5 Essential Tips For Asc 606 Memo Template Summary

Unlock the secrets to a compliant ASC 606 memo template with our 5 essential tips. Learn how to navigate revenue recognition, contract modifications, and performance obligations. Ensure accurate financial reporting and avoid costly mistakes. Discover the key elements of a successful ASC 606 implementation and simplify your compliance process.

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) introduced the Accounting Standards Codification (ASC) 606, also known as Revenue from Contracts with Customers, to provide a comprehensive framework for revenue recognition. This standard applies to all entities that enter into contracts with customers to transfer goods or services. As a result, many companies have had to adapt their accounting processes and create an ASC 606 memo template to ensure compliance.

The ASC 606 memo template is a crucial document that outlines the company's revenue recognition policies and procedures. It serves as a guide for accountants and finance teams to ensure that revenue is recognized correctly and consistently. In this article, we will discuss five essential tips for creating an effective ASC 606 memo template.

Tip 1: Understand the Five-Step Revenue Recognition Process

Before creating an ASC 606 memo template, it's essential to understand the five-step revenue recognition process outlined in the standard:

- Identify the contract with the customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations

- Recognize revenue when (or as) the entity satisfies a performance obligation

Step 1: Identify the Contract with the Customer

In this step, the company must identify the contract with the customer and determine whether it is within the scope of ASC 606. The contract must meet specific criteria, such as being enforceable, having commercial substance, and being approved by both parties.

Step 2: Identify the Performance Obligations in the Contract

In this step, the company must identify the distinct performance obligations in the contract. A performance obligation is a promise to transfer a distinct good or service to the customer. The company must determine whether each performance obligation is distinct or if it is a series of distinct goods or services that are substantially the same.

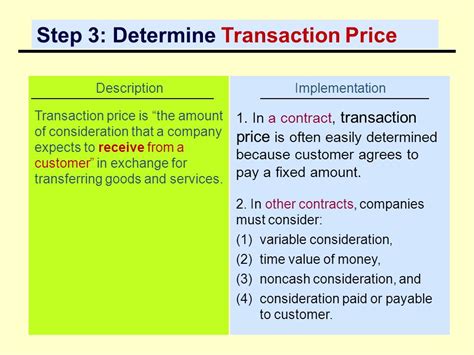

Step 3: Determine the Transaction Price

In this step, the company must determine the transaction price, which is the amount of consideration to which the entity expects to be entitled in exchange for transferring goods or services to the customer. The transaction price may include fixed amounts, variable amounts, or a combination of both.

Step 4: Allocate the Transaction Price to the Performance Obligations

In this step, the company must allocate the transaction price to each performance obligation based on the relative standalone selling price (SSP) of each distinct good or service.

Step 5: Recognize Revenue When (or As) the Entity Satisfies a Performance Obligation

In this final step, the company must recognize revenue when (or as) it satisfies a performance obligation. Revenue is recognized when the company transfers control of a distinct good or service to the customer.

Tip 2: Document All Revenue Recognition Policies and Procedures

The ASC 606 memo template should document all revenue recognition policies and procedures, including:

- The company's revenue recognition policy

- The process for identifying contracts with customers

- The process for identifying performance obligations

- The process for determining the transaction price

- The process for allocating the transaction price to performance obligations

- The process for recognizing revenue

This documentation will help ensure that revenue is recognized consistently and accurately.

Tip 3: Include Examples and Illustrations

The ASC 606 memo template should include examples and illustrations to help explain complex revenue recognition concepts. This will make it easier for accountants and finance teams to understand the policies and procedures.

Tip 4: Establish a Review and Approval Process

The ASC 606 memo template should establish a review and approval process to ensure that revenue is recognized correctly and consistently. This process should include:

- A review of all contracts with customers

- A review of all performance obligations

- A review of all transaction prices

- A review of all revenue recognition entries

The review and approval process should be documented in the ASC 606 memo template.

Tip 5: Update the Memo Template Regularly

The ASC 606 memo template should be updated regularly to reflect changes in revenue recognition policies and procedures. This will ensure that the template remains accurate and effective.

In conclusion, creating an effective ASC 606 memo template requires a thorough understanding of the five-step revenue recognition process, documentation of all revenue recognition policies and procedures, inclusion of examples and illustrations, establishment of a review and approval process, and regular updates.

ASC 606 Memo Template Image Gallery

We hope this article has provided valuable insights and tips for creating an effective ASC 606 memo template. Remember to regularly review and update your template to ensure compliance with the latest revenue recognition standards. If you have any questions or need further guidance, please don't hesitate to ask.