Accrued interest is a type of interest that is earned but not yet paid. It is a common concept in finance, particularly in accounting and investing. Calculating accrued interest is crucial to determine the total amount of interest earned or owed. Microsoft Excel is a powerful tool to calculate accrued interest, and in this article, we will explore five ways to do so.

Accrued interest can arise in various situations, such as bonds, loans, and investments. It is essential to calculate accrued interest accurately to ensure that financial statements and reports are accurate. Excel provides several formulas and functions to calculate accrued interest, making it a versatile tool for financial calculations.

Understanding Accrued Interest

Before diving into the calculations, it's essential to understand the concept of accrued interest. Accrued interest is the interest earned on an investment or loan from the last payment date to the current date. It is calculated as a percentage of the principal amount and is usually expressed as a decimal value.

Key Components of Accrued Interest

- Principal amount: The initial amount invested or borrowed.

- Interest rate: The rate at which interest is earned or owed.

- Time: The period over which interest is accrued.

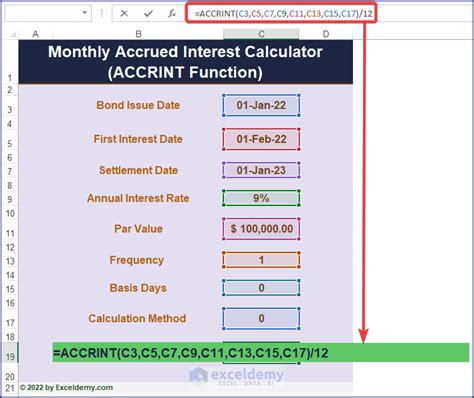

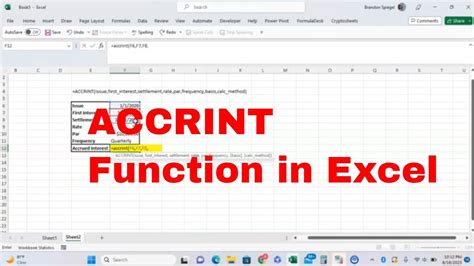

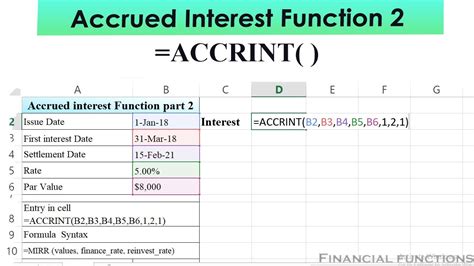

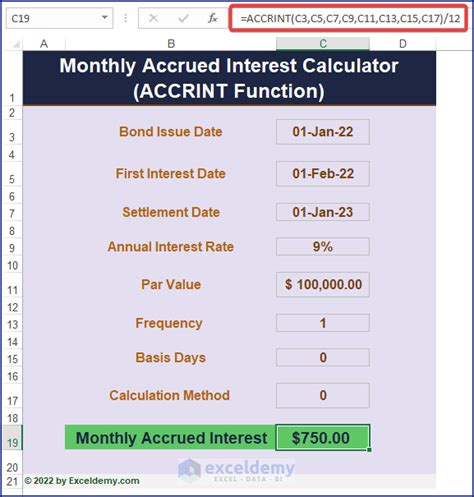

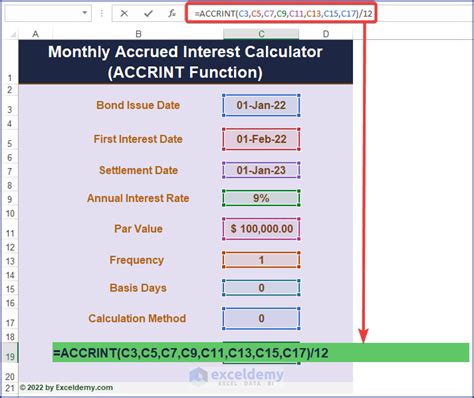

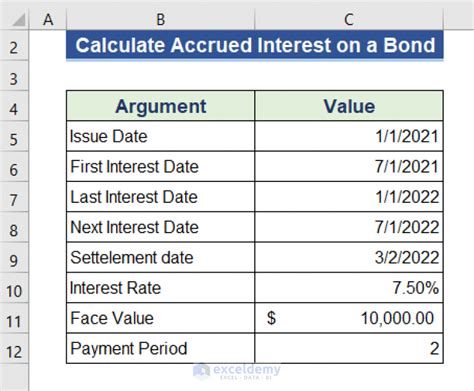

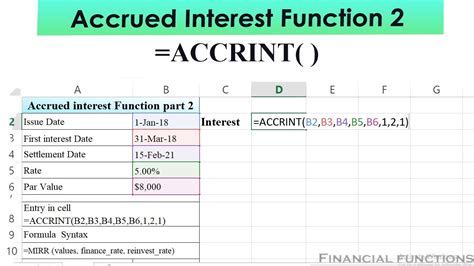

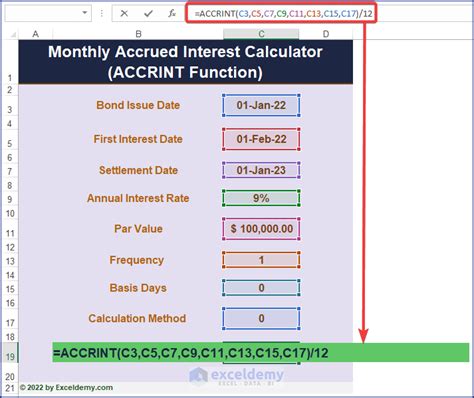

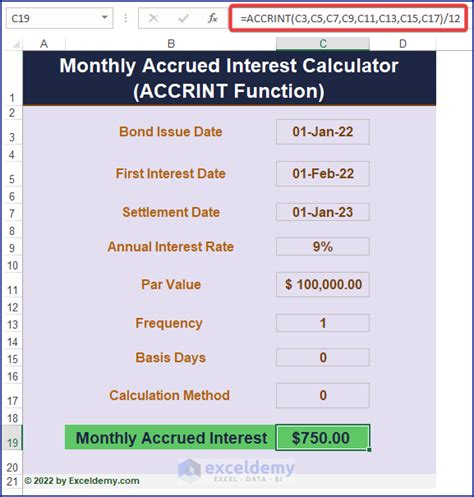

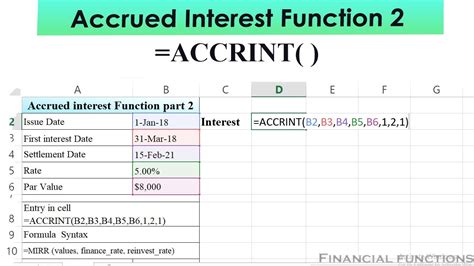

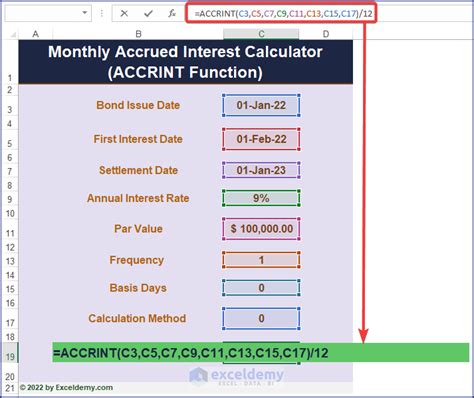

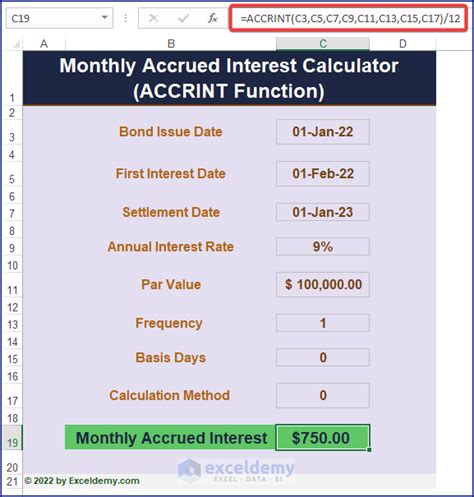

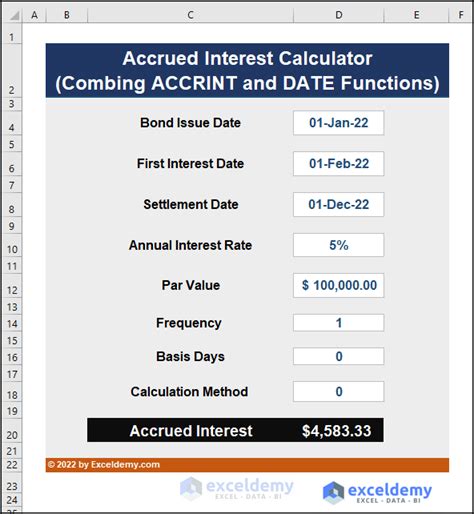

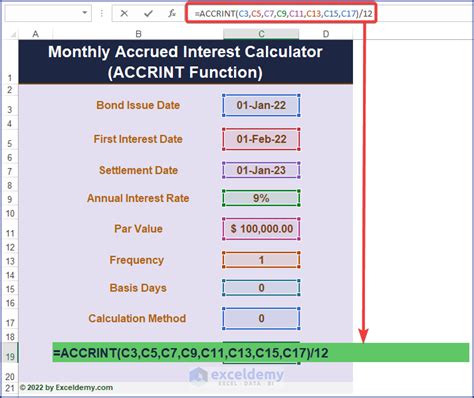

Method 1: Using the ACCRINT Function

The ACCRINT function is a built-in Excel function that calculates accrued interest. The syntax for the ACCRINT function is:

ACCRINT(issue, first_interest, settlement, rate, [par], [frequency])

- issue: The issue date of the security.

- first_interest: The first interest date of the security.

- settlement: The settlement date of the security.

- rate: The annual interest rate.

- [par]: The par value of the security. (Optional)

- [frequency]: The number of times interest is compounded per year. (Optional)

To calculate accrued interest using the ACCRINT function, follow these steps:

- Enter the issue date, first interest date, and settlement date in separate cells.

- Enter the annual interest rate in a separate cell.

- Use the ACCRINT function to calculate accrued interest.

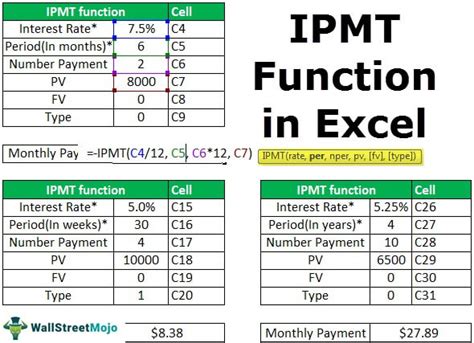

Method 2: Using the IPMT Function

The IPMT function is another built-in Excel function that calculates interest payments. The syntax for the IPMT function is:

IPMT(rate, per, nper, pv, [fv], [type])

- rate: The annual interest rate.

- per: The period for which interest is calculated.

- nper: The total number of periods.

- pv: The present value (the initial amount).

- [fv]: The future value (the amount after nper periods). (Optional)

- [type]: The type of payment (0 = end of period, 1 = beginning of period). (Optional)

To calculate accrued interest using the IPMT function, follow these steps:

- Enter the annual interest rate, period, and total number of periods in separate cells.

- Enter the present value (the initial amount) in a separate cell.

- Use the IPMT function to calculate interest payments.

- Calculate accrued interest by multiplying the interest payment by the number of periods.

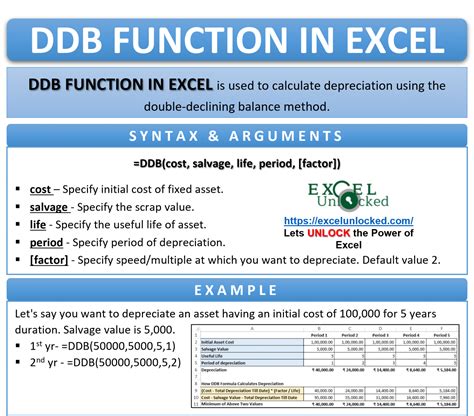

Method 3: Using the DDB Function

The DDB function is a built-in Excel function that calculates depreciation using the double-declining balance method. However, it can also be used to calculate accrued interest. The syntax for the DDB function is:

DDB(cost, salvage, life, period, [factor])

- cost: The initial amount.

- salvage: The residual value (the value after the life of the asset).

- life: The total number of periods.

- period: The period for which interest is calculated.

- [factor]: The depreciation factor (1.5 for double-declining balance). (Optional)

To calculate accrued interest using the DDB function, follow these steps:

- Enter the initial amount, residual value, and total number of periods in separate cells.

- Enter the period for which interest is calculated in a separate cell.

- Use the DDB function to calculate depreciation.

- Calculate accrued interest by subtracting the residual value from the initial amount and multiplying by the depreciation factor.

Method 4: Using a Formula

You can also calculate accrued interest using a formula. The formula for accrued interest is:

Accrued Interest = Principal x Rate x Time

To calculate accrued interest using a formula, follow these steps:

- Enter the principal amount, interest rate, and time in separate cells.

- Use the formula to calculate accrued interest.

Method 5: Using a Template

You can also use a template to calculate accrued interest. A template is a pre-designed spreadsheet that can be customized to suit your needs.

To calculate accrued interest using a template, follow these steps:

- Download an accrued interest template from the internet or create your own template.

- Enter the principal amount, interest rate, and time in the template.

- The template will calculate accrued interest automatically.

Gallery of Accrued Interest in Excel

Accrued Interest Image Gallery

Conclusion

Calculating accrued interest is a crucial step in financial calculations. Excel provides several methods to calculate accrued interest, including the ACCRINT function, IPMT function, DDB function, formulas, and templates. By using these methods, you can accurately calculate accrued interest and ensure that your financial statements and reports are accurate.