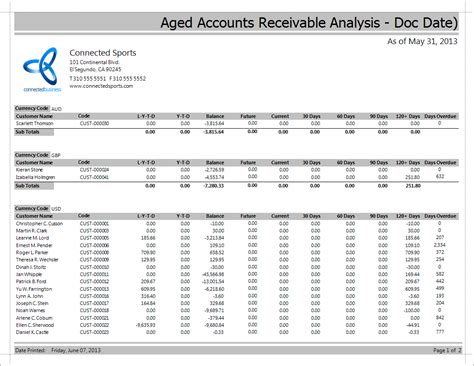

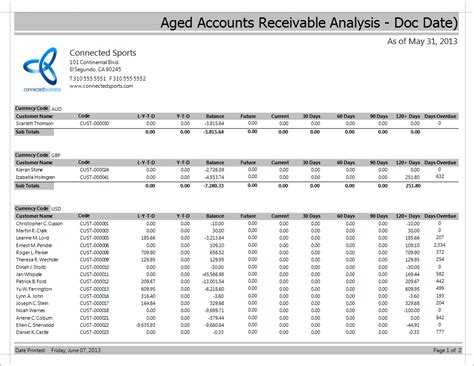

Example of Accounts Receivable Aging Report Template in Excel

Here is an example of what the template might look like:

| Customer Name | Invoice Number | Invoice Date | Due Date | Outstanding Balance | Aging Category |

|---|---|---|---|---|---|

| John Smith | INV001 | 2022-01-01 | 2022-01-31 | $100.00 | 0-30 days |

| Jane Doe | INV002 | 2022-02-01 | 2022-02-28 | $200.00 | 31-60 days |

| Bob Johnson | INV003 | 2022-03-01 | 2022-03-31 | $300.00 | 61-90 days |

Tips for Using the Accounts Receivable Aging Report

Here are some tips for using the accounts receivable aging report to improve cash flow and reduce bad debt:

- Monitor the report regularly: Review the report regularly to identify trends and patterns in customer payments.

- Follow up with customers: Use the report to follow up with customers who are behind on payments.

- Adjust credit terms: Adjust credit terms for customers who consistently pay late.

- Use the report to negotiate with customers: Use the report to negotiate with customers who are struggling to pay.

Best Practices for Managing Accounts Receivable

Managing accounts receivable effectively is critical for maintaining a healthy cash flow. Here are some best practices to follow:

1. Set Clear Credit Terms

Set clear credit terms with customers, including payment terms and late payment fees.

2. Send Invoices Promptly

Send invoices promptly to ensure customers receive them in a timely manner.

3. Follow Up with Customers

Follow up with customers who are behind on payments to ensure timely payment.

4. Use Technology to Automate

Use technology to automate accounts receivable processes, such as invoice generation and payment reminders.

Benefits of Effective Accounts Receivable Management

Effective accounts receivable management has numerous benefits, including:

- Improved cash flow

- Reduced bad debt

- Increased customer satisfaction

- Improved relationships with suppliers

Common Challenges in Accounts Receivable Management

Despite the importance of accounts receivable management, many businesses face challenges in this area. Here are some common challenges:

1. Late Payments

Late payments are a common challenge in accounts receivable management.

2. Insufficient Credit Checks

Insufficient credit checks can lead to bad debt and cash flow problems.

3. Inefficient Processes

Inefficient processes can lead to delays in payment and increased administrative costs.

4. Lack of Automation

Lack of automation can lead to manual errors and increased administrative costs.

Conclusion

In conclusion, accounts receivable aging reports are a critical tool for businesses to manage their cash flow effectively. By creating a template in Excel and following best practices for managing accounts receivable, businesses can improve cash flow, reduce bad debt, and maintain healthy relationships with suppliers and customers.

Accounts Receivable Aging Report Template Image Gallery

We hope this article has provided valuable insights into the importance of accounts receivable aging reports and how to create a template in Excel. By following best practices for managing accounts receivable, businesses can improve cash flow, reduce bad debt, and maintain healthy relationships with suppliers and customers. Share your thoughts and experiences with accounts receivable aging reports in the comments below.