Intro

Discover 5 Hamilton financial tips for smart money management, budgeting, and investing, to achieve financial freedom and stability with effective wealth creation strategies.

Financial management is a crucial aspect of our lives, and it's essential to have a solid understanding of how to handle our money effectively. The hit musical Hamilton, created by Lin-Manuel Miranda, offers more than just an entertaining story about American history. It also provides valuable lessons about financial literacy, responsibility, and planning. In this article, we will explore five Hamilton-inspired financial tips that can help you improve your financial situation and achieve your long-term goals.

The musical Hamilton is not just a story about Alexander Hamilton's life; it's also a reflection of the financial struggles and successes of the founding fathers. The show's themes of perseverance, hard work, and strategic planning can be applied to our financial lives. By embracing these principles, we can create a brighter financial future for ourselves and our families. Whether you're a fan of the musical or just looking for practical financial advice, these five tips will provide you with a solid foundation for managing your finances effectively.

The world of personal finance can be overwhelming, with numerous options and strategies available. However, by focusing on a few key principles, you can simplify your financial life and make progress towards your goals. The five Hamilton-inspired financial tips outlined in this article will cover topics such as budgeting, saving, investing, and debt management. By the end of this article, you'll have a better understanding of how to apply these principles to your own financial situation and start building a stronger financial foundation.

Understanding Your Financial Situation

Assessing Your Income and Expenses

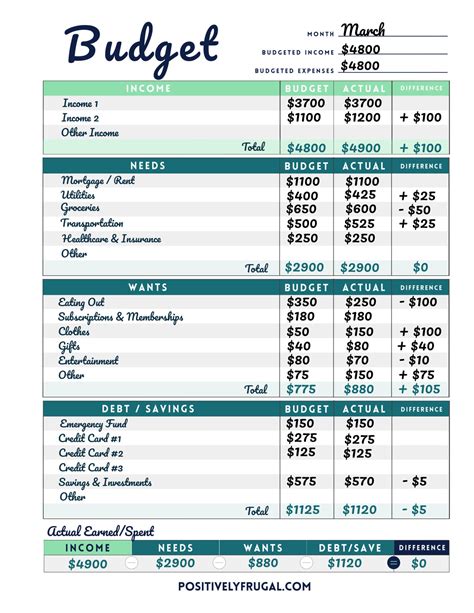

Assessing your income and expenses is a critical step in understanding your financial situation. Start by calculating your net income, which is your take-home pay after taxes and other deductions. Then, categorize your expenses into needs (housing, food, transportation), wants (entertainment, hobbies), and debts (credit cards, loans). This will help you prioritize your spending and make adjustments to allocate your money more effectively. Remember to also account for irregular expenses, such as car maintenance or property taxes, to ensure you're prepared for unexpected costs.Creating a Budget

Prioritizing Your Spending

Prioritizing your spending is essential to achieving your financial goals. Start by identifying your essential expenses, such as housing, food, and transportation. Then, allocate your money towards these expenses first, ensuring you have enough to cover your basic needs. Next, allocate money towards your financial goals, such as saving for a emergency fund or paying off debt. Finally, use any remaining money for discretionary spending, such as entertainment or hobbies. Remember to review and adjust your budget regularly to ensure you're on track to meet your financial goals.Managing Debt

Building an Emergency Fund

Building an emergency fund is critical to managing debt and achieving financial stability. An emergency fund provides a cushion against unexpected expenses, such as car repairs or medical bills, helping you avoid going into debt. Aim to save 3-6 months' worth of living expenses in an easily accessible savings account. This will provide you with a safety net in case of unexpected expenses, and help you avoid accumulating new debt. Remember to review and adjust your emergency fund regularly, to ensure it's adequate to cover your changing expenses and financial goals.Investing for the Future

Maximizing Retirement Savings

Maximizing retirement savings is critical to achieving long-term financial security. Consider contributing to a 401(k) or IRA, which offer tax benefits and compound interest to help your savings grow. Aim to save at least 10% to 15% of your income towards retirement, and take advantage of any employer matching contributions. Remember to review and adjust your retirement savings regularly, to ensure you're on track to meet your retirement goals.Staying Disciplined and Patient

Financial Literacy Image Gallery

By following these five Hamilton-inspired financial tips, you can improve your financial situation and achieve your long-term goals. Remember to stay disciplined and patient, and avoid getting caught up in get-rich-quick schemes or making impulsive financial decisions. With time and effort, you can build a stronger financial foundation and enjoy a brighter financial future. We encourage you to share your thoughts and experiences with financial management in the comments below, and to share this article with anyone who may benefit from these tips. By working together, we can create a community that supports and encourages each other to achieve financial stability and success.