Intro

Streamline your lease accounting with our ASC 842 Lease Accounting Template. Master the 5 essential steps to ensure compliance with the latest GAAP standards. Learn how to identify, measure, and disclose leases, plus navigate lease classification, lease modification, and more. Simplify your accounting process today!

The Financial Accounting Standards Board (FASB) introduced the Accounting Standards Codification (ASC) 842, which revolutionized the way companies account for leases. The new standard requires lessees to recognize lease assets and liabilities on their balance sheets, which can be a daunting task for many organizations. To simplify the process, we'll outline the 5 essential steps for creating an ASC 842 lease accounting template.

As companies transition to the new standard, they need to ensure compliance with ASC 842. A well-structured lease accounting template can help streamline the process, reduce errors, and provide a clear understanding of lease-related assets and liabilities. In this article, we'll provide a comprehensive guide on creating an ASC 842 lease accounting template, including the essential steps, benefits, and best practices.

Implementing ASC 842 can be a complex process, but with a solid understanding of the requirements and a reliable template, companies can ensure accurate financial reporting and compliance. Whether you're a lessee or a lessor, this article will help you navigate the challenges of lease accounting under ASC 842.

Understanding ASC 842 Requirements

Before creating a lease accounting template, it's essential to understand the requirements of ASC 842. The new standard introduces significant changes to lease accounting, including the recognition of lease assets and liabilities on the balance sheet. Lessees must identify lease contracts, determine the lease term, and calculate the present value of lease payments to recognize the lease asset and liability.

Key Components of ASC 842

- Lease identification: Lessees must identify lease contracts and determine whether the contract contains a lease.

- Lease term: Lessees must determine the lease term, including any renewal or termination options.

- Lease payments: Lessees must calculate the present value of lease payments, including fixed payments, in-substance fixed payments, and variable lease payments.

- Lease assets and liabilities: Lessees must recognize the lease asset and liability on the balance sheet, representing the right to use the underlying asset and the obligation to make lease payments.

Step 1: Gather Lease Data

The first step in creating an ASC 842 lease accounting template is to gather lease data. This includes collecting information about lease contracts, including the lease term, lease payments, and underlying assets. Lessees must also identify any renewal or termination options, as well as any variable lease payments.

Lease Data Requirements

- Lease contract details: Collect information about the lease contract, including the lease term, lease payments, and underlying assets.

- Lease payments: Gather data on fixed payments, in-substance fixed payments, and variable lease payments.

- Renewal and termination options: Identify any renewal or termination options, including the probability of exercising these options.

- Variable lease payments: Collect data on variable lease payments, including the amount and frequency of payments.

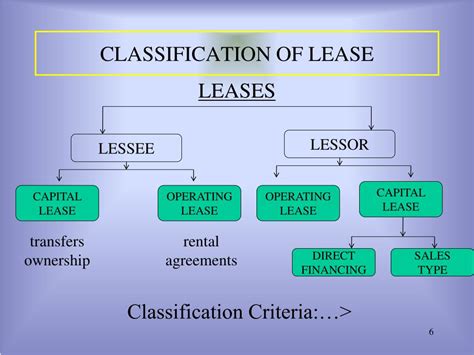

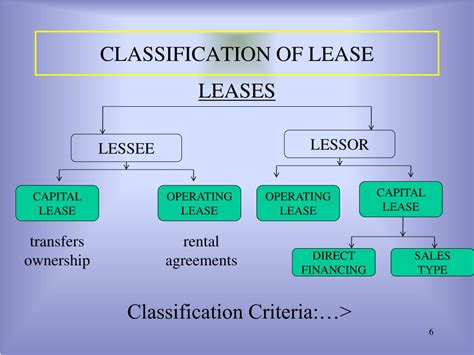

Step 2: Determine Lease Classification

The second step is to determine the lease classification. ASC 842 introduces two types of leases: finance leases and operating leases. Lessees must determine whether the lease is a finance lease or an operating lease, based on the transfer of ownership, the present value of lease payments, and the useful life of the underlying asset.

Lease Classification Requirements

- Transfer of ownership: Determine whether the lease transfers ownership of the underlying asset to the lessee.

- Present value of lease payments: Calculate the present value of lease payments to determine whether the lease is a finance lease or an operating lease.

- Useful life of the underlying asset: Determine the useful life of the underlying asset to determine whether the lease is a finance lease or an operating lease.

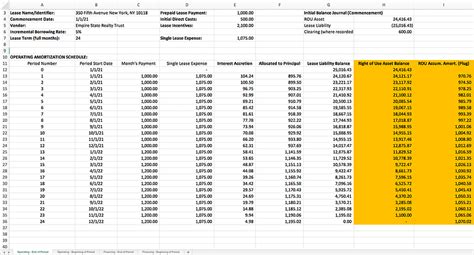

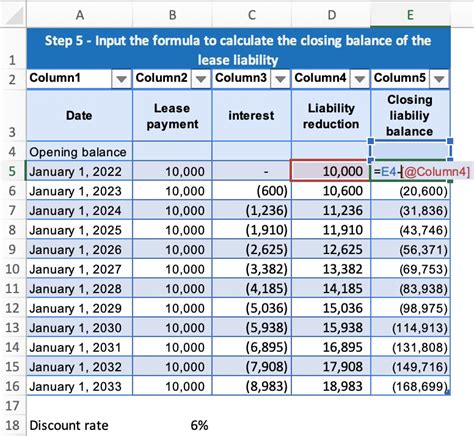

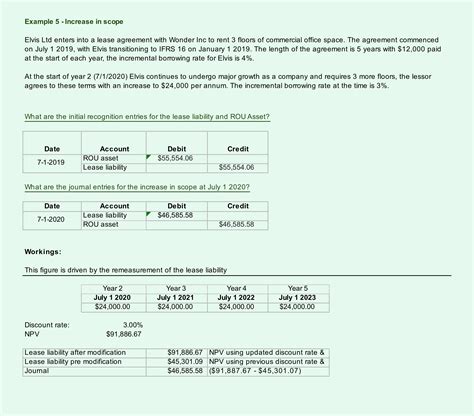

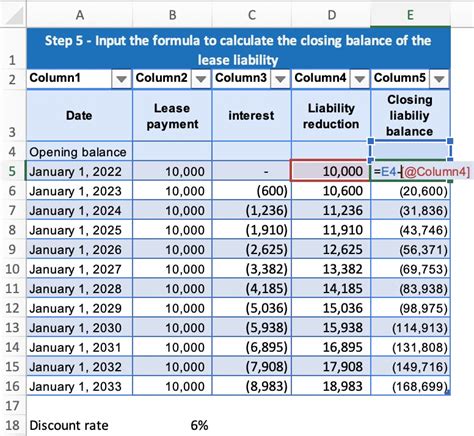

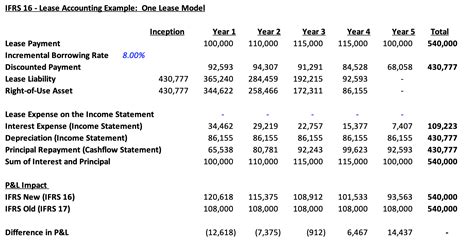

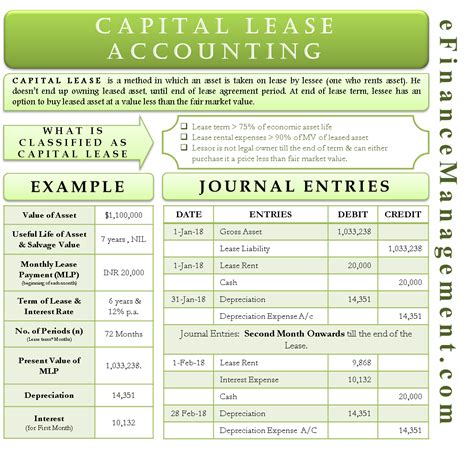

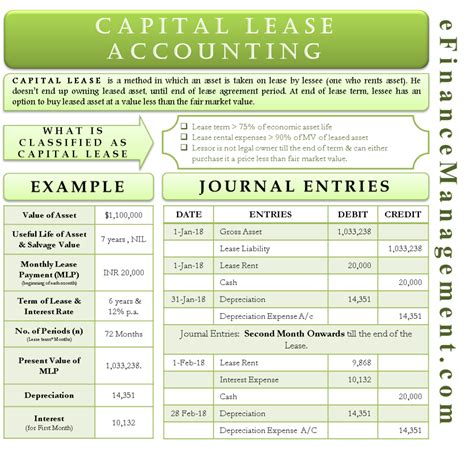

Step 3: Calculate Lease Assets and Liabilities

The third step is to calculate the lease assets and liabilities. Lessees must calculate the present value of lease payments to recognize the lease asset and liability on the balance sheet. The lease asset represents the right to use the underlying asset, while the lease liability represents the obligation to make lease payments.

Lease Asset and Liability Calculation Requirements

- Present value of lease payments: Calculate the present value of lease payments to determine the lease asset and liability.

- Lease asset: Recognize the lease asset on the balance sheet, representing the right to use the underlying asset.

- Lease liability: Recognize the lease liability on the balance sheet, representing the obligation to make lease payments.

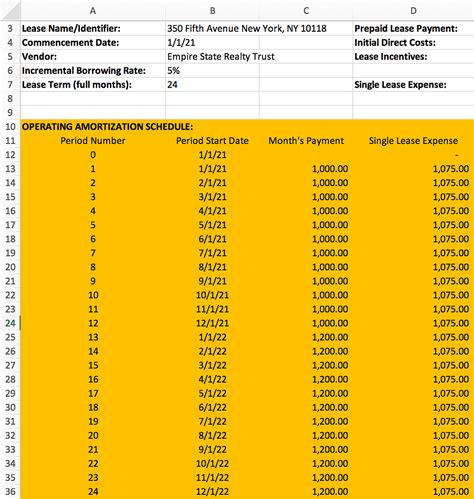

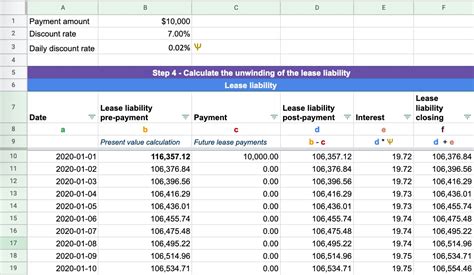

Step 4: Record Lease-Related Expenses

The fourth step is to record lease-related expenses. Lessees must record lease-related expenses, including amortization of the lease asset and interest on the lease liability.

Lease-Related Expense Requirements

- Amortization of lease asset: Record the amortization of the lease asset over the lease term.

- Interest on lease liability: Record the interest on the lease liability over the lease term.

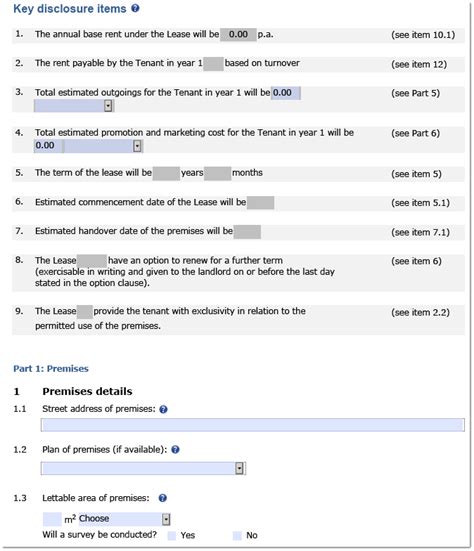

Step 5: Disclose Lease Information

The final step is to disclose lease information. Lessees must disclose lease information in the financial statements, including the lease asset and liability, lease payments, and lease term.

Lease Disclosure Requirements

- Lease asset and liability: Disclose the lease asset and liability on the balance sheet.

- Lease payments: Disclose the lease payments in the income statement.

- Lease term: Disclose the lease term in the financial statements.

ASC 842 Lease Accounting Template Image Gallery

By following these 5 essential steps, lessees can create an ASC 842 lease accounting template that simplifies the lease accounting process and ensures compliance with the new standard. Remember to gather lease data, determine lease classification, calculate lease assets and liabilities, record lease-related expenses, and disclose lease information to ensure accurate financial reporting and compliance.