Intro

Boost payroll efficiency with the ADP pay stub template with calculator. Learn 7 ways to utilize this tool for seamless paycheck processing, accurate calculations, and streamlined financial record-keeping. Discover how to simplify wage calculations, deductions, and benefits tracking, and optimize your payroll workflow with our expert guide and templates.

In today's digital age, managing payroll and employee compensation can be a daunting task for small businesses and entrepreneurs. One tool that can simplify this process is an ADP pay stub template with a calculator. ADP, or Automatic Data Processing, is a well-established provider of payroll processing and HR management solutions. Their pay stub template can help streamline payroll operations, reduce errors, and increase efficiency.

Using an ADP pay stub template with a calculator can offer numerous benefits, including reduced administrative burdens, improved accuracy, and enhanced employee satisfaction. In this article, we will explore seven ways to utilize an ADP pay stub template with a calculator to optimize your payroll management.

Understanding the ADP Pay Stub Template with Calculator

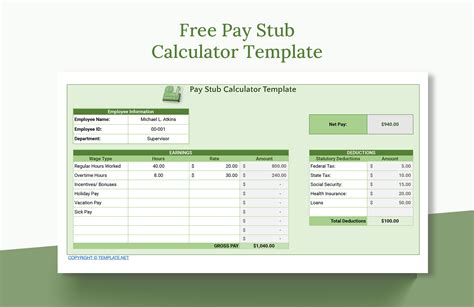

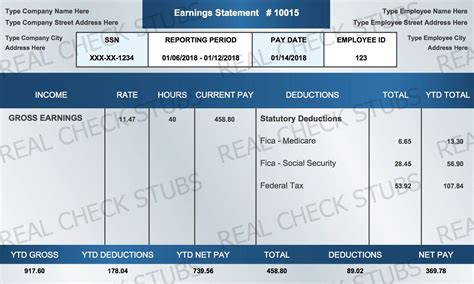

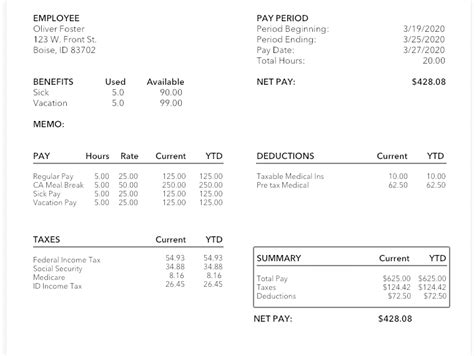

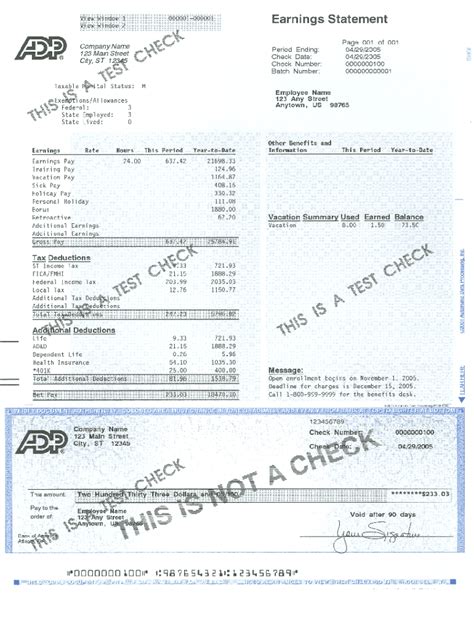

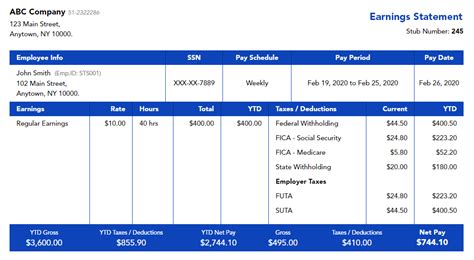

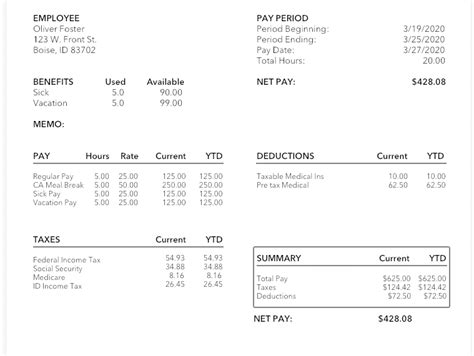

Before we dive into the seven ways to use an ADP pay stub template with a calculator, it's essential to understand what this tool is and how it works. An ADP pay stub template is a pre-designed document that outlines an employee's pay information, including their name, address, pay date, pay period, gross earnings, deductions, and net pay. The calculator function allows you to easily calculate employee earnings, deductions, and net pay.

Benefits of Using an ADP Pay Stub Template with Calculator

- Reduced administrative burdens: Automate payroll calculations and minimize the risk of human error.

- Improved accuracy: Ensure accurate calculations and reduce the likelihood of disputes or compliance issues.

- Enhanced employee satisfaction: Provide employees with clear, concise, and accurate pay information, promoting transparency and trust.

1. Simplify Payroll Calculations

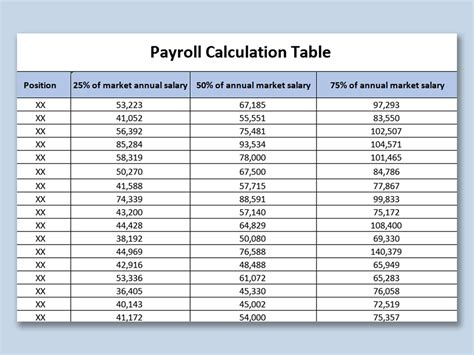

One of the most significant advantages of using an ADP pay stub template with a calculator is the ability to simplify payroll calculations. The calculator function allows you to quickly and accurately calculate employee earnings, deductions, and net pay, reducing the risk of human error and minimizing administrative burdens.

How to Use the Calculator Function

- Enter employee information, including name, address, and pay date.

- Input pay period information, including start and end dates.

- Enter employee earnings, including hourly rate, hours worked, and gross earnings.

- Calculate deductions, including taxes, benefits, and other withholdings.

- Calculate net pay using the calculator function.

2. Automate Pay Stub Generation

Another way to use an ADP pay stub template with a calculator is to automate pay stub generation. By integrating the template with your payroll processing system, you can generate pay stubs automatically, reducing administrative burdens and minimizing the risk of human error.

Benefits of Automating Pay Stub Generation

- Reduced administrative burdens: Automate pay stub generation and minimize manual data entry.

- Improved accuracy: Ensure accurate pay stubs and reduce the likelihood of disputes or compliance issues.

- Enhanced employee satisfaction: Provide employees with clear, concise, and accurate pay information, promoting transparency and trust.

3. Improve Compliance with Pay Stub Laws

Using an ADP pay stub template with a calculator can also help improve compliance with pay stub laws. By ensuring accurate and complete pay stubs, you can minimize the risk of non-compliance and associated fines or penalties.

Pay Stub Laws and Regulations

- Fair Labor Standards Act (FLSA): Requires employers to provide employees with accurate and complete pay stubs.

- State and local laws: Varying requirements for pay stub content, format, and distribution.

4. Enhance Employee Satisfaction

Providing employees with clear, concise, and accurate pay information can enhance employee satisfaction and promote transparency and trust. By using an ADP pay stub template with a calculator, you can ensure that employees receive accurate and complete pay stubs, reducing disputes and complaints.

Benefits of Enhanced Employee Satisfaction

- Improved employee morale: Provide employees with clear, concise, and accurate pay information, promoting transparency and trust.

- Reduced disputes and complaints: Minimize errors and inaccuracies, reducing the likelihood of disputes and complaints.

- Increased employee retention: Promote transparency and trust, increasing employee satisfaction and retention.

5. Reduce Administrative Burdens

Using an ADP pay stub template with a calculator can also reduce administrative burdens associated with payroll processing. By automating payroll calculations and generating pay stubs automatically, you can minimize manual data entry and reduce administrative burdens.

Benefits of Reduced Administrative Burdens

- Improved productivity: Automate payroll calculations and generate pay stubs automatically, reducing manual data entry.

- Reduced costs: Minimize administrative burdens and reduce associated costs.

- Enhanced focus on core business activities: Reduce administrative burdens and focus on core business activities.

6. Improve Payroll Accuracy

Using an ADP pay stub template with a calculator can also improve payroll accuracy. By ensuring accurate and complete pay stubs, you can minimize errors and inaccuracies, reducing the likelihood of disputes or compliance issues.

Benefits of Improved Payroll Accuracy

- Reduced errors and inaccuracies: Minimize errors and inaccuracies, reducing the likelihood of disputes or compliance issues.

- Improved compliance: Ensure accurate and complete pay stubs, minimizing the risk of non-compliance and associated fines or penalties.

- Enhanced employee satisfaction: Provide employees with clear, concise, and accurate pay information, promoting transparency and trust.

7. Enhance Payroll Security

Finally, using an ADP pay stub template with a calculator can enhance payroll security. By ensuring accurate and complete pay stubs, you can minimize the risk of identity theft and associated crimes.

Benefits of Enhanced Payroll Security

- Reduced risk of identity theft: Minimize the risk of identity theft and associated crimes.

- Improved compliance: Ensure accurate and complete pay stubs, minimizing the risk of non-compliance and associated fines or penalties.

- Enhanced employee satisfaction: Provide employees with clear, concise, and accurate pay information, promoting transparency and trust.

ADP Pay Stub Template with Calculator Image Gallery

By utilizing an ADP pay stub template with a calculator, you can streamline payroll operations, reduce administrative burdens, and improve accuracy. Whether you're a small business owner or an HR professional, this tool can help you optimize payroll management and promote transparency and trust with your employees.