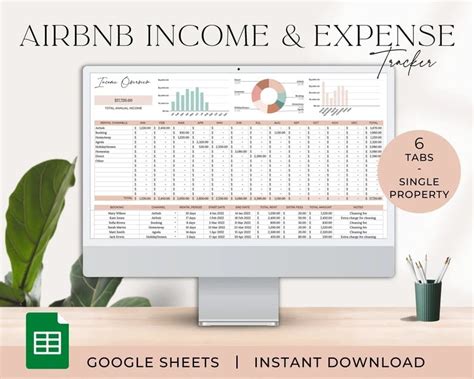

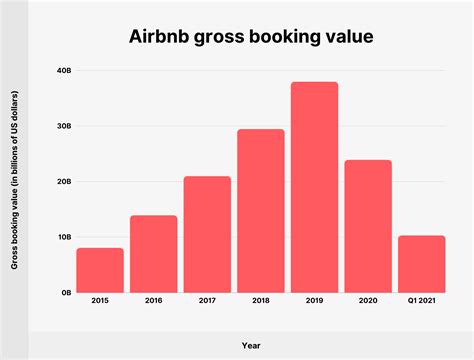

As an Airbnb host, managing your expenses is crucial to ensure you're making a profit. With the rise of short-term rentals, it's becoming increasingly important to stay on top of your finances. In this article, we'll explore the 7 essential tools for Airbnb expense tracking that can help you streamline your finances and maximize your returns.

Why Expense Tracking is Crucial for Airbnb Hosts

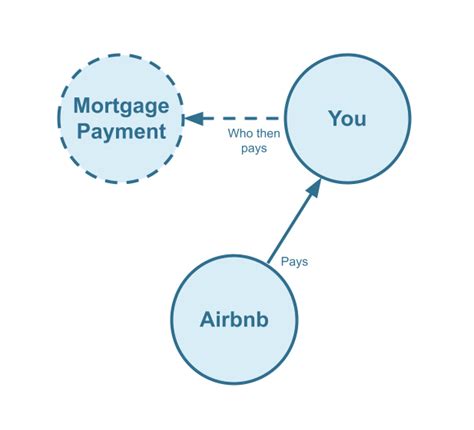

As an Airbnb host, you're not just renting out a property, you're running a small business. And like any business, you need to keep track of your expenses to ensure you're making a profit. Without proper expense tracking, you may be missing out on deductions, overpaying taxes, or even losing money on your rental.

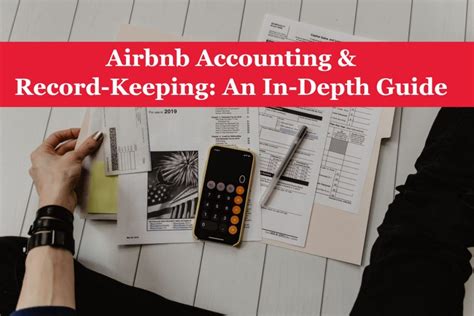

Benefits of Expense Tracking for Airbnb Hosts

- Accurate tax deductions: Keep track of expenses related to your rental property to claim deductions on your tax return.

- Increased profitability: Identify areas where you can cut costs and optimize your expenses to increase your profits.

- Better financial management: Stay on top of your finances and make informed decisions about your business.

Tool #1: QuickBooks

QuickBooks is a popular accounting software that's perfect for small businesses, including Airbnb hosts. With QuickBooks, you can track your income and expenses, create invoices, and even manage your taxes.

Key Features:

- Expense tracking: Easily track your expenses and categorize them for tax deductions.

- Invoicing: Create professional invoices for your guests and track payments.

- Tax management: Stay on top of your taxes and ensure you're taking advantage of all available deductions.

Tool #2: Expensify

Expensify is a user-friendly expense tracking app that's perfect for Airbnb hosts. With Expensify, you can track your expenses on the go, create reports, and even export data to your accounting software.

Key Features:

- Mobile app: Track your expenses on the go with the Expensify mobile app.

- Automatic expense tracking: Expensify can automatically track your expenses from your bank statements and credit cards.

- Reporting: Create reports to track your expenses and identify areas for improvement.

Tool #3: Mint

Mint is a personal finance app that's also perfect for Airbnb hosts. With Mint, you can track your income and expenses, create a budget, and even set financial goals.

Key Features:

- Budgeting: Create a budget and track your expenses to ensure you're staying within your means.

- Financial goals: Set financial goals, such as saving for a new property or paying off debt.

- Alerts: Receive alerts when you go over budget or when bills are due.

Tool #4: Wave

Wave is a cloud-based accounting software that's perfect for small businesses, including Airbnb hosts. With Wave, you can track your income and expenses, create invoices, and even manage your taxes.

Key Features:

- Expense tracking: Easily track your expenses and categorize them for tax deductions.

- Invoicing: Create professional invoices for your guests and track payments.

- Tax management: Stay on top of your taxes and ensure you're taking advantage of all available deductions.

Tool #5: Zoho Expense

Zoho Expense is a cloud-based expense tracking software that's perfect for Airbnb hosts. With Zoho Expense, you can track your expenses, create reports, and even export data to your accounting software.

Key Features:

- Expense tracking: Easily track your expenses and categorize them for tax deductions.

- Reporting: Create reports to track your expenses and identify areas for improvement.

- Integration: Integrate with your accounting software to export data and streamline your finances.

Tool #6: Shoeboxed

Shoeboxed is a cloud-based expense tracking software that's perfect for Airbnb hosts. With Shoeboxed, you can track your expenses, create reports, and even export data to your accounting software.

Key Features:

- Expense tracking: Easily track your expenses and categorize them for tax deductions.

- Reporting: Create reports to track your expenses and identify areas for improvement.

- Integration: Integrate with your accounting software to export data and streamline your finances.

Tool #7: FreshBooks

FreshBooks is a cloud-based accounting software that's perfect for small businesses, including Airbnb hosts. With FreshBooks, you can track your income and expenses, create invoices, and even manage your taxes.

Key Features:

- Expense tracking: Easily track your expenses and categorize them for tax deductions.

- Invoicing: Create professional invoices for your guests and track payments.

- Tax management: Stay on top of your taxes and ensure you're taking advantage of all available deductions.

Airbnb Expense Tracking Tools Gallery

By using these 7 essential tools for Airbnb expense tracking, you'll be able to streamline your finances, reduce stress, and increase your profitability. Whether you're a seasoned host or just starting out, these tools will help you take your Airbnb business to the next level.