Intro

Unlock the power of arm mortgage calculator in Excel with our expert guide. Master adjustable-rate mortgage calculations, amortization schedules, and payment breakdowns. Learn how to create a customizable arm mortgage calculator template, and optimize your mortgage planning with ease. Discover 5 actionable steps to simplify complex mortgage calculations.

In today's fast-paced real estate market, having the right tools to navigate complex financial calculations can make all the difference. One such tool is the Adjustable Rate Mortgage (ARM) calculator, which can be easily built in Microsoft Excel. Mastering the ARM mortgage calculator in Excel can empower you to make informed decisions, compare different loan options, and ultimately save time and money. In this article, we'll explore five ways to master the ARM mortgage calculator in Excel, including understanding the basics, setting up the calculator, customizing inputs, and more.

Understanding the Basics of ARM Mortgage Calculator

Before diving into the world of ARM mortgage calculators in Excel, it's essential to understand the basics of how Adjustable Rate Mortgages work. ARM mortgages have interest rates that can change over time, typically based on a benchmark rate, such as the London Interbank Offered Rate (LIBOR). This means that your monthly payments can increase or decrease as the interest rate fluctuates.

To master the ARM mortgage calculator in Excel, you need to grasp the key components of an ARM loan, including:

- Initial interest rate: The starting interest rate of the loan

- Adjustment period: The frequency at which the interest rate can change (e.g., annually, bi-annually)

- Index rate: The benchmark rate used to determine the new interest rate (e.g., LIBOR)

- Margin: The lender's markup on the index rate

- Caps: The maximum amount by which the interest rate can increase

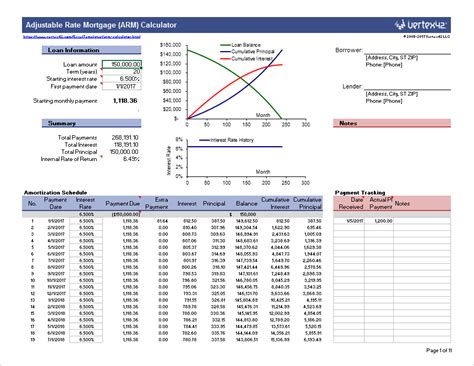

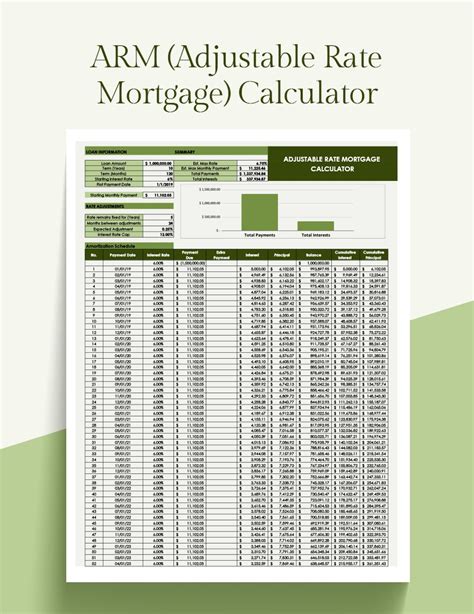

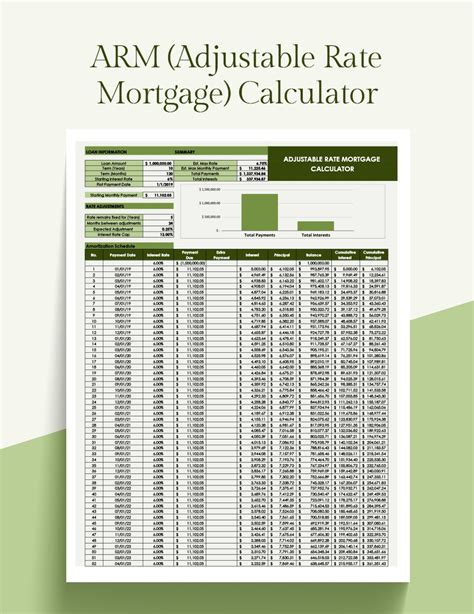

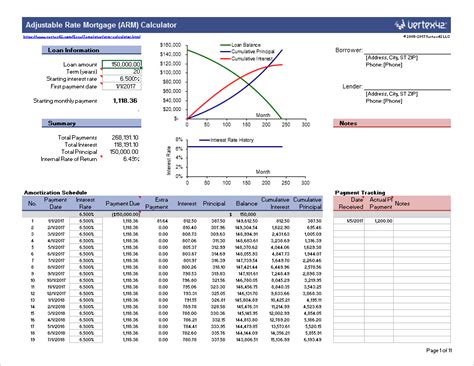

Setting Up the ARM Mortgage Calculator in Excel

To set up an ARM mortgage calculator in Excel, you'll need to create a new spreadsheet and input the following formulas:

- Monthly payment formula: =PMT(Initial Interest Rate, Loan Term, Loan Amount)

- Interest rate formula: =IF(Adjustment Period=1, Initial Interest Rate+Margin, Index Rate+Margin)

- Amortization schedule formula: =IPMT(Interest Rate, Loan Term, Loan Amount)

You can customize these formulas to fit your specific needs and loan scenarios.

Customizing Inputs and Scenarios

One of the most significant advantages of using an ARM mortgage calculator in Excel is the ability to customize inputs and scenarios. By adjusting the variables, you can test different loan options and see how changes in interest rates, loan terms, and other factors affect your monthly payments.

Some common customizations include:

- Changing the initial interest rate: To see how different starting interest rates impact your monthly payments

- Adjusting the loan term: To compare the effects of different loan terms on your monthly payments

- Switching between fixed and adjustable rates: To compare the benefits and drawbacks of fixed-rate versus adjustable-rate loans

By experimenting with different scenarios, you can gain a deeper understanding of how ARM mortgages work and make more informed decisions about your loan options.

Using Data Tables and Charts to Visualize Results

To take your ARM mortgage calculator to the next level, you can use data tables and charts to visualize your results. This will help you quickly compare different loan scenarios and identify trends.

Some ideas for data tables and charts include:

- Creating a loan comparison chart: To compare the monthly payments and total interest paid for different loan scenarios

- Building a sensitivity analysis table: To see how changes in interest rates or loan terms affect your monthly payments

- Designing a graph to show interest rate fluctuations: To visualize how changes in interest rates impact your monthly payments

By using data tables and charts, you can gain a clearer understanding of the complexities of ARM mortgages and make more informed decisions.

Sharing and Collaborating with Others

Finally, one of the most significant benefits of using an ARM mortgage calculator in Excel is the ability to share and collaborate with others. By sharing your calculator with colleagues, clients, or partners, you can facilitate discussions and ensure everyone is on the same page.

Some ideas for sharing and collaborating include:

- Creating a shared Excel file: To collaborate with others in real-time

- Exporting data to other formats: To share your results with others who may not have Excel

- Using Excel's built-in collaboration tools: To track changes and comments from others

By sharing and collaborating with others, you can leverage the collective knowledge and expertise of your team to make more informed decisions.

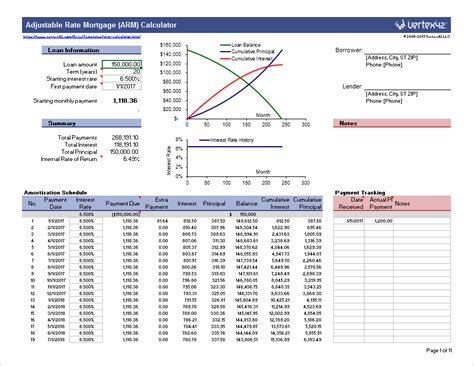

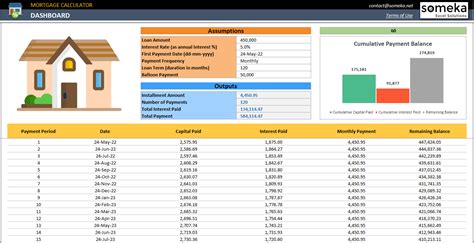

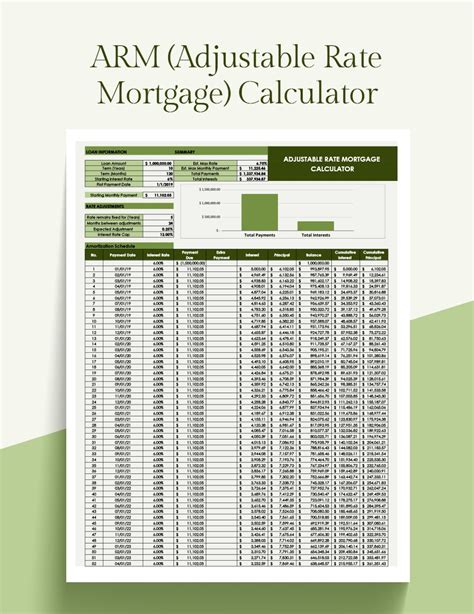

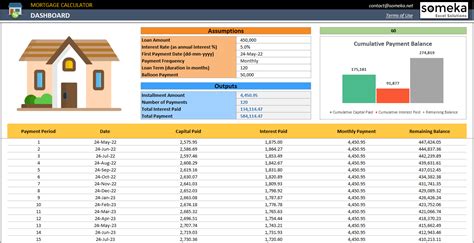

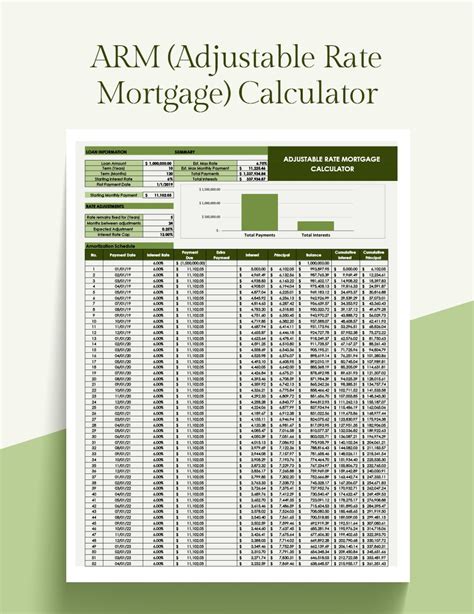

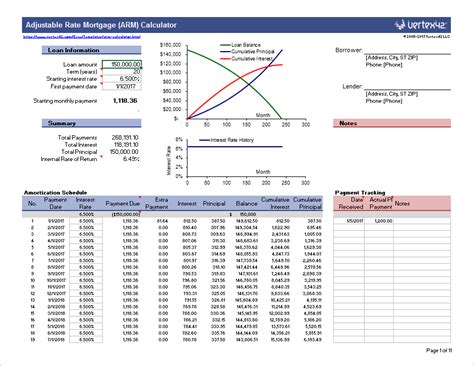

Gallery of ARM Mortgage Calculator Excel Templates

ARM Mortgage Calculator Excel Templates

By mastering the ARM mortgage calculator in Excel, you'll be able to make more informed decisions, compare different loan options, and ultimately save time and money. Remember to customize inputs and scenarios, use data tables and charts to visualize results, and share and collaborate with others to get the most out of your ARM mortgage calculator.