Managing accounts receivable is a critical aspect of any business's financial health. It involves tracking the amount of money customers owe to your company, following up on outstanding invoices, and ensuring timely payments. To streamline this process, an accounts receivable dashboard can be incredibly useful. In this article, we will explore the benefits of using an accounts receivable dashboard Excel template, its key components, and how to create or download a free template.

Benefits of Using an Accounts Receivable Dashboard

An accounts receivable dashboard offers several benefits that can improve your company's financial management and reduce the risk of bad debt. Here are some of the key advantages:

- Improved Visibility: An accounts receivable dashboard provides a clear overview of your company's outstanding invoices, allowing you to track payments and identify potential issues.

- Enhanced Cash Flow Management: By monitoring your accounts receivable, you can anticipate cash inflows and make informed decisions about your company's financial situation.

- Reduced Bad Debt: An accounts receivable dashboard helps you identify overdue invoices, enabling you to take prompt action and minimize the risk of bad debt.

- Increased Efficiency: Automating your accounts receivable process with a dashboard can save time and reduce the workload of your accounting team.

Key Components of an Accounts Receivable Dashboard

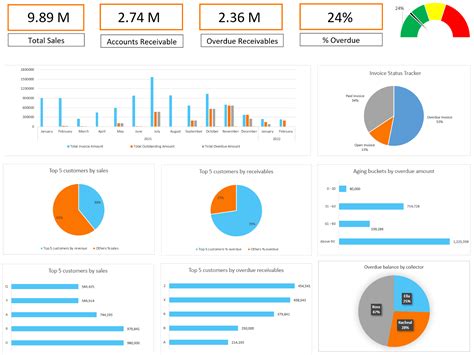

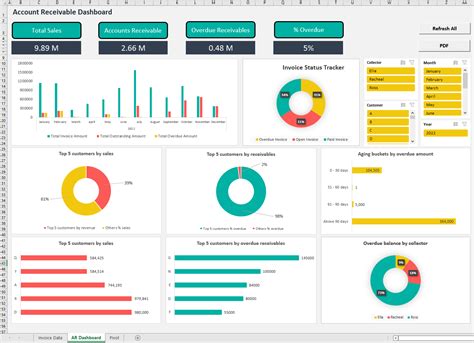

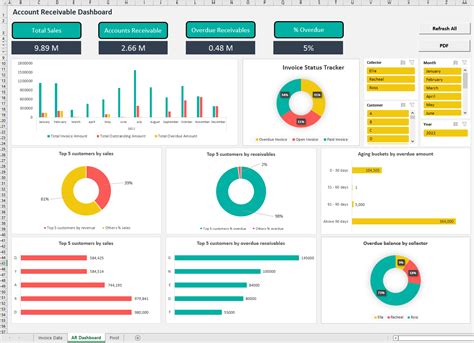

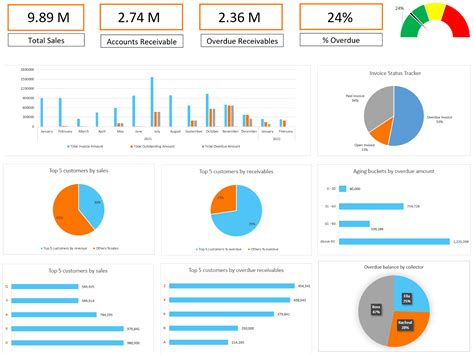

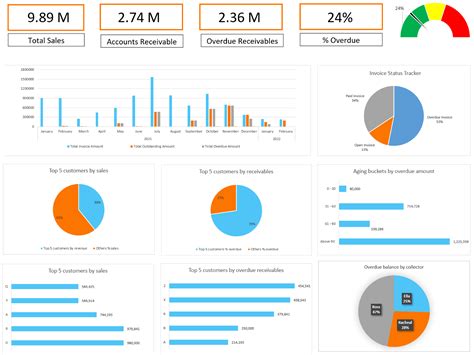

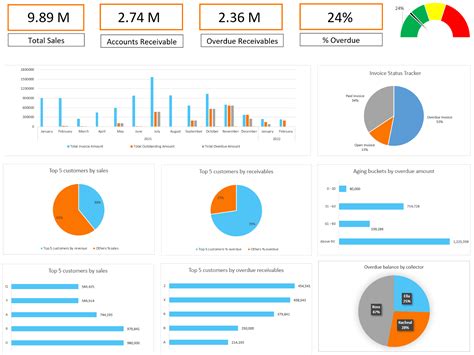

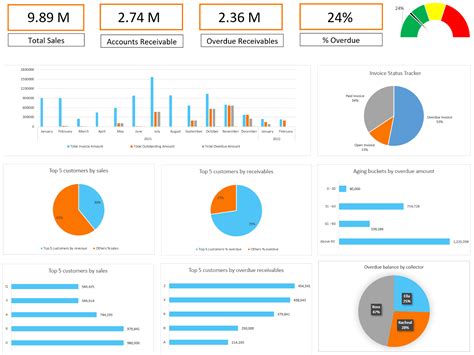

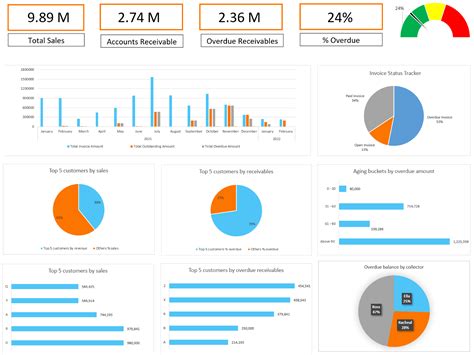

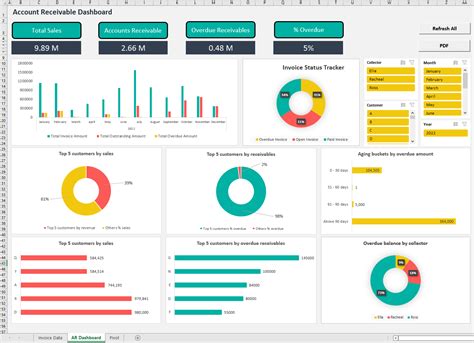

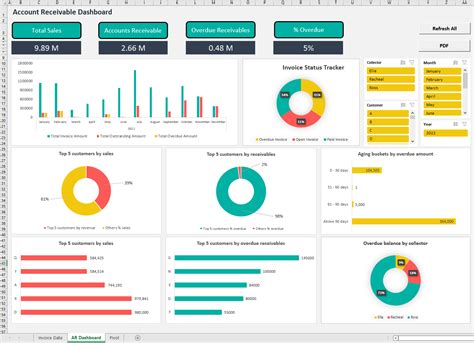

A well-designed accounts receivable dashboard should include the following key components:

- Outstanding Invoices: A list of all outstanding invoices, including the invoice date, due date, and amount.

- Aging Analysis: A summary of outstanding invoices by age, typically categorized as 0-30 days, 31-60 days, 61-90 days, and over 90 days.

- Top Customers: A list of your company's top customers by outstanding balance or payment history.

- Payment History: A record of all payments received, including the payment date, amount, and method.

- Cash Flow Forecast: A projection of future cash inflows based on outstanding invoices and payment history.

Creating an Accounts Receivable Dashboard in Excel

While there are many accounts receivable dashboard templates available for download, you can also create your own using Excel. Here's a step-by-step guide:

- Set up a spreadsheet: Create a new Excel spreadsheet and set up separate sheets for outstanding invoices, aging analysis, top customers, payment history, and cash flow forecast.

- Enter data: Enter your company's accounts receivable data into the relevant sheets, including invoice date, due date, amount, customer name, and payment history.

- Create formulas and charts: Use Excel formulas and charts to summarize and analyze your data, such as calculating outstanding balances and creating aging analysis charts.

- Design the dashboard: Use Excel's dashboard tools to create a user-friendly interface, including tables, charts, and gauges.

Free Accounts Receivable Dashboard Excel Templates

If you prefer to download a pre-designed template, there are many free accounts receivable dashboard Excel templates available online. Here are a few options:

- Microsoft Templates: Microsoft offers a range of free Excel templates, including an accounts receivable dashboard template.

- Vertex42: Vertex42 provides a free accounts receivable dashboard template that includes features such as aging analysis and cash flow forecasting.

- Smartsheet: Smartsheet offers a free accounts receivable dashboard template that includes features such as automated workflows and reporting.

When downloading a template, make sure to choose one that meets your company's specific needs and is compatible with your version of Excel.

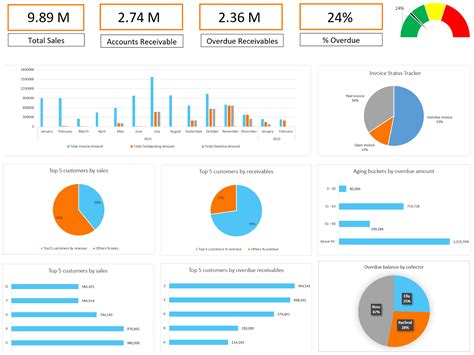

Accounts Receivable Dashboard Image Gallery

Conclusion

An accounts receivable dashboard is a powerful tool for managing your company's outstanding invoices and improving cash flow. By creating or downloading a free accounts receivable dashboard Excel template, you can streamline your accounts receivable process and make informed decisions about your company's financial situation. Remember to choose a template that meets your company's specific needs and is compatible with your version of Excel.

We hope this article has provided you with valuable insights into the benefits and components of an accounts receivable dashboard. If you have any questions or comments, please feel free to share them below.