Discover the intricacies of Army Lieutenant Colonel retirement pay, including O-5 pension calculations, retirement eligibility, and Veterans Administration benefits. Understand how years of service, rank, and final pay grade impact retirement income. Get expert insights into military pension plans and maximize your post-service compensation as a Lieutenant Colonel.

The sacrifices and dedication of military personnel are truly deserving of recognition and reward. For Army Lieutenant Colonels, retirement is a significant milestone that marks the end of a distinguished career. One of the most critical aspects of military retirement is the financial compensation that comes with it. In this article, we will delve into the intricacies of Army Lieutenant Colonel retirement pay, exploring the various factors that influence the amount and the process of calculating it.

The Significance of Retirement Pay

Retirement pay is a vital aspect of military compensation, providing a steady income stream for retired personnel and their families. For Army Lieutenant Colonels, retirement pay is a well-deserved reward for their years of service, sacrifice, and dedication to their country. Understanding how retirement pay is calculated and the factors that affect it can help Lieutenant Colonels plan for their financial future.

Calculating Retirement Pay

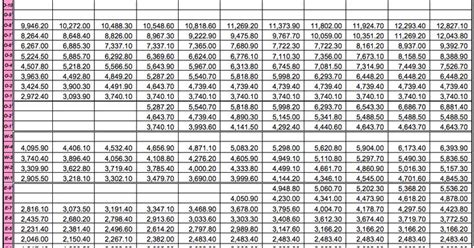

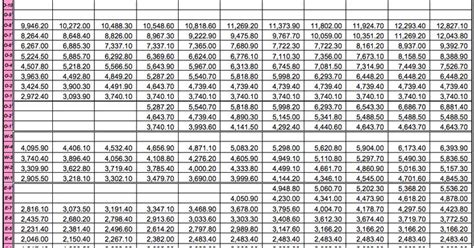

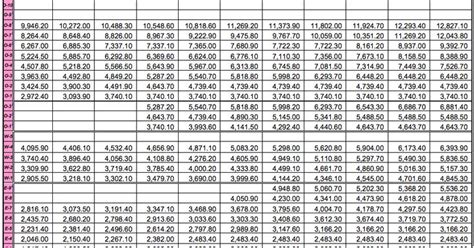

The calculation of retirement pay for Army Lieutenant Colonels is based on their years of service and their final pay grade. The formula for calculating retirement pay is as follows:

Retirement Pay = (Years of Service x Final Pay Grade x 2.5%)

For example, if a Lieutenant Colonel has 20 years of service and a final pay grade of O-5 (the pay grade for Lieutenant Colonels), their retirement pay would be calculated as follows:

Retirement Pay = (20 x O-5 x 2.5%) = 50% of final pay grade

In this example, the Lieutenant Colonel's retirement pay would be 50% of their final pay grade.

Factors Affecting Retirement Pay

Several factors can affect the amount of retirement pay received by Army Lieutenant Colonels. Some of these factors include:

- Years of Service: The more years of service, the higher the retirement pay.

- Final Pay Grade: The higher the final pay grade, the higher the retirement pay.

- Time in Grade: The longer a Lieutenant Colonel serves in their final pay grade, the higher their retirement pay.

- High-3 Formula: The high-3 formula is used to calculate retirement pay for personnel who entered the military after September 8, 1980. This formula calculates retirement pay based on the average of the highest 36 months of basic pay.

Retirement Pay Options

Army Lieutenant Colonels have several retirement pay options to choose from, including:

- Immediate Retirement: This option provides immediate retirement pay, but with a reduced amount.

- Deferred Retirement: This option allows Lieutenant Colonels to defer their retirement pay until a later date, but with a higher amount.

- REDUX: The REDUX option allows Lieutenant Colonels to receive a $30,000 bonus at the 15-year mark in exchange for a reduced retirement pay.

Survivor Benefit Plan (SBP)

The Survivor Benefit Plan (SBP) is an insurance program that provides a monthly annuity to the surviving spouse of a retired military personnel. The SBP is optional and can be elected by the Lieutenant Colonel at retirement.

Taxation of Retirement Pay

Retirement pay is taxable, and the amount of taxes owed will depend on the individual's tax bracket and filing status. It's essential for Lieutenant Colonels to understand the tax implications of their retirement pay and plan accordingly.

Conclusion

Army Lieutenant Colonel retirement pay is a complex topic, and understanding the various factors that influence the amount and the process of calculating it can be overwhelming. By understanding the significance of retirement pay, the calculation formula, and the factors that affect it, Lieutenant Colonels can make informed decisions about their financial future. Whether you're nearing retirement or just starting your military career, it's essential to plan ahead and make the most of your retirement pay.

Gallery of Army Lieutenant Colonel Retirement Pay

Army Lieutenant Colonel Retirement Pay Image Gallery

FAQs

Q: What is the formula for calculating Army Lieutenant Colonel retirement pay? A: The formula for calculating retirement pay is as follows: Retirement Pay = (Years of Service x Final Pay Grade x 2.5%)

Q: What factors affect Army Lieutenant Colonel retirement pay? A: Several factors can affect retirement pay, including years of service, final pay grade, time in grade, and the high-3 formula.

Q: What is the Survivor Benefit Plan (SBP)? A: The Survivor Benefit Plan (SBP) is an insurance program that provides a monthly annuity to the surviving spouse of a retired military personnel.

Q: Is retirement pay taxable? A: Yes, retirement pay is taxable, and the amount of taxes owed will depend on the individual's tax bracket and filing status.

We hope this article has provided valuable insights into Army Lieutenant Colonel retirement pay. If you have any questions or comments, please feel free to share them below.