Intro

Streamline your financial management with 5 easy bank reconciliation templates in Excel. Learn how to reconcile statements, identify discrepancies, and ensure accuracy with these free, downloadable templates. Improve your accounting workflow and reduce errors with these simple, customizable tools, perfect for small businesses and individuals alike.

In today's digital age, managing finances has become more efficient than ever. One crucial aspect of financial management is bank reconciliation, which ensures that your company's financial records match the bank's records. To make this process smoother, using a bank reconciliation template in Excel can be incredibly helpful. In this article, we will explore five easy-to-use bank reconciliation templates in Excel that can save you time and reduce errors.

What is Bank Reconciliation?

Bank reconciliation is the process of comparing your company's internal financial records with the records provided by your bank to ensure that they match. This process helps identify any discrepancies, errors, or potential fraud. By regularly reconciling your bank statements, you can maintain accurate financial records, prevent errors, and ensure compliance with accounting standards.

Why Use a Bank Reconciliation Template in Excel?

Using a bank reconciliation template in Excel offers several benefits. Firstly, it streamlines the reconciliation process, saving you time and effort. Secondly, it reduces the likelihood of errors, as the template provides a structured format for recording and calculating transactions. Finally, it allows for easy tracking and analysis of your company's financial data.

5 Easy Bank Reconciliation Templates in Excel

Here are five easy-to-use bank reconciliation templates in Excel that you can download and customize to suit your company's needs:

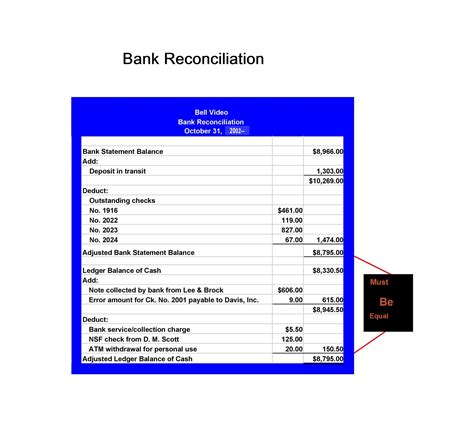

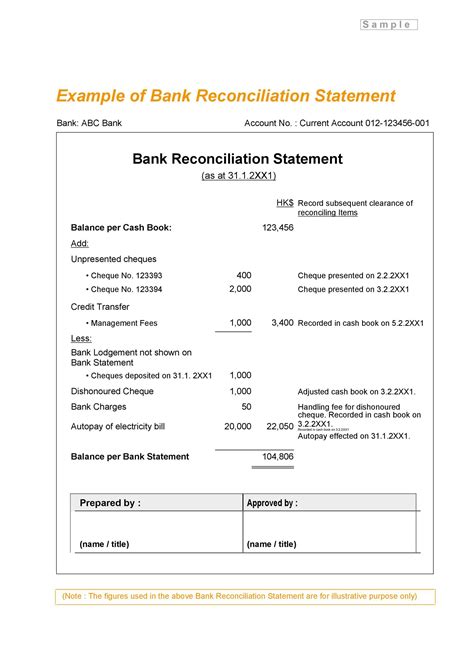

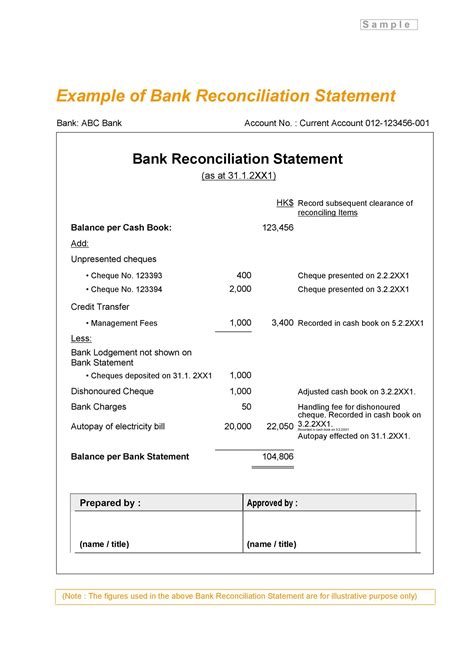

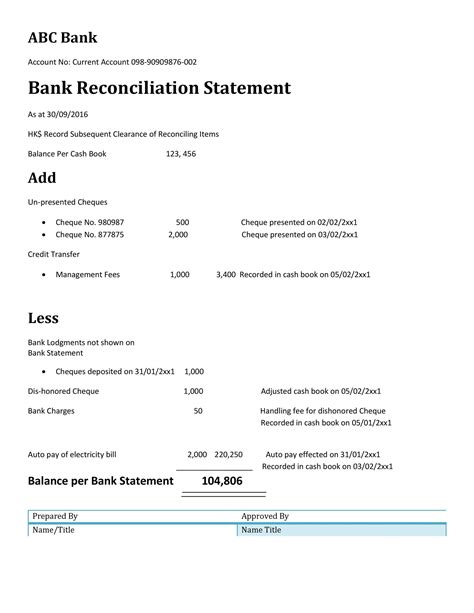

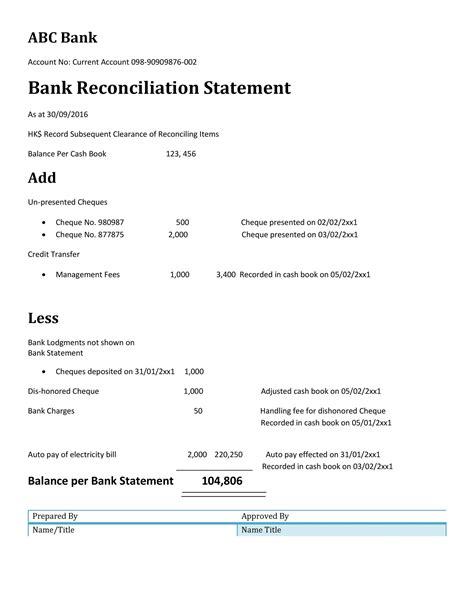

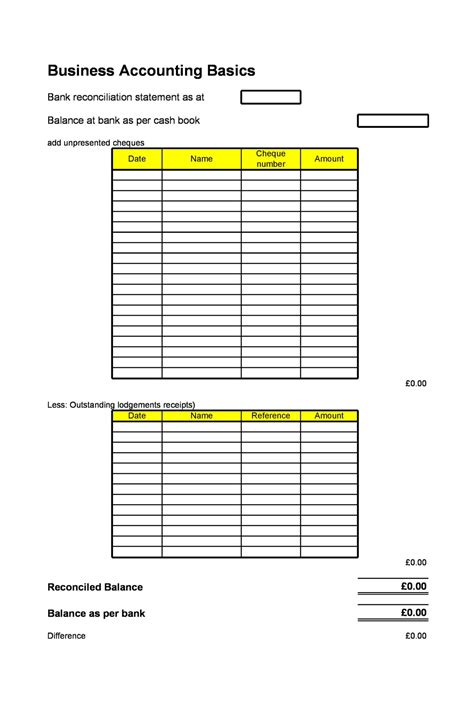

1. Basic Bank Reconciliation Template

This template provides a simple and straightforward format for reconciling your bank statements. It includes columns for recording deposits, withdrawals, and adjustments, as well as a section for calculating the reconciliation amount.

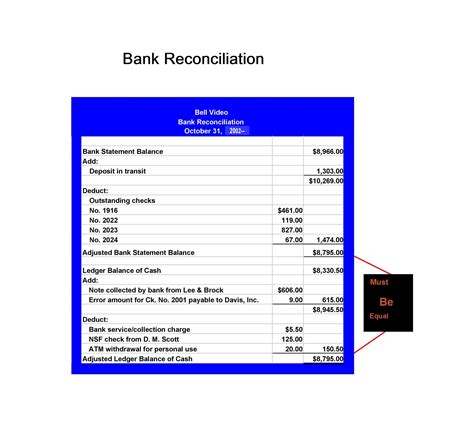

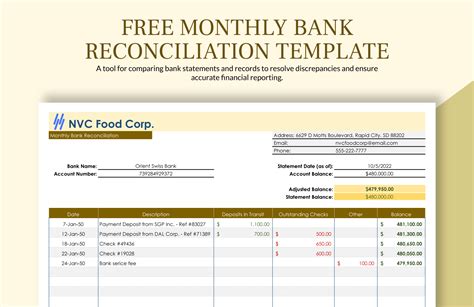

2. Detailed Bank Reconciliation Template

This template provides a more detailed format for reconciling your bank statements. It includes columns for recording specific transaction types, such as checks, debit card transactions, and bank fees.

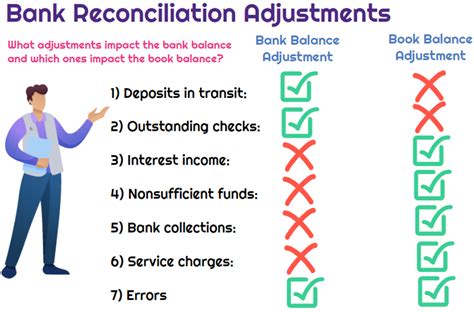

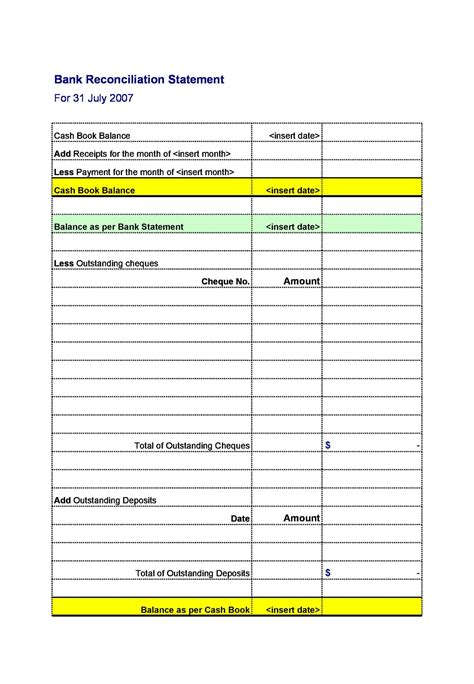

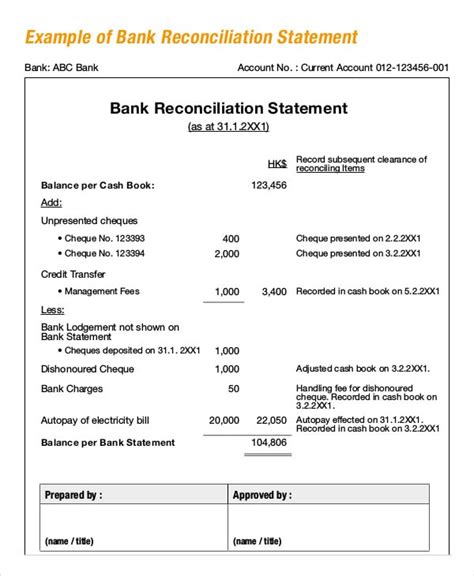

3. Bank Reconciliation Template with Adjustments

This template allows you to record adjustments made to your bank statements, such as corrections for errors or omissions. It also includes a section for calculating the reconciliation amount.

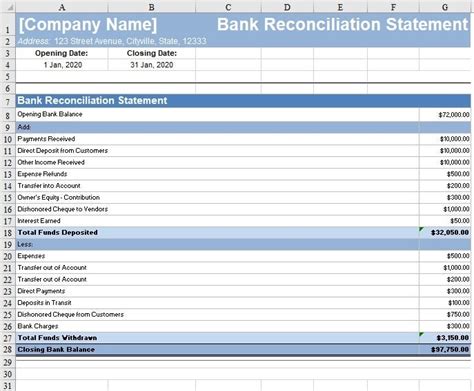

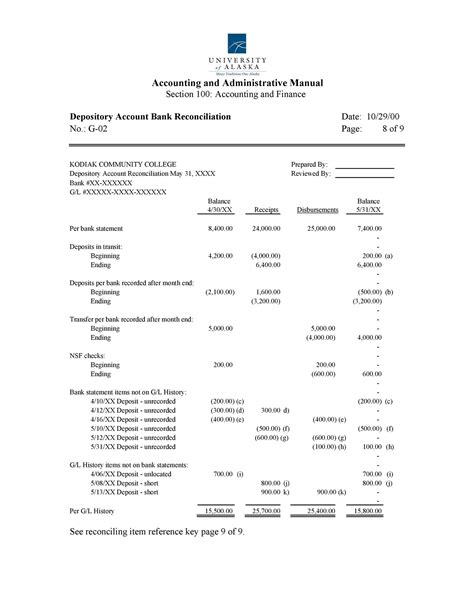

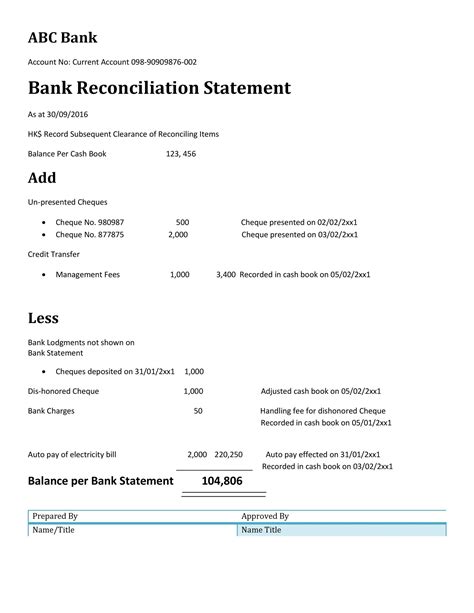

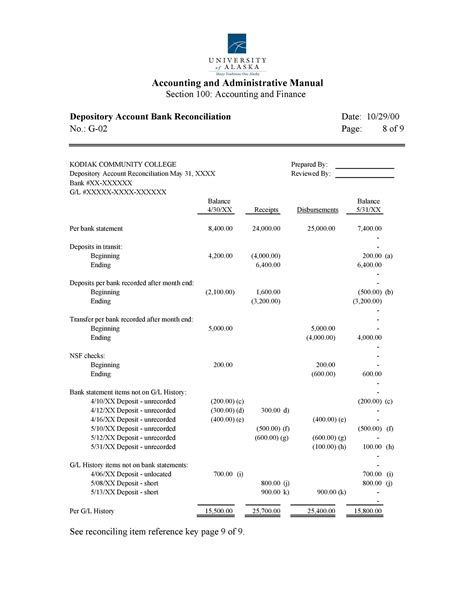

4. Bank Reconciliation Template with Multiple Accounts

This template allows you to reconcile multiple bank accounts simultaneously. It includes columns for recording transactions for each account, as well as a section for calculating the reconciliation amount for each account.

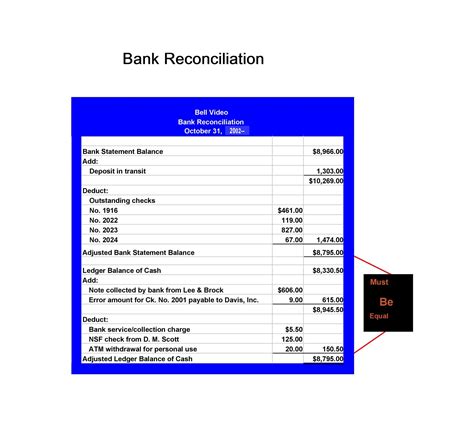

5. Automated Bank Reconciliation Template

This template uses Excel formulas to automate the reconciliation process. It includes columns for recording transactions, as well as formulas to calculate the reconciliation amount and identify discrepancies.

How to Use a Bank Reconciliation Template in Excel

Using a bank reconciliation template in Excel is a straightforward process. Here are the steps to follow:

- Download and customize the template to suit your company's needs.

- Record your company's internal financial transactions in the template.

- Obtain your bank statement and record the transactions in the template.

- Compare the two sets of transactions and identify any discrepancies.

- Calculate the reconciliation amount and make any necessary adjustments.

- Review and analyze the reconciliation report to ensure accuracy and compliance.

Gallery of Bank Reconciliation Templates

Bank Reconciliation Template Gallery

Final Thoughts

Using a bank reconciliation template in Excel can save you time and reduce errors in the reconciliation process. By following the steps outlined in this article and customizing one of the five easy-to-use templates, you can ensure accurate and compliant financial records for your company. Don't forget to share your thoughts and experiences with bank reconciliation templates in the comments below!