Intro

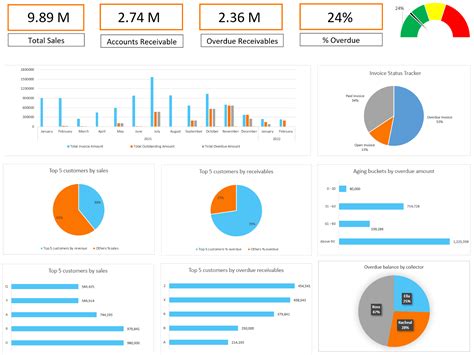

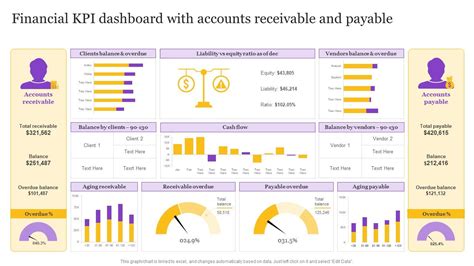

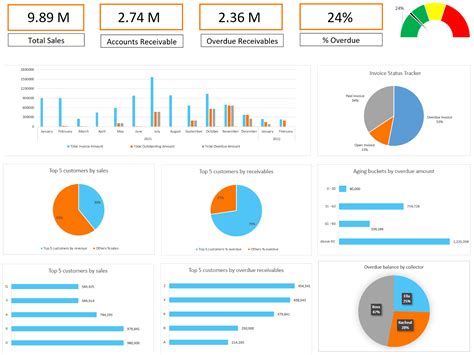

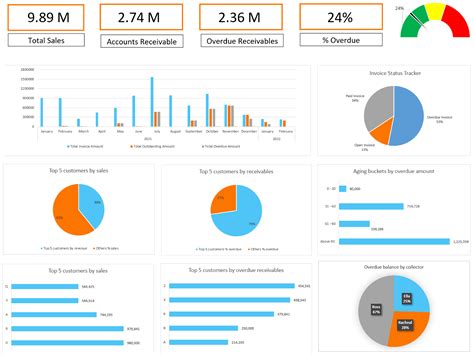

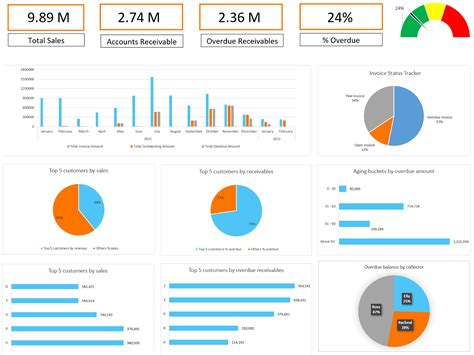

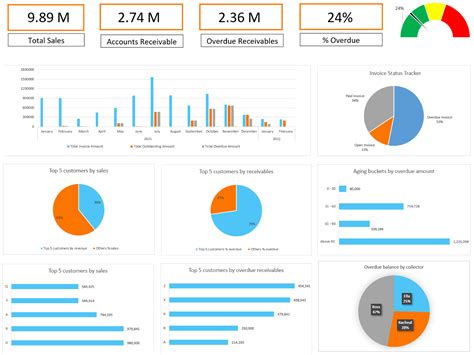

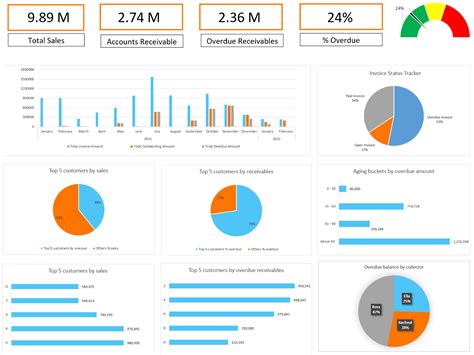

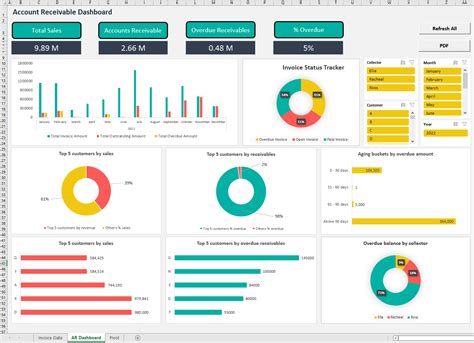

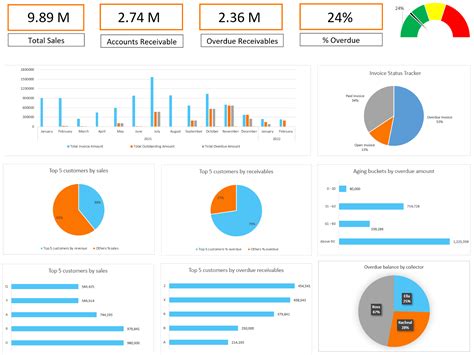

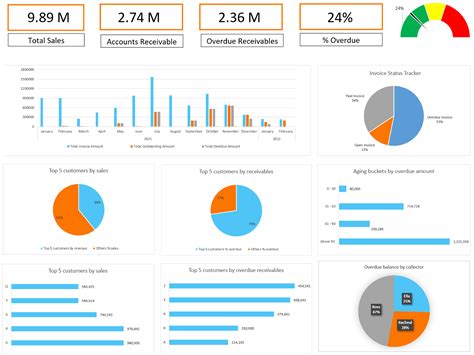

Boost cash flow and streamline financial management with an effective accounts receivable dashboard. Learn how to build a dashboard that tracks key metrics, identifies trends, and enhances decision-making. Discover the 5 essential ways to create a dashboard that optimizes accounts receivable management, including data visualization, KPI tracking, and real-time monitoring.

Effective financial management is crucial for the success of any business. One key aspect of financial management is accounts receivable, which involves managing the amounts owed to a business by its customers. A well-designed accounts receivable dashboard can help businesses track and manage their receivables more efficiently, reducing the risk of late payments and improving cash flow.

In this article, we will explore five ways to build an effective accounts receivable dashboard.

Understanding the Importance of Accounts Receivable

Accounts receivable is a critical component of a company's financial health. It represents the amount of money that customers owe to a business for goods or services purchased on credit. Effective management of accounts receivable is essential to ensure that a business receives timely payments from its customers.

Why Do You Need an Accounts Receivable Dashboard?

An accounts receivable dashboard provides a centralized platform for managing and tracking receivables. It helps businesses to identify areas of improvement, monitor cash flow, and make informed decisions about credit policies and customer relationships.

Here are some benefits of having an accounts receivable dashboard:

- Improved cash flow management

- Reduced risk of late payments and bad debt

- Enhanced visibility into customer payment behavior

- Better decision-making about credit policies and customer relationships

- Increased efficiency in managing and tracking receivables

5 Ways to Build an Effective Accounts Receivable Dashboard

Building an effective accounts receivable dashboard requires careful consideration of several key factors. Here are five ways to build an effective accounts receivable dashboard:

1. Identify Key Performance Indicators (KPIs)

The first step in building an effective accounts receivable dashboard is to identify the key performance indicators (KPIs) that will be used to measure and track receivables. Some common KPIs for accounts receivable include:

- Days Sales Outstanding (DSO)

- Accounts Receivable Turnover

- Average Days to Pay

- Payment Percentage

- Bad Debt Percentage

2. Choose the Right Visualization Tools

The next step is to choose the right visualization tools to display the KPIs. Some common visualization tools include:

- Bar charts

- Line charts

- Pie charts

- Scatter plots

- Heat maps

The choice of visualization tool will depend on the type of data being displayed and the desired level of detail.

Benefits of Data Visualization

Data visualization provides several benefits, including:

- Improved comprehension of complex data

- Enhanced decision-making

- Increased efficiency in identifying trends and patterns

- Better communication of insights and recommendations

3. Design a User-Friendly Interface

A user-friendly interface is essential for an effective accounts receivable dashboard. The interface should be easy to navigate, with clear and concise labels and minimal clutter.

Some best practices for designing a user-friendly interface include:

- Use a simple and intuitive layout

- Use clear and concise labels

- Minimize clutter and unnecessary features

- Use visual hierarchies to organize data

4. Incorporate Drill-Down Capabilities

Drill-down capabilities allow users to access more detailed data and analysis from the dashboard. This can be useful for identifying trends and patterns, as well as for making more informed decisions.

Some best practices for incorporating drill-down capabilities include:

- Use interactive charts and tables

- Provide links to more detailed data and analysis

- Use filters and sorting capabilities to narrow down data

5. Regularly Review and Update the Dashboard

Finally, it is essential to regularly review and update the accounts receivable dashboard to ensure that it remains effective and relevant.

Some best practices for reviewing and updating the dashboard include:

- Regularly review KPIs and adjust as needed

- Update data and analysis on a regular basis

- Solicit feedback from users and stakeholders

- Make adjustments to the design and layout as needed

Conclusion

Building an effective accounts receivable dashboard requires careful consideration of several key factors, including identifying KPIs, choosing the right visualization tools, designing a user-friendly interface, incorporating drill-down capabilities, and regularly reviewing and updating the dashboard.

By following these best practices, businesses can create an accounts receivable dashboard that provides valuable insights and helps to improve cash flow management, reduce the risk of late payments and bad debt, and enhance decision-making about credit policies and customer relationships.

Gallery of Accounts Receivable Dashboard Examples

Accounts Receivable Dashboard Examples

We hope this article has provided valuable insights into building an effective accounts receivable dashboard. If you have any questions or comments, please feel free to share them below.