Intro

For many Americans, food stamps – also known as the Supplemental Nutrition Assistance Program (SNAP) – serve as a vital lifeline, helping to put food on the table and alleviate hunger. However, when it comes to taxes, recipients may wonder if their benefits are considered taxable income. In this article, we'll delve into the world of food stamps and taxes, exploring the ins and outs of this complex issue.

To understand whether food stamps are considered taxable income, it's essential to grasp the basics of the program. Food stamps are a government-funded initiative designed to provide financial assistance to low-income individuals and families, helping them purchase food and other essential items. The program is administered by the US Department of Agriculture (USDA) and is typically distributed through Electronic Benefit Transfer (EBT) cards.

Are Food Stamps Considered Taxable Income?

The short answer is no, food stamps are not considered taxable income. According to the Internal Revenue Service (IRS), SNAP benefits are not subject to federal income tax. This means that recipients do not need to report their food stamp benefits as income on their tax returns.

The reason for this is that food stamps are considered a non-taxable, non-cash benefit. The program is designed to provide a specific type of assistance – food – rather than a direct cash payment. As such, the IRS does not consider food stamps to be taxable income.

How Does This Impact Tax Returns?

Since food stamps are not considered taxable income, recipients do not need to report their benefits on their tax returns. This means that food stamp recipients will not need to include their benefits in their total income, and they will not be subject to taxes on these benefits.

It's essential to note, however, that other types of government assistance, such as unemployment benefits or Social Security benefits, may be subject to federal income tax. Recipients of these programs should consult the IRS or a tax professional to determine how these benefits impact their tax obligations.

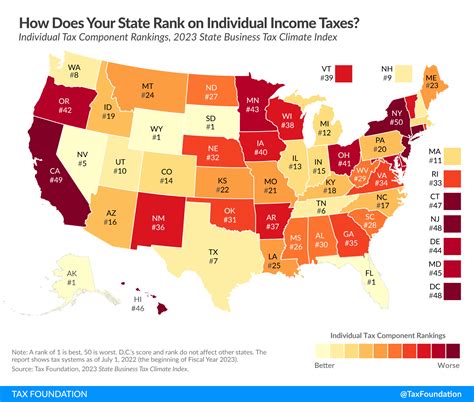

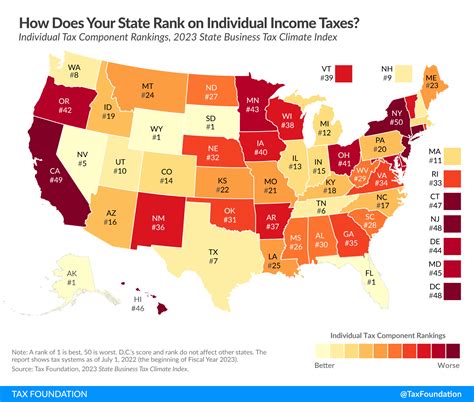

State and Local Taxes: A Different Story

While food stamps are not considered taxable income at the federal level, state and local governments may have different rules. Some states may consider food stamp benefits to be taxable income, while others may exempt them from taxation.

It's crucial for food stamp recipients to check with their state and local governments to determine if their benefits are subject to state or local taxes. Recipients can consult their state's tax authority or a tax professional to ensure they are meeting their tax obligations.

What About Other Types of Government Assistance?

In addition to food stamps, there are other types of government assistance that may be subject to taxation. Some examples include:

- Unemployment benefits: These benefits are subject to federal income tax and may also be subject to state and local taxes.

- Social Security benefits: A portion of Social Security benefits may be subject to federal income tax, depending on the recipient's income level.

- Medicaid benefits: Medicaid benefits are generally not subject to federal income tax, but recipients may need to report other income related to their Medicaid benefits.

Recipients of these programs should consult the IRS or a tax professional to determine how their benefits impact their tax obligations.

Tax Planning for Food Stamp Recipients

While food stamps are not considered taxable income, recipients may still need to plan for taxes. Here are some tips for food stamp recipients:

- Keep accurate records: Recipients should keep accurate records of their food stamp benefits, as well as any other income or expenses.

- Consult a tax professional: Recipients may want to consult a tax professional to ensure they are meeting their tax obligations and taking advantage of any available tax credits or deductions.

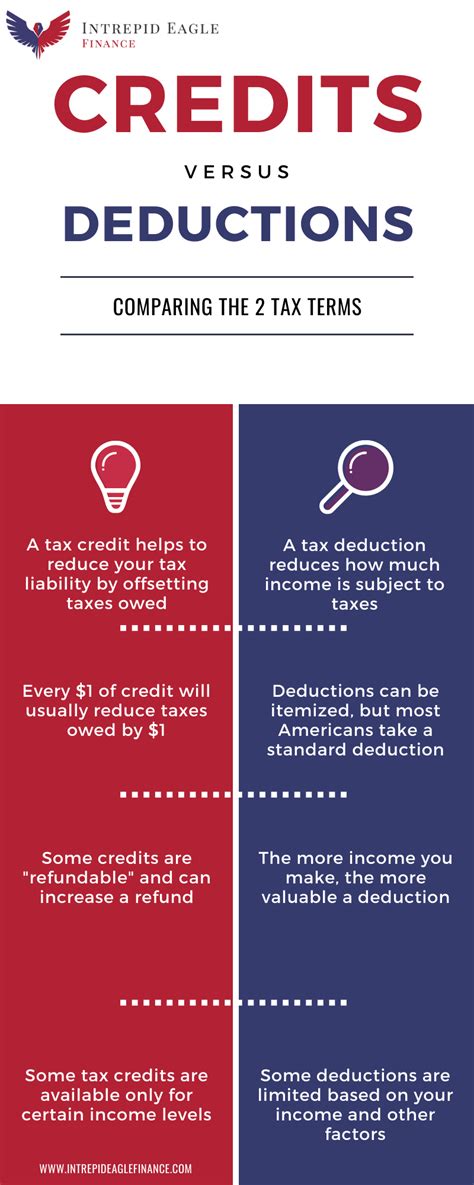

- Explore tax credits: Recipients may be eligible for tax credits, such as the Earned Income Tax Credit (EITC), which can help reduce their tax liability.

Additional Resources

For more information on food stamps and taxes, recipients can consult the following resources:

- IRS Publication 525: This publication provides information on taxable and non-taxable income, including government assistance programs like food stamps.

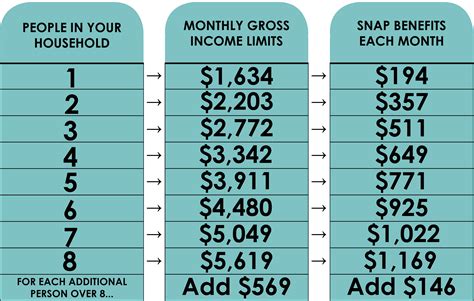

- USDA Food and Nutrition Service: This website provides information on the SNAP program, including eligibility requirements and benefit levels.

- State and local tax authorities: Recipients can contact their state and local tax authorities to determine if their food stamp benefits are subject to state or local taxes.

Food Stamps and Taxes Image Gallery

By understanding the ins and outs of food stamps and taxes, recipients can ensure they are meeting their tax obligations and taking advantage of available tax credits and deductions. Whether you're a food stamp recipient or simply looking to learn more about government assistance programs, we hope this article has provided valuable insights into this complex topic.