Intro

Master ASC 842 in Excel with our 5-step guide. Learn how to implement the new lease accounting standard, identify lease components, and calculate lease liabilities. Discover expert tips for automating ASC 842 compliance in Excel, including lease classification, amortization schedules, and journal entry templates.

Mastering ASC 842 in Excel requires a deep understanding of the lease accounting standard and its application in financial modeling. The Accounting Standards Codification (ASC) 842, also known as the Lease Accounting Standard, was issued by the Financial Accounting Standards Board (FASB) to improve financial reporting transparency and comparability among companies.

The new standard brings significant changes to the way companies account for leases, requiring lessees to recognize lease assets and liabilities on their balance sheets. As a result, companies need to implement robust financial models to ensure compliance with ASC 842. In this article, we will discuss the 5 essential steps to mastering ASC 842 in Excel.

Understanding the Basics of ASC 842

Before diving into the world of Excel, it's crucial to understand the fundamental principles of ASC 842. The standard defines a lease as a contract that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. Lessees must recognize a lease asset and a lease liability on their balance sheets, with certain exceptions.

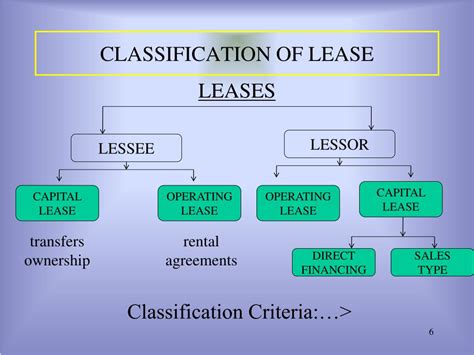

ASC 842 introduces two types of leases: operating leases and finance leases. Operating leases are those where the lessee does not have control over the underlying asset, while finance leases are those where the lessee has control over the asset. The standard also introduces a new concept called the "lease term," which is the period during which the lessee has the right to use the asset.

Identifying Lease Components

To apply ASC 842 in Excel, you need to identify the lease components, including the lease term, lease payments, and discount rate. The lease term is the period during which the lessee has the right to use the asset, while the lease payments are the amounts paid by the lessee to the lessor for the use of the asset. The discount rate is the rate used to discount the lease payments to their present value.

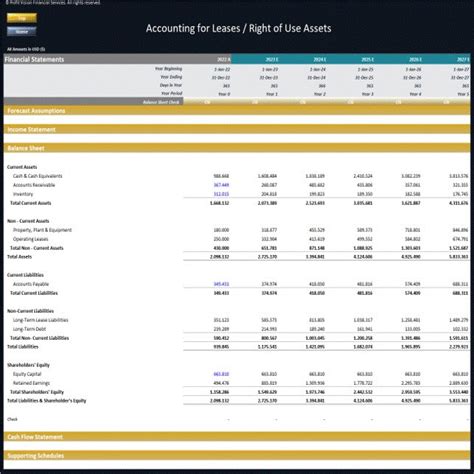

Building the Lease Accounting Model

To build a robust lease accounting model in Excel, you need to create a template that captures the lease components and applies the ASC 842 rules. The model should include the following components:

- Lease term

- Lease payments

- Discount rate

- Lease asset

- Lease liability

- Amortization schedule

The lease asset and lease liability should be calculated using the present value of the lease payments, discounted using the discount rate.

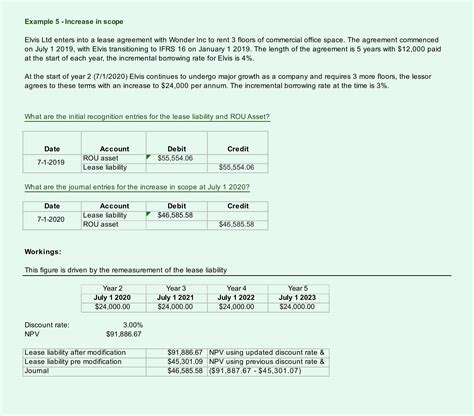

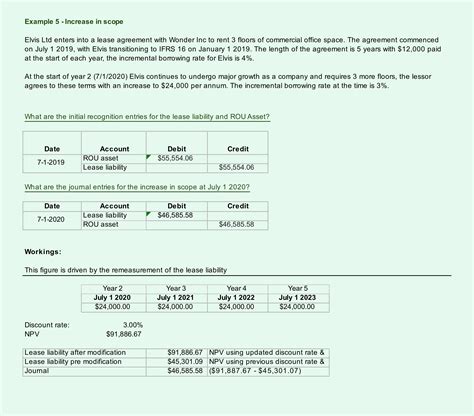

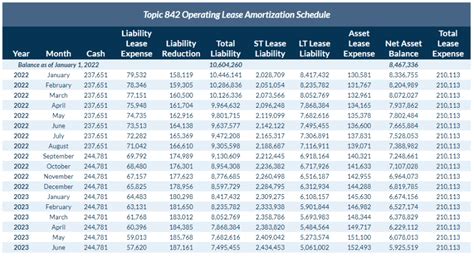

Creating the Amortization Schedule

The amortization schedule is a critical component of the lease accounting model. It shows the periodic amortization of the lease asset and the lease liability over the lease term. The amortization schedule should be calculated using the effective interest method.

Automating the Lease Accounting Process

To automate the lease accounting process in Excel, you can use macros and formulas to streamline the calculations. Macros can be used to create the amortization schedule and update the lease asset and lease liability balances. Formulas can be used to calculate the present value of the lease payments and the discount rate.

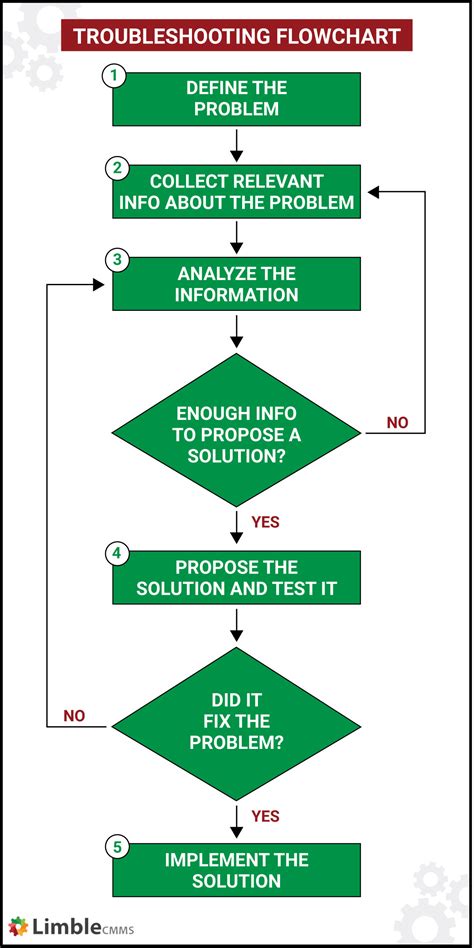

Troubleshooting Common Issues

When implementing ASC 842 in Excel, you may encounter common issues such as incorrect lease term, lease payments, or discount rate. To troubleshoot these issues, you need to review the lease agreement and ensure that the inputs are accurate.

Best Practices for Implementing ASC 842 in Excel

To ensure a smooth implementation of ASC 842 in Excel, follow these best practices:

- Use a robust lease accounting model that captures all the lease components

- Ensure that the inputs are accurate and complete

- Use macros and formulas to automate the lease accounting process

- Review the lease agreement and ensure that the inputs are accurate

- Document the lease accounting process and ensure that it is transparent and auditable

Conclusion

Implementing ASC 842 in Excel requires a deep understanding of the lease accounting standard and its application in financial modeling. By following the 5 essential steps outlined in this article, you can master ASC 842 in Excel and ensure compliance with the new standard.

We encourage you to share your experiences and challenges in implementing ASC 842 in Excel. Your feedback will help us improve our content and provide better guidance to our readers.

ASC 842 Image Gallery