Intro

Learn to create a comprehensive nonprofit budget template in 7 essential steps. Master financial planning, prioritize expenses, and secure funding with our expert guide. Discover how to allocate resources, manage grants, and ensure sustainability, ensuring your organizations financial health and success.

Creating a nonprofit budget template is a crucial step in managing the financial resources of a nonprofit organization. A well-crafted budget template helps ensure that the organization's financial goals are aligned with its mission and objectives. In this article, we will walk you through the 7 essential steps to create a nonprofit budget template that meets the unique needs of your organization.

Understanding the Importance of a Nonprofit Budget Template

A nonprofit budget template is a tool that helps organizations manage their financial resources effectively. It provides a framework for tracking income and expenses, making financial decisions, and ensuring that the organization's financial goals are met. A well-designed budget template can help nonprofits:

- Make informed financial decisions

- Ensure transparency and accountability

- Manage cash flow and reduce financial risk

- Measure financial performance and progress towards goals

Step 1: Identify Your Nonprofit's Financial Goals and Objectives

Before creating a nonprofit budget template, it's essential to identify your organization's financial goals and objectives. This will help you determine what financial data to track and how to structure your budget template. Some common financial goals for nonprofits include:

- Increasing revenue from donations and grants

- Reducing expenses and improving efficiency

- Building an emergency fund or reserve

- Investing in new programs or services

Step 2: Gather Financial Data and Information

To create a nonprofit budget template, you'll need to gather financial data and information about your organization. This may include:

- Historical financial statements and reports

- Current financial data, such as income and expenses

- Budgeting assumptions and forecasts

- Information about your organization's financial policies and procedures

Step 3: Determine the Budget Period and Frequency

The budget period and frequency will depend on your organization's specific needs and requirements. Common budget periods for nonprofits include:

- Annual budget: a 12-month budget that aligns with the organization's fiscal year

- Quarterly budget: a 3-month budget that is updated and revised regularly

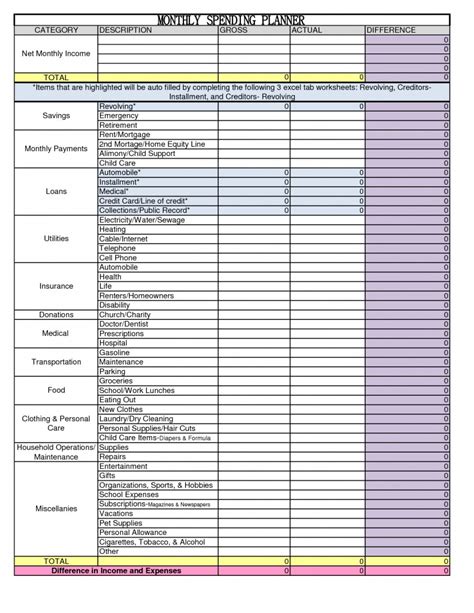

- Monthly budget: a budget that is updated and revised on a monthly basis

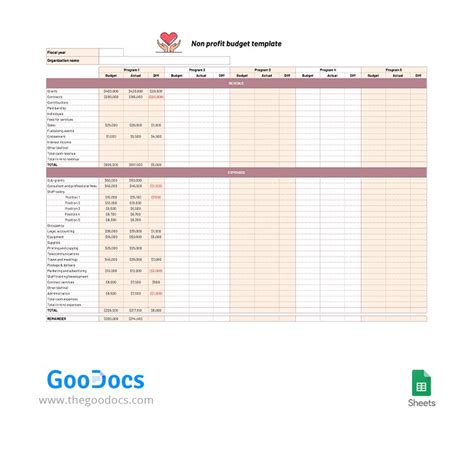

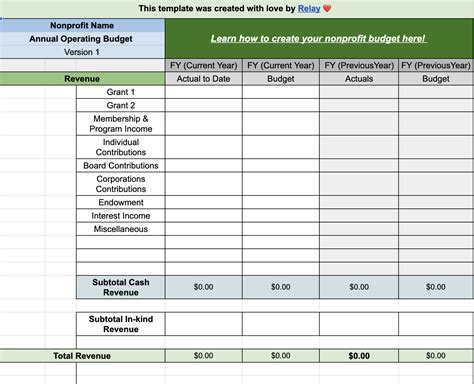

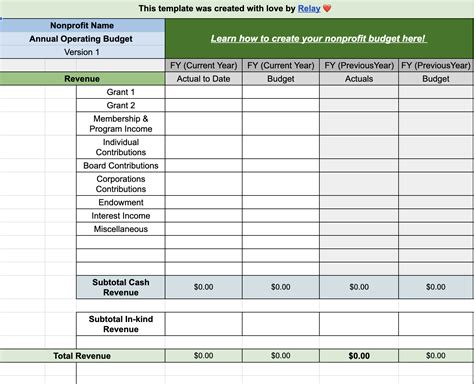

Step 4: Choose a Budget Template Format

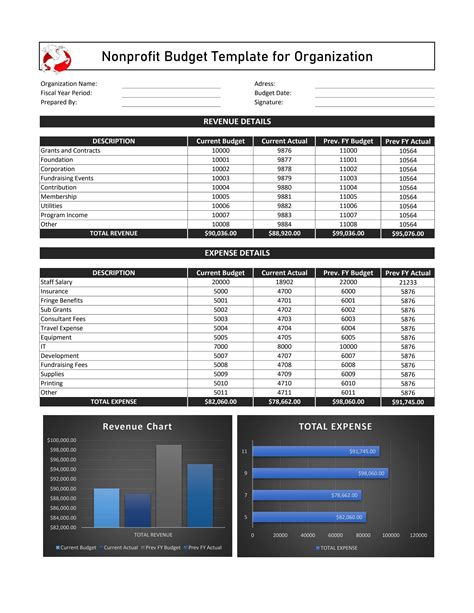

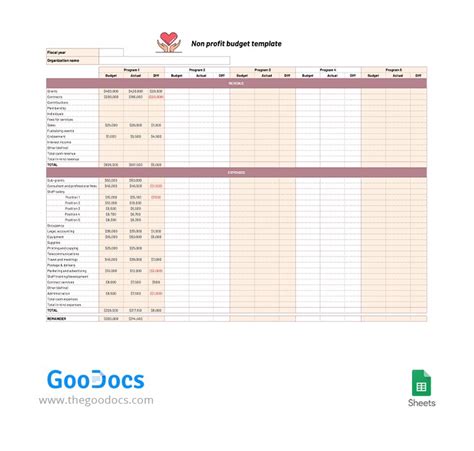

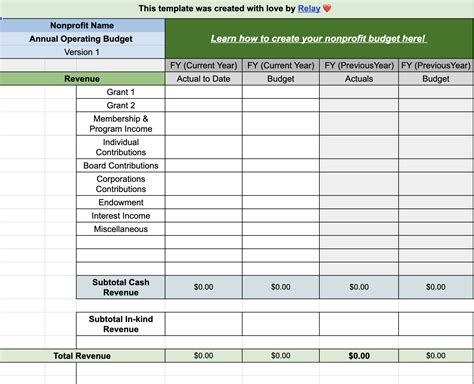

There are several budget template formats to choose from, including:

- Excel spreadsheet: a flexible and customizable format that allows for easy data manipulation and analysis

- Google Sheets: a cloud-based format that allows for real-time collaboration and data sharing

- Budgeting software: specialized software that provides pre-built budget templates and automated reporting features

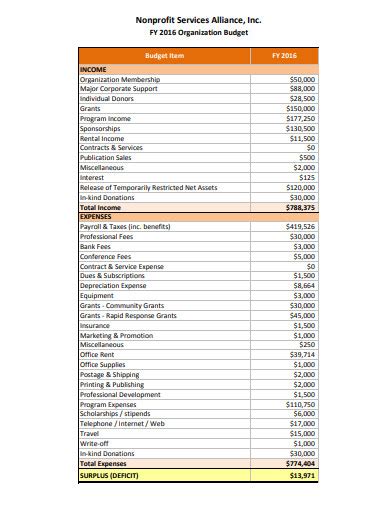

Step 5: Set Up Your Budget Template Structure

The budget template structure will depend on your organization's specific needs and requirements. A common structure for nonprofits includes:

- Income: a section for tracking revenue from donations, grants, and other sources

- Expenses: a section for tracking expenses, including salaries, rent, and program expenses

- Assets: a section for tracking assets, including cash, investments, and property

- Liabilities: a section for tracking liabilities, including loans and debts

Step 6: Enter Budget Assumptions and Forecasts

Once you have set up your budget template structure, you'll need to enter budget assumptions and forecasts. This may include:

- Revenue projections: estimates of income from donations, grants, and other sources

- Expense projections: estimates of expenses, including salaries, rent, and program expenses

- Budgeting assumptions: assumptions about the organization's financial performance and progress towards goals

Step 7: Review and Revise Your Budget Template

Finally, review and revise your budget template to ensure that it meets your organization's needs and requirements. This may include:

- Reviewing financial data and information to ensure accuracy and completeness

- Revising budget assumptions and forecasts to reflect changes in the organization's financial performance

- Updating the budget template to reflect changes in the organization's financial goals and objectives

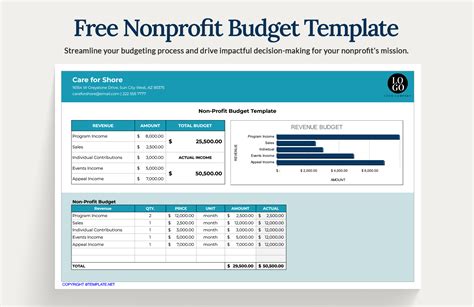

Nonprofit Budget Template Image Gallery

We hope this article has provided you with the essential steps to create a nonprofit budget template that meets the unique needs of your organization. Remember to review and revise your budget template regularly to ensure that it remains effective and accurate.