Balancing the books is an essential task for any business, and one of the most critical components of this process is balance sheet reconciliation. This involves verifying that the company's financial records are accurate and up-to-date, ensuring that the balance sheet reflects the true financial position of the business. In this article, we'll break down the balance sheet reconciliation process into five easy steps, providing you with a clear understanding of how to get it done efficiently.

Why is Balance Sheet Reconciliation Important?

Before we dive into the steps, it's essential to understand why balance sheet reconciliation is crucial for your business. This process helps identify and correct errors, ensures compliance with accounting standards, and provides a clear picture of your company's financial health. By reconciling your balance sheet regularly, you can:

- Identify and correct errors or discrepancies in your financial records

- Ensure compliance with accounting standards and regulatory requirements

- Make informed decisions about your business based on accurate financial data

- Improve your company's financial transparency and accountability

Step 1: Gather Necessary Documents and Information

The first step in balance sheet reconciliation is to gather all necessary documents and information. This includes:

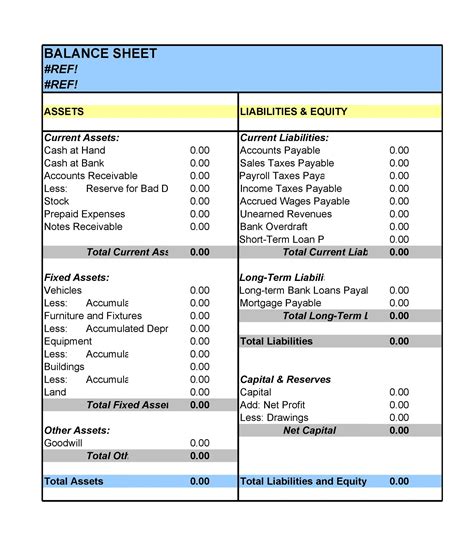

- The company's balance sheet

- General ledger accounts

- Bank statements

- Accounts payable and accounts receivable ledgers

- Inventory reports

- Any other relevant financial documents

Make sure you have the most up-to-date versions of these documents, and that they are accurate and complete.

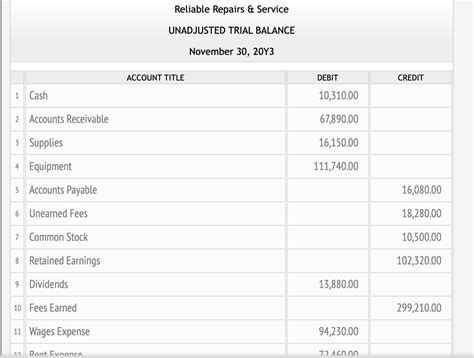

Step 2: Identify and Verify Account Balances

In this step, you'll need to identify and verify the balances of each account on the balance sheet. This involves:

- Checking the account balances against the general ledger accounts

- Verifying the accuracy of the account balances against external sources, such as bank statements

- Identifying any discrepancies or errors in the account balances

Make sure to investigate and resolve any discrepancies or errors you find during this step.

Step 3: Reconcile Cash and Bank Accounts

Reconciling cash and bank accounts is a critical part of balance sheet reconciliation. This involves:

- Verifying the cash and bank account balances against the general ledger accounts

- Reconciling the account balances against the bank statements

- Identifying and resolving any discrepancies or errors in the cash and bank account balances

Make sure to investigate and resolve any discrepancies or errors you find during this step.

Step 4: Reconcile Accounts Payable and Accounts Receivable

In this step, you'll need to reconcile the accounts payable and accounts receivable accounts. This involves:

- Verifying the accounts payable and accounts receivable balances against the general ledger accounts

- Reconciling the account balances against external sources, such as vendor invoices and customer receipts

- Identifying and resolving any discrepancies or errors in the accounts payable and accounts receivable balances

Make sure to investigate and resolve any discrepancies or errors you find during this step.

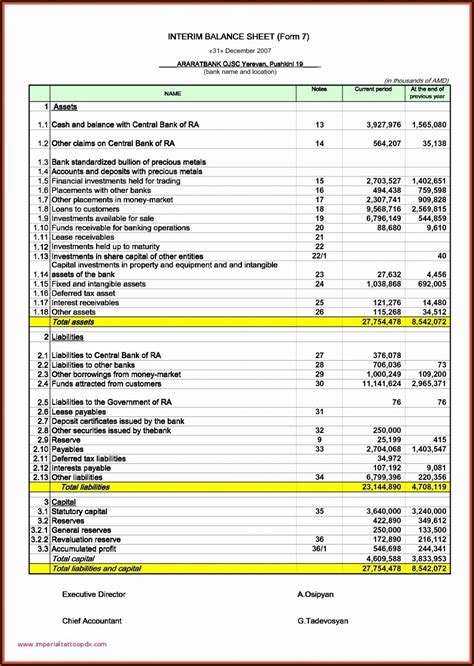

Step 5: Review and Verify the Reconciliations

The final step in balance sheet reconciliation is to review and verify the reconciliations. This involves:

- Reviewing the reconciliations for accuracy and completeness

- Verifying that all discrepancies or errors have been resolved

- Ensuring that the balance sheet reflects the true financial position of the company

Make sure to double-check your work and verify that the balance sheet is accurate and up-to-date.

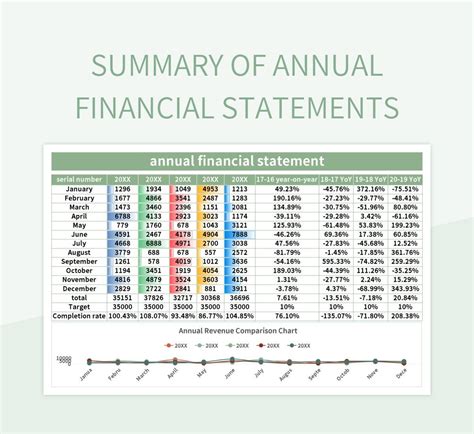

Balance Sheet Reconciliation Image Gallery

By following these five easy steps, you'll be able to complete a successful balance sheet reconciliation and ensure that your company's financial records are accurate and up-to-date. Remember to review and verify your work carefully, and don't hesitate to seek professional help if you need it. Happy reconciling!