Unlock alternative investment opportunities with Arrived Private Credit Fund. Discover the 5 key benefits of this innovative fund, including diversified income streams, reduced risk, and access to exclusive real estate deals. Learn how Arriveds private credit fund can enhance your portfolio with stable returns and unique investment opportunities.

Private credit funds have gained popularity in recent years as an attractive investment option for individuals and institutions seeking alternative sources of income. Among these, the Arrived Private Credit Fund has emerged as a notable player in the market. In this article, we will delve into the benefits of investing in the Arrived Private Credit Fund, exploring its features, advantages, and potential returns.

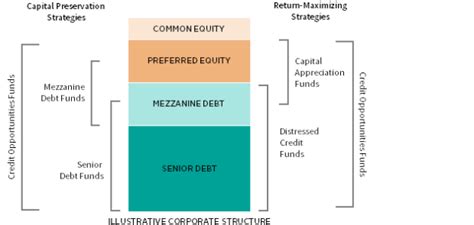

The Arrived Private Credit Fund is a real estate investment vehicle that allows individuals to invest in private credit loans secured by real estate assets. By pooling funds from multiple investors, the Arrived Private Credit Fund provides access to a diversified portfolio of loans, mitigating risk and offering a stable source of income. But what makes this fund particularly appealing? Let's examine the benefits of investing in the Arrived Private Credit Fund.

Benefit #1: Regular Income Generation

One of the primary benefits of investing in the Arrived Private Credit Fund is the potential for regular income generation. The fund's investment strategy focuses on lending to real estate developers and property owners, providing a steady stream of interest payments to investors. This income can be particularly attractive in a low-yield environment, where traditional fixed-income investments may not offer the same level of returns.

How it works:

The Arrived Private Credit Fund originates loans to real estate borrowers, typically with a short-term to medium-term duration. These loans are secured by the underlying real estate assets, providing a level of collateralization that helps mitigate risk. As the borrowers repay the loans, the fund distributes the interest payments to investors, providing a regular income stream.

Benefit #2: Diversification and Risk Mitigation

Another significant benefit of investing in the Arrived Private Credit Fund is the potential for diversification and risk mitigation. By pooling funds from multiple investors, the fund creates a diversified portfolio of loans, reducing reliance on any single borrower or asset. This diversification can help mitigate risk, as the impact of any individual loan default is spread across the entire portfolio.

How it works:

The Arrived Private Credit Fund employs a rigorous underwriting process to select loans that meet strict criteria, including creditworthiness, loan-to-value ratios, and property type. This process helps minimize the risk of default, while the diversified portfolio structure further reduces exposure to any single loan or asset.

Benefit #3: Access to Real Estate Investments

The Arrived Private Credit Fund provides investors with access to real estate investments that might be difficult to access directly. By investing in private credit loans secured by real estate assets, investors can gain exposure to a broad range of property types, including residential, commercial, and industrial assets.

How it works:

The Arrived Private Credit Fund originates loans to real estate developers and property owners, providing financing for a variety of projects, from single-family home construction to commercial property redevelopment. By investing in these loans, the fund provides investors with a way to participate in the real estate market, without the need for direct property ownership.

Benefit #4: Professional Management and Oversight

The Arrived Private Credit Fund is managed by experienced professionals with a deep understanding of the real estate and credit markets. This expertise helps ensure that the fund is managed prudently, with a focus on maximizing returns while minimizing risk.

How it works:

The fund's management team is responsible for originating and underwriting loans, as well as monitoring and servicing the portfolio. This active management approach helps identify potential risks and opportunities, allowing the fund to adapt to changing market conditions.

Benefit #5: Potential for Attractive Returns

Finally, the Arrived Private Credit Fund offers the potential for attractive returns, particularly in a low-yield environment. By investing in private credit loans secured by real estate assets, the fund can generate returns that are competitive with other alternative investment options.

How it works:

The fund's investment strategy is designed to generate returns through interest payments from borrowers, as well as potential principal repayments. By carefully selecting loans and managing the portfolio, the fund aims to provide investors with attractive returns, while minimizing risk.

Private Credit Fund Image Gallery

In conclusion, the Arrived Private Credit Fund offers a compelling investment opportunity for those seeking alternative sources of income. With its potential for regular income generation, diversification and risk mitigation, access to real estate investments, professional management and oversight, and potential for attractive returns, this fund is certainly worth considering. As with any investment, it's essential to conduct thorough research and consult with a financial advisor to determine if the Arrived Private Credit Fund aligns with your investment goals and risk tolerance.

We invite you to share your thoughts and questions about the Arrived Private Credit Fund in the comments section below. If you found this article informative, please consider sharing it with your network.