Managing loan repayments and tracking the balance can be a daunting task, especially for individuals and businesses with multiple debts. An amortization schedule is a powerful tool that helps you visualize your loan repayments, interest payments, and outstanding balance over time. In this article, we will explore how to create an amortization schedule template in Google Sheets, making it easy to manage your loan repayments.

Creating an amortization schedule template in Google Sheets can be a bit overwhelming, but don't worry, we've got you covered. With this template, you'll be able to track your loan repayments, interest payments, and outstanding balance with ease.

Benefits of Using an Amortization Schedule Template

An amortization schedule template offers several benefits, including:

- Helps you understand your loan repayment schedule and plan your finances accordingly

- Allows you to track your interest payments and outstanding balance over time

- Enables you to make informed decisions about your loan repayments, such as making extra payments or refinancing your loan

- Provides a clear picture of your debt obligations and helps you prioritize your payments

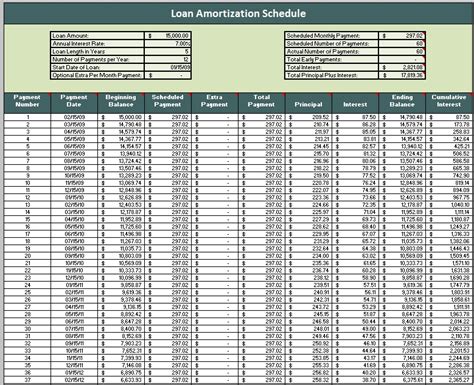

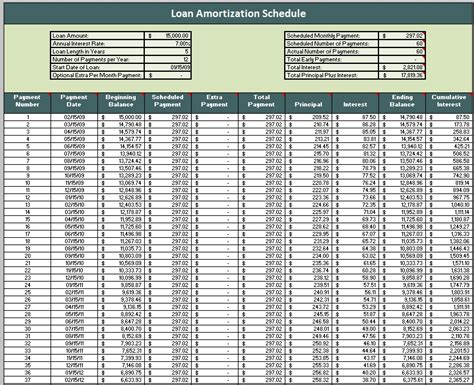

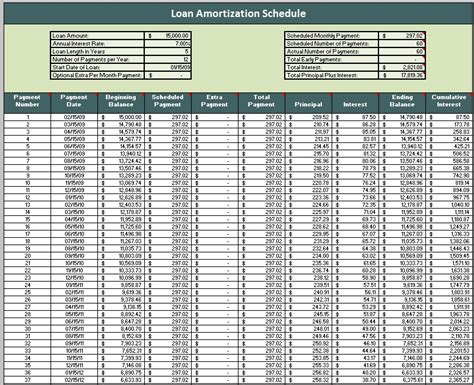

How to Create an Amortization Schedule Template in Google Sheets

Creating an amortization schedule template in Google Sheets is a straightforward process. Here's a step-by-step guide to get you started:

- Open Google Sheets and create a new spreadsheet.

- Set up your template by creating the following columns:

- Date

- Payment

- Interest

- Principal

- Balance

- Enter the following formulas to calculate your amortization schedule:

- Payment:

=PMT(rate, nper, pv, [fv], [type]) - Interest:

=IPMT(rate, nper, pv, [fv], [type]) - Principal:

=PPMT(rate, nper, pv, [fv], [type]) - Balance:

=pv-PPMT(rate, nper, pv, [fv], [type])

- Payment:

- Format your template by adjusting the column widths, font sizes, and colors to make it visually appealing.

Customizing Your Amortization Schedule Template

Once you've created your amortization schedule template, you can customize it to suit your specific needs. Here are a few ways to customize your template:

- Add a chart to visualize your loan repayments and outstanding balance over time

- Create a dropdown menu to select different loan options, such as loan term and interest rate

- Use conditional formatting to highlight important dates, such as payment due dates

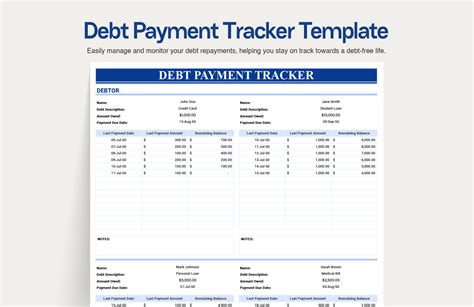

Example Use Case: Managing Multiple Debts

Let's say you have multiple debts, including a mortgage, car loan, and credit card debt. You can use your amortization schedule template to track each debt separately and visualize your overall debt obligations.

- Create a separate sheet for each debt, using the same template

- Enter the relevant loan details, such as loan term, interest rate, and loan amount

- Use a dashboard sheet to summarize your overall debt obligations and visualize your progress

Best Practices for Using an Amortization Schedule Template

Here are some best practices to keep in mind when using an amortization schedule template:

- Regularly update your template to reflect changes in your loan repayments or interest rates

- Use your template to make informed decisions about your loan repayments, such as making extra payments or refinancing your loan

- Consider sharing your template with a financial advisor or accountant to get expert advice

Common Mistakes to Avoid

When using an amortization schedule template, there are a few common mistakes to avoid:

- Failing to update your template regularly, which can lead to inaccurate calculations

- Not considering all debt obligations, such as credit card debt or student loans

- Not using your template to make informed decisions about your loan repayments

Conclusion

Creating an amortization schedule template in Google Sheets is a powerful way to manage your loan repayments and track your outstanding balance over time. By following the steps outlined in this article, you can create a customized template that suits your specific needs. Remember to regularly update your template and use it to make informed decisions about your loan repayments.

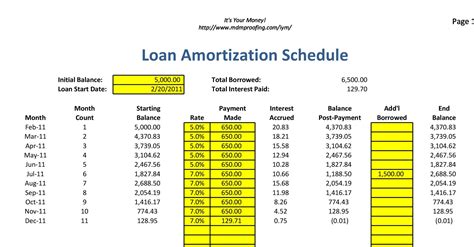

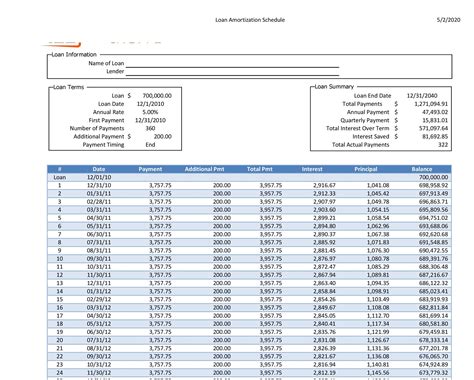

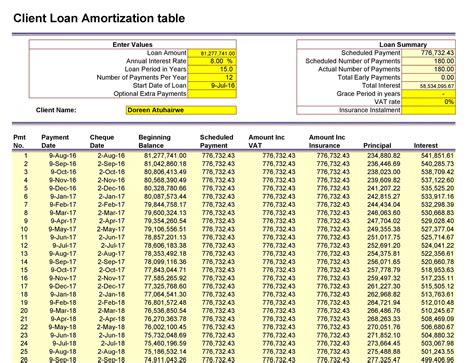

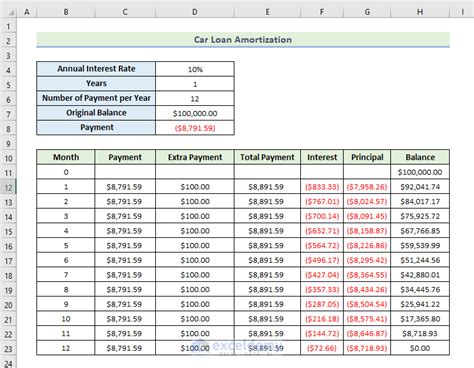

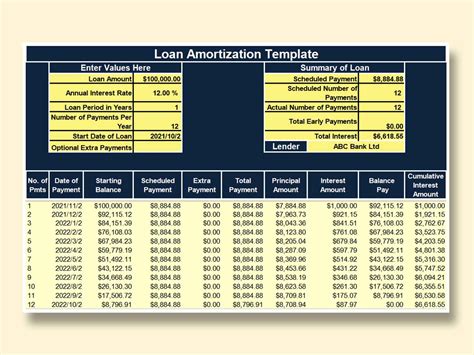

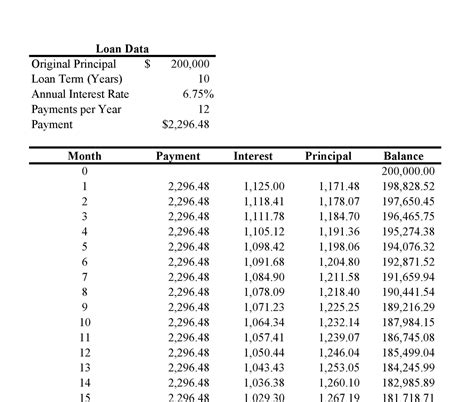

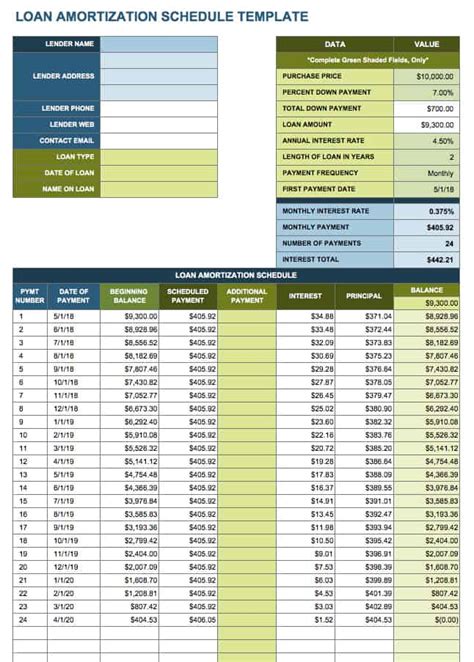

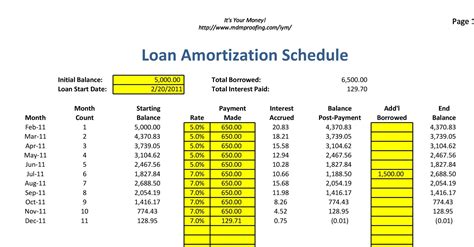

Amortization Schedule Template Gallery

We hope this article has been helpful in creating an amortization schedule template in Google Sheets. If you have any questions or need further assistance, please don't hesitate to ask. Share your experiences and tips for using an amortization schedule template in the comments below!