Intro

The Accounting Standards Codification (ASC) 606, also known as Revenue from Contracts with Customers, is a revenue recognition standard issued by the Financial Accounting Standards Board (FASB). The standard provides a framework for companies to recognize revenue in a consistent and transparent manner. In this article, we will discuss the ASC 606 revenue recognition template guide and provide an example to help you understand the concept better.

What is ASC 606?

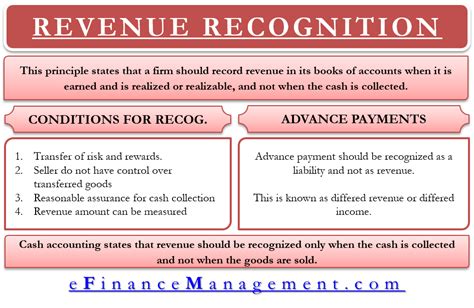

ASC 606 is a revenue recognition standard that provides a single, comprehensive model for companies to recognize revenue in their financial statements. The standard is based on the concept of "control" and requires companies to recognize revenue when they transfer control of a product or service to a customer.

Why is ASC 606 important?

ASC 606 is important because it provides a consistent and transparent framework for revenue recognition. The standard helps to eliminate inconsistencies in revenue recognition practices and provides investors and other stakeholders with a clearer understanding of a company's financial performance.

Key Principles of ASC 606

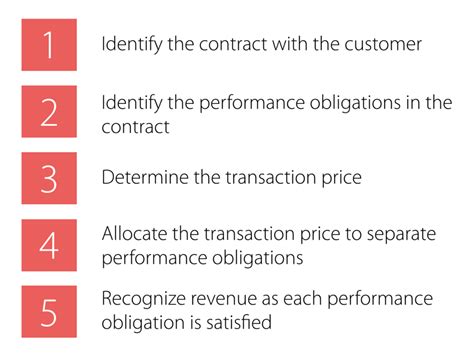

The ASC 606 revenue recognition standard is based on five key principles:

- Identify the contract: Identify the contract with the customer, including the terms and conditions of the contract.

- Identify the performance obligations: Identify the distinct goods or services that are promised to the customer.

- Determine the transaction price: Determine the transaction price, including any variable consideration.

- Allocate the transaction price: Allocate the transaction price to each performance obligation.

- Recognize revenue: Recognize revenue when the performance obligation is satisfied.

ASC 606 Revenue Recognition Template Guide

To help you implement the ASC 606 revenue recognition standard, we have created a template guide that outlines the key steps and considerations.

Step 1: Identify the Contract

| Contract Details | Description |

|---|---|

| Contract Date | Date of contract execution |

| Contract Term | Length of contract term |

| Customer Information | Customer name, address, and contact information |

| Product/Service Description | Description of product or service being sold |

Step 2: Identify the Performance Obligations

| Performance Obligations | Description |

|---|---|

| Product A | Delivery of Product A |

| Service B | Provision of Service B |

| Warranty | Provision of warranty for Product A |

Step 3: Determine the Transaction Price

| Transaction Price | Description |

|---|---|

| Fixed Price | Fixed price for Product A and Service B |

| Variable Consideration | Discounts, refunds, or other variable considerations |

Step 4: Allocate the Transaction Price

| Performance Obligations | Allocated Transaction Price |

|---|---|

| Product A | $100 |

| Service B | $200 |

| Warranty | $50 |

Step 5: Recognize Revenue

| Performance Obligations | Revenue Recognition |

|---|---|

| Product A | Recognize revenue when Product A is delivered |

| Service B | Recognize revenue when Service B is provided |

| Warranty | Recognize revenue over the warranty period |

Example of ASC 606 Revenue Recognition

Let's consider an example of a company that sells software licenses and provides maintenance services.

Contract Details

- Contract Date: January 1, 2022

- Contract Term: 2 years

- Customer Information: XYZ Corporation

- Product/Service Description: Software License and Maintenance Services

Performance Obligations

- Software License: Delivery of software license

- Maintenance Services: Provision of maintenance services for 2 years

Transaction Price

- Fixed Price: $100,000 (software license) + $20,000 (maintenance services) = $120,000

- Variable Consideration: Discounts for early payment

Allocate the Transaction Price

- Software License: $100,000

- Maintenance Services: $20,000

Recognize Revenue

- Software License: Recognize revenue when software license is delivered (January 1, 2022)

- Maintenance Services: Recognize revenue over the 2-year maintenance period (January 1, 2022 - December 31, 2023)

Gallery of ASC 606 Revenue Recognition

ASC 606 Revenue Recognition Image Gallery

Frequently Asked Questions (FAQs)

Q: What is ASC 606? A: ASC 606 is a revenue recognition standard issued by the Financial Accounting Standards Board (FASB).

Q: What are the key principles of ASC 606? A: The five key principles of ASC 606 are: identify the contract, identify the performance obligations, determine the transaction price, allocate the transaction price, and recognize revenue.

Q: How do I implement ASC 606? A: To implement ASC 606, you need to follow the five key principles and use a revenue recognition template to guide you.

Call to Action

We hope this article has provided you with a comprehensive guide to ASC 606 revenue recognition. If you have any questions or need further guidance, please comment below or contact us.