Intro

Discover how to calculate your Army deployment pay with our expert guide. Learn the 5 ways to determine your deployment pay, including base pay, allowances, and special pays. Understand how hostile fire pay, hardship duty pay, and family separation pay impact your earnings. Maximize your military income with our comprehensive deployment pay calculator.

Deployment can be a challenging and uncertain experience for military personnel and their families. One aspect that can provide some stability and predictability is understanding the compensation and benefits that come with deployment. In this article, we will explore the ways to calculate Army deployment pay, providing you with a comprehensive guide to help you navigate this complex topic.

Army deployment pay is a critical component of a soldier's compensation package, and it's essential to understand how it's calculated to ensure you're receiving the correct amount. The calculation involves several factors, including the soldier's rank, time in service, and deployment location. We will break down these factors and provide examples to help you calculate your deployment pay accurately.

Understanding the Basics of Army Deployment Pay

Army deployment pay is a type of special pay that's intended to compensate soldiers for the hardships and dangers associated with deploying to a combat zone or other hazardous areas. The pay is tax-free and is in addition to a soldier's basic pay and allowances.

Types of Deployment Pay

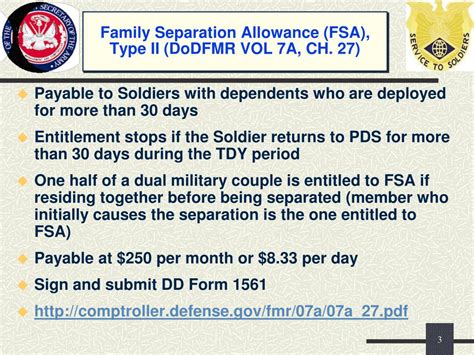

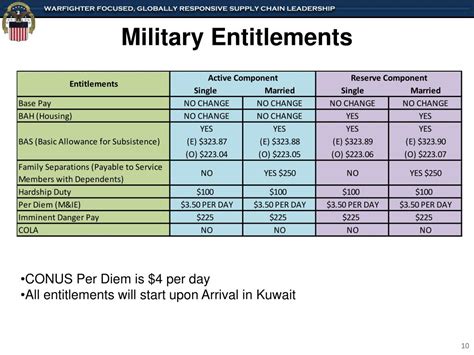

There are several types of deployment pay, including:

- Combat Zone Tax Exclusion (CZTE)

- Hazardous Duty Pay (HDP)

- Hostile Fire Pay (HFP)

- Imminent Danger Pay (IDP)

Each type of pay has its own eligibility criteria and calculation methods. We will explore these in more detail later in this article.

Calculating Army Deployment Pay

Calculating Army deployment pay involves several factors, including the soldier's rank, time in service, and deployment location. Here are the steps to calculate your deployment pay:

- Determine your deployment location: Your deployment location will determine the type of deployment pay you're eligible for. Combat zones, such as Afghanistan and Iraq, qualify for CZTE and HDP, while other hazardous areas, such as Somalia and Syria, qualify for IDP.

- Check your eligibility: Ensure you meet the eligibility criteria for the type of deployment pay you're applying for. This may include meeting specific time-in-service requirements or deploying to a designated combat zone.

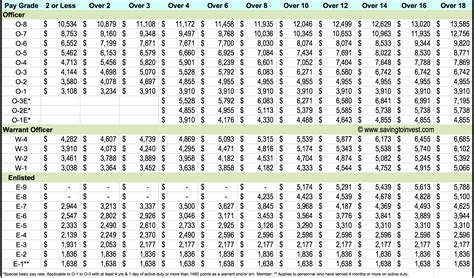

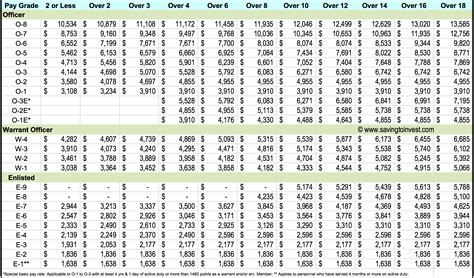

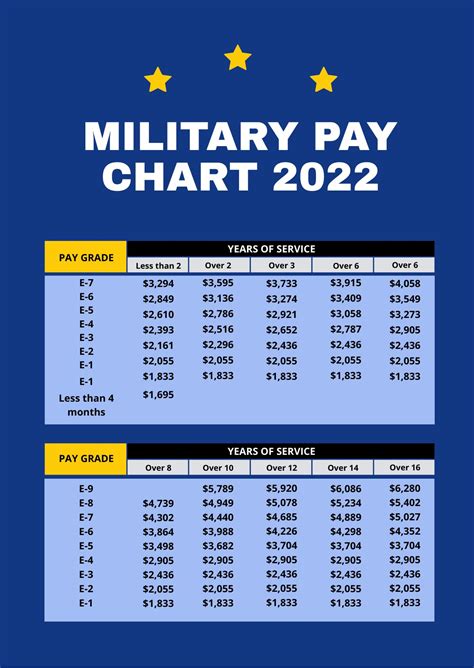

- Calculate your basic pay: Your basic pay is the foundation of your deployment pay calculation. You can find your basic pay rate on the Defense Finance and Accounting Service (DFAS) website.

- Apply the deployment pay rate: Once you've determined your deployment location and checked your eligibility, apply the relevant deployment pay rate to your basic pay. This rate varies depending on the type of deployment pay and your deployment location.

Example Calculation

Let's say you're a Sergeant (E-5) with 10 years of service, deploying to Afghanistan for 12 months. Your basic pay rate is $3,000 per month.

- CZTE: $500 per month (tax-free)

- HDP: $150 per month (tax-free)

- Total deployment pay: $650 per month (tax-free)

In this example, your total deployment pay would be $650 per month, tax-free, in addition to your basic pay of $3,000 per month.

Maximizing Your Deployment Pay

To maximize your deployment pay, consider the following strategies:

- Take advantage of tax-free pay: Deployment pay is tax-free, which means you won't have to pay federal income tax on this income.

- Choose a deployment location wisely: Deploying to a combat zone or other hazardous area can result in higher deployment pay rates.

- Meet eligibility criteria: Ensure you meet the eligibility criteria for the type of deployment pay you're applying for.

Common Mistakes to Avoid

When calculating your deployment pay, avoid the following common mistakes:

- Failing to check eligibility criteria: Ensure you meet the eligibility criteria for the type of deployment pay you're applying for.

- Miscalculating deployment pay rates: Double-check your deployment pay rate to ensure you're receiving the correct amount.

- Not taking advantage of tax-free pay: Deployment pay is tax-free, which can result in significant savings.

FAQs

Here are some frequently asked questions about Army deployment pay:

- What is Army deployment pay?: Army deployment pay is a type of special pay that's intended to compensate soldiers for the hardships and dangers associated with deploying to a combat zone or other hazardous areas.

- How is deployment pay calculated?: Deployment pay is calculated based on the soldier's rank, time in service, and deployment location.

- Is deployment pay tax-free?: Yes, deployment pay is tax-free.

Gallery of Army Deployment Pay Images

Army Deployment Pay Images

Conclusion

Calculating Army deployment pay can be complex, but by following these steps and avoiding common mistakes, you can ensure you're receiving the correct amount. Remember to take advantage of tax-free pay and choose a deployment location wisely to maximize your deployment pay.

We hope this article has provided you with a comprehensive guide to calculating Army deployment pay. If you have any further questions or concerns, please don't hesitate to comment below.