Intro

Learn how to calculate APR easily using the annual percentage rate formula in Excel. Discover the simple steps to calculate APR for loans and credit cards, and understand the importance of APR in personal finance. Get expert tips on using Excel formulas to make informed financial decisions and save money.

Calculating the Annual Percentage Rate (APR) is a crucial task for anyone dealing with loans, credit cards, or investments. APR represents the interest rate charged on a loan or credit product over a year, including fees and compound interest. In this article, we will explore the APR formula, its components, and how to calculate it easily in Excel.

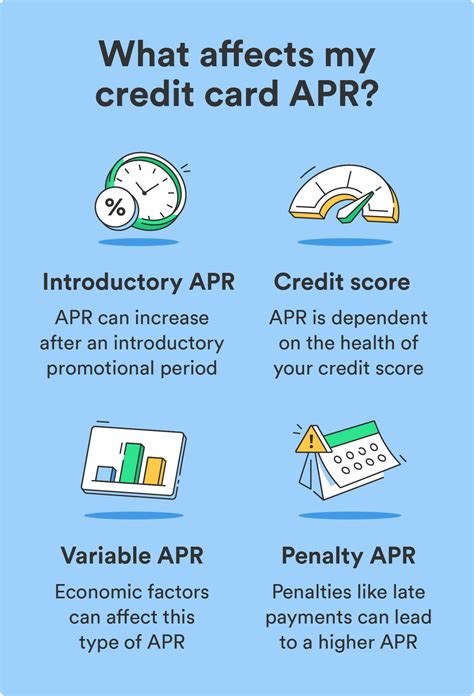

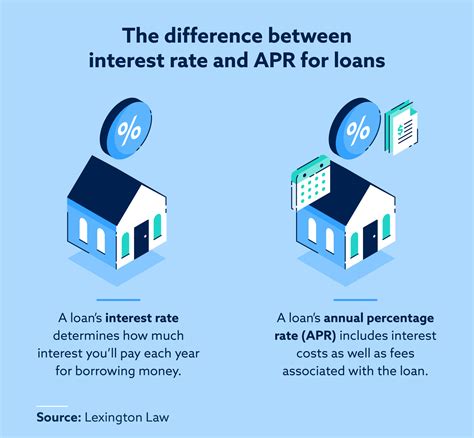

Understanding APR and Its Components

Before diving into the APR formula, it's essential to understand its components:

- Interest Rate: The interest rate charged on the principal amount borrowed.

- Fees: Additional charges, such as origination fees, late payment fees, or balance transfer fees.

- Compound Interest: Interest calculated on both the principal amount and any accrued interest.

APR Formula

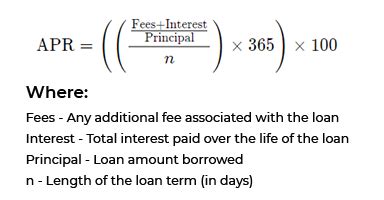

The APR formula is:

APR = (1 + (Interest Rate + Fees) / Principal) ^ (1 / Number of Compounding Periods) - 1

Where:

- Interest Rate is the nominal interest rate

- Fees are the total fees charged

- Principal is the initial amount borrowed

- Number of Compounding Periods is the number of times interest is compounded per year

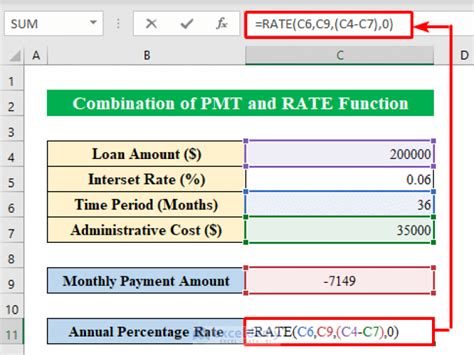

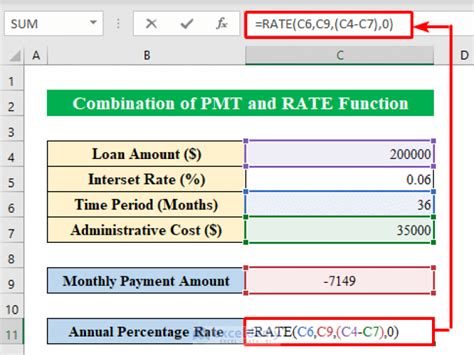

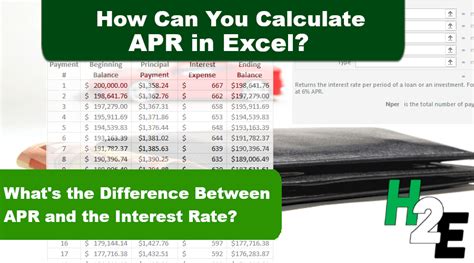

Calculating APR in Excel

To calculate APR in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns:

- Interest Rate

- Fees

- Principal

- Number of Compounding Periods

- APR

- Enter the values for the interest rate, fees, principal, and number of compounding periods.

- In the APR column, use the formula:

= (1 + (Interest Rate + Fees) / Principal) ^ (1 / Number of Compounding Periods) - 1

- Format the APR column as a percentage.

Example: Calculating APR for a Credit Card

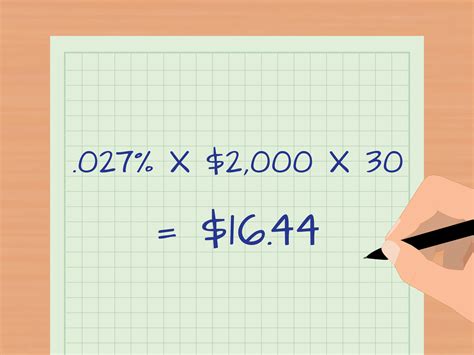

Suppose you have a credit card with an interest rate of 18%, an annual fee of $50, and a principal balance of $1,000. The credit card compounds interest monthly.

| Interest Rate | Fees | Principal | Number of Compounding Periods |

|---|---|---|---|

| 18% | $50 | $1,000 | 12 |

Using the APR formula in Excel:

= (1 + (0.18 + 50) / 1000) ^ (1 / 12) - 1

The calculated APR is 19.17%.

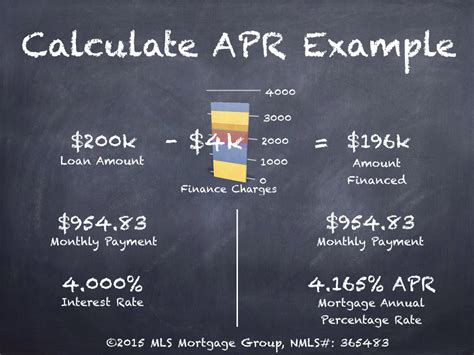

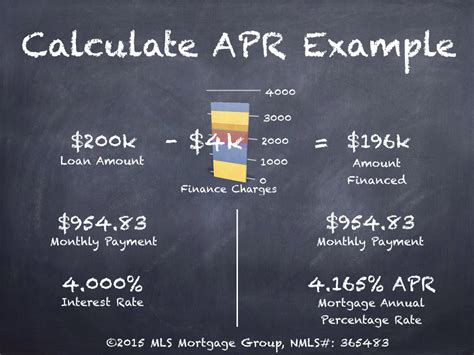

APR Calculation for Loans

When calculating APR for loans, you need to consider the loan term, loan amount, and interest rate. You can use the following formula:

APR = (Total Interest Paid / Loan Amount) / (Loan Term / 12)

Where:

- Total Interest Paid is the total interest paid over the loan term

- Loan Amount is the initial loan amount

- Loan Term is the loan term in years

Example: Calculating APR for a Personal Loan

Suppose you have a personal loan with a loan amount of $5,000, an interest rate of 12%, and a loan term of 3 years.

| Loan Amount | Interest Rate | Loan Term |

|---|---|---|

| $5,000 | 12% | 3 years |

Using the APR formula:

APR = (Total Interest Paid / $5,000) / (3 / 12)

The calculated APR is 12.55%.

Conclusion and Next Steps

Calculating APR is a crucial step in understanding the true cost of loans and credit products. By using the APR formula and Excel, you can easily calculate the APR for various financial products. Remember to consider all fees and compounding interest when calculating APR.

Now that you've learned how to calculate APR, take the next step and apply this knowledge to your personal finances or business. Share your experiences and questions in the comments section below.

Gallery of APR-Related Images

APR-Related Image Gallery

Note: The images used in this article are for illustration purposes only.