Intro

Unlock the benefits of Atlantic Edge Credit Union membership! Discover a wide range of financial services, including competitive loan rates, flexible savings options, and convenient online banking. Enjoy exclusive member perks, robust account security, and personalized support. Learn how Atlantic Edge Credit Union services can help you achieve financial stability and success.

As a member of the Atlantic Edge Credit Union, you're part of a community that's dedicated to providing exceptional financial services and benefits. With a focus on serving the needs of its members, Atlantic Edge Credit Union offers a wide range of services and benefits that can help you achieve your financial goals. In this article, we'll explore the benefits and services offered by Atlantic Edge Credit Union, and how they can help you save, borrow, and invest wisely.

Being part of a credit union comes with its own set of advantages. Unlike traditional banks, credit unions are not-for-profit organizations that are owned and controlled by their members. This means that any profits made by the credit union are reinvested into the organization, allowing for better rates and services for members.

Benefits of Atlantic Edge Credit Union Membership

As a member of Atlantic Edge Credit Union, you can enjoy a range of benefits that can help you manage your finances more effectively. Some of the key benefits of membership include:

- Competitive interest rates on loans and deposits

- Low fees and charges

- Personalized service from experienced staff

- Access to a range of financial products and services

- Opportunities to participate in decision-making through voting and volunteering

Financial Products and Services

Atlantic Edge Credit Union offers a wide range of financial products and services to help you manage your finances. Some of the key products and services include:

- Savings accounts: Atlantic Edge Credit Union offers a range of savings accounts that can help you save for the future.

- Loans: The credit union offers competitive interest rates on a range of loan products, including personal loans, mortgages, and credit cards.

- Investments: Atlantic Edge Credit Union offers a range of investment products, including certificates of deposit and individual retirement accounts.

- Insurance: The credit union offers a range of insurance products, including life insurance and disability insurance.

Atlantic Edge Credit Union Services

In addition to its financial products, Atlantic Edge Credit Union also offers a range of services to help you manage your finances. Some of the key services include:

- Online banking: Atlantic Edge Credit Union offers online banking services that allow you to manage your accounts and conduct transactions from the comfort of your own home.

- Mobile banking: The credit union also offers mobile banking services that allow you to manage your accounts and conduct transactions on the go.

- Financial counseling: Atlantic Edge Credit Union offers financial counseling services to help you manage your finances and achieve your financial goals.

- Investment advice: The credit union also offers investment advice to help you make informed investment decisions.

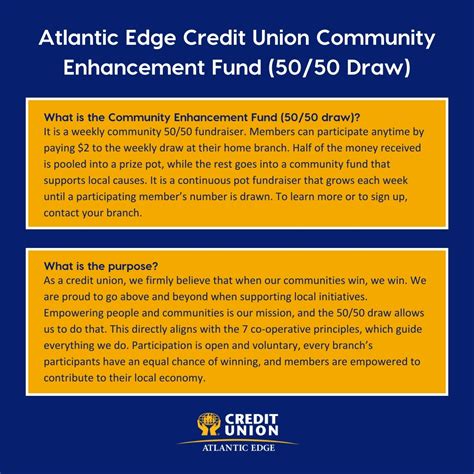

Community Involvement

Atlantic Edge Credit Union is committed to giving back to the community. The credit union participates in a range of community events and charitable initiatives, and offers scholarships and other financial assistance to members in need.

How to Join Atlantic Edge Credit Union

Joining Atlantic Edge Credit Union is easy. To become a member, you'll need to meet the credit union's eligibility requirements and follow these steps:

- Determine your eligibility: Check the credit union's website to see if you're eligible for membership.

- Gather required documents: You'll need to provide proof of identity and proof of address.

- Fill out the membership application: You can apply online or in person at one of the credit union's branches.

- Fund your account: You'll need to make an initial deposit to open your account.

Conclusion

Atlantic Edge Credit Union offers a wide range of benefits and services to its members. From competitive interest rates and low fees to personalized service and community involvement, the credit union is dedicated to helping its members achieve their financial goals. Whether you're looking to save, borrow, or invest, Atlantic Edge Credit Union has the products and services you need.

We encourage you to share your experiences with Atlantic Edge Credit Union in the comments below. Have you had a positive experience with the credit union? Do you have any questions or concerns? Let us know!

Atlantic Edge Credit Union Image Gallery