Intro

As the financial landscape continues to evolve, businesses are finding themselves faced with new challenges and regulations. One such challenge is the adoption of Accounting Standards Codification (ASC) 842, which requires companies to recognize and measure leases on their balance sheets. To help navigate this complex process, many organizations are turning to Excel templates to simplify the transition. In this article, we'll explore five ways to master the ASC 842 template in Excel, ensuring a seamless implementation and accurate financial reporting.

Understanding ASC 842: A Brief Overview

ASC 842 is a new accounting standard that requires lessees to recognize lease assets and liabilities on their balance sheets. This means that companies must now account for lease obligations in a more transparent and detailed manner. The standard applies to all leases with terms of 12 months or more, and it affects a wide range of industries, including retail, manufacturing, and real estate.

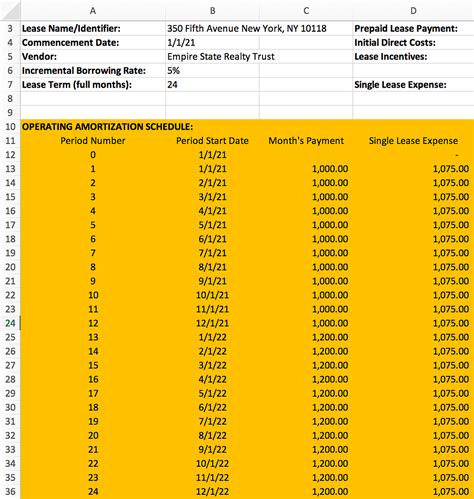

The Importance of Excel Templates in ASC 842 Implementation

Excel templates have become an essential tool for companies implementing ASC 842. These templates provide a structured framework for tracking and calculating lease-related data, making it easier to comply with the new standard. By using an ASC 842 template in Excel, businesses can streamline their accounting processes, reduce errors, and improve financial reporting.

1. Setting Up the Template: A Step-by-Step Guide

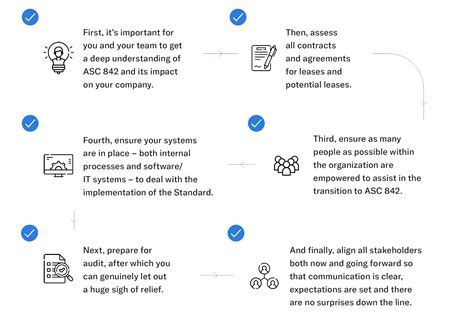

To master the ASC 842 template in Excel, it's essential to set it up correctly. Here's a step-by-step guide to help you get started:

- Download the ASC 842 template from a reputable source or create one from scratch.

- Customize the template to fit your company's specific needs and lease portfolio.

- Set up separate sheets for different lease types, such as operating leases and finance leases.

- Create a data entry sheet for capturing lease details, including lease terms, payment schedules, and asset information.

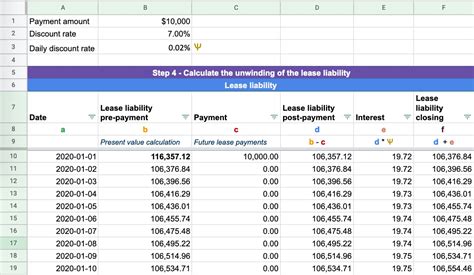

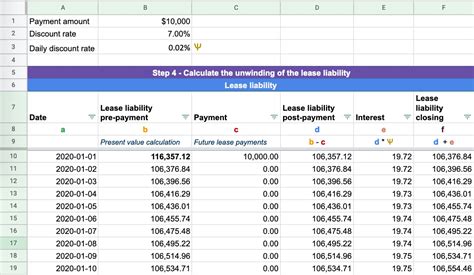

- Establish a calculation sheet for determining lease liabilities and assets.

2. Data Entry and Management: Tips and Best Practices

Accurate data entry is critical to ensuring the success of your ASC 842 implementation. Here are some tips and best practices to keep in mind:

- Establish a centralized data management system to track and update lease information.

- Use drop-down menus and validation rules to minimize errors and ensure data consistency.

- Set up automatic calculations and formulas to reduce manual input and improve accuracy.

- Regularly review and update lease data to reflect changes in the lease portfolio.

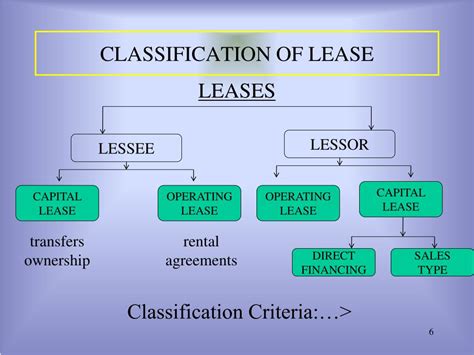

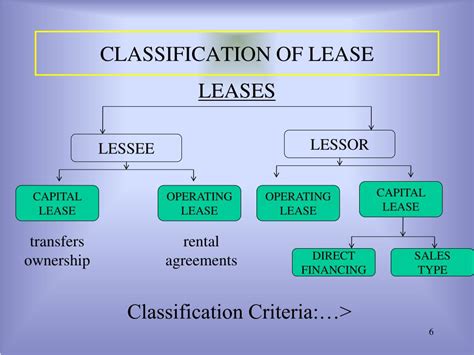

3. Lease Classification and Accounting: A Deep Dive

Lease classification and accounting are critical components of ASC 842. Here's a deep dive into the different types of leases and how to account for them:

- Operating leases: These leases are considered "off-balance-sheet" and are accounted for as operating expenses.

- Finance leases: These leases are considered "on-balance-sheet" and are accounted for as assets and liabilities.

- Short-term leases: These leases have terms of 12 months or less and are exempt from ASC 842.

- Low-value leases: These leases have lease payments of $5,000 or less and are exempt from ASC 842.

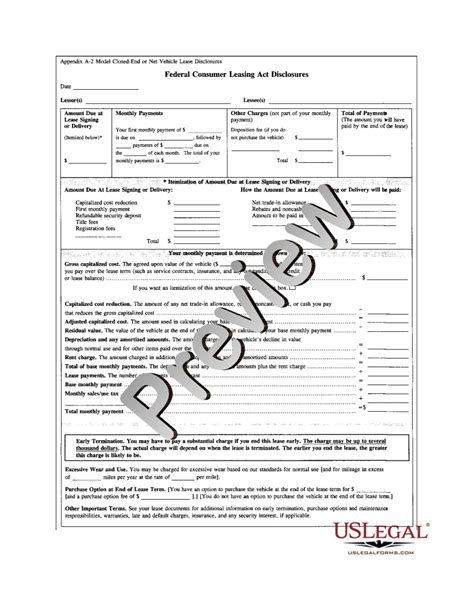

4. Disclosures and Financial Reporting: What You Need to Know

ASC 842 requires companies to disclose lease-related information in their financial statements. Here's what you need to know:

- Lease liabilities and assets must be reported on the balance sheet.

- Lease expenses and income must be reported on the income statement.

- Disclosure requirements include lease terms, payment schedules, and asset information.

- Companies must also disclose any lease-related risks and uncertainties.

5. Troubleshooting and Auditing: Common Issues and Solutions

As with any new accounting standard, there are bound to be challenges and issues that arise during implementation. Here are some common issues and solutions to help you troubleshoot and audit your ASC 842 template:

- Inconsistent data entry: Regularly review and update lease data to ensure accuracy and consistency.

- Calculation errors: Use automatic calculations and formulas to minimize manual input and improve accuracy.

- Disclosure requirements: Ensure that all lease-related information is properly disclosed in financial statements.

Gallery of ASC 842 Template in Excel

ASC 842 Template in Excel Image Gallery

By following these five ways to master the ASC 842 template in Excel, you'll be well on your way to ensuring a successful implementation and accurate financial reporting. Remember to regularly review and update your template to reflect changes in the lease portfolio and to ensure compliance with ASC 842. With the right tools and knowledge, you'll be able to navigate the complexities of ASC 842 with confidence.

We hope this article has been informative and helpful in your journey to master the ASC 842 template in Excel. If you have any questions or comments, please don't hesitate to reach out.