Intro

Discover the ins and outs of Basic Allowance for Subsistence (BAS) with our comprehensive guide. Learn how BAS impacts military personnel, the differences between BAS and BAH, and how to calculate your allowance. Get expert tips on managing BAS for food and housing expenses, and optimize your military compensation package.

The concept of Basic Allowance for Subsistence (BAS) can be complex, but understanding its ins and outs is crucial for military personnel to manage their finances effectively. BAS is a non-taxable allowance that is intended to offset the cost of food for enlisted personnel. However, deciphering the intricacies of BAS can be a daunting task, especially for those new to the military. In this article, we will delve into five ways to understand BAS, helping you make the most of this allowance and optimize your financial situation.

What is Basic Allowance for Subsistence?

BAS is a monthly stipend that is designed to help military personnel cover their food expenses. It is a non-taxable allowance, which means that it is not subject to federal income tax. The amount of BAS varies depending on the individual's pay grade, family size, and other factors. Understanding what BAS entails is the first step in maximizing its benefits.

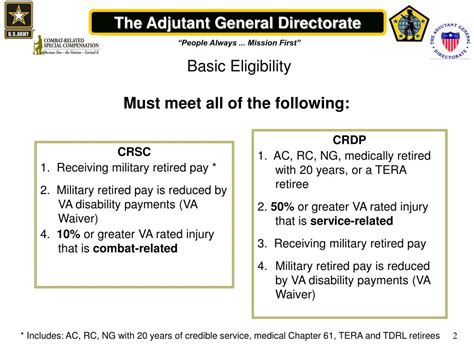

BAS vs. Other Military Allowances

It's essential to distinguish BAS from other military allowances, such as Basic Allowance for Housing (BAH) and Cost of Living Allowance (COLA). While BAH is intended to help military personnel cover their housing expenses, COLA is designed to offset the cost of living in areas with a high cost of living. BAS, on the other hand, is specifically intended to help with food expenses.

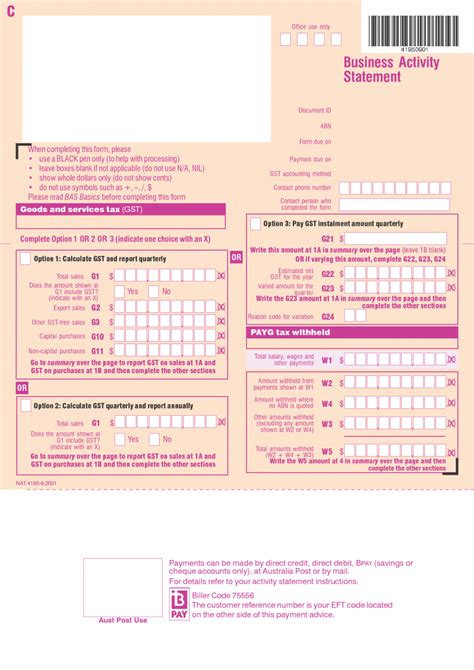

Calculating Your BAS

The amount of BAS you receive depends on your pay grade, family size, and the number of dependents you have. The military uses a complex formula to calculate BAS, taking into account factors such as the cost of food, the individual's pay grade, and the number of dependents. You can use the Defense Travel Management Office's (DTMO) calculator to estimate your BAS.

Factors Affecting BAS

Several factors can impact the amount of BAS you receive, including:

- Pay grade: Higher pay grades typically receive more BAS.

- Family size: Personnel with larger families may receive more BAS to account for increased food expenses.

- Number of dependents: The number of dependents you have can impact your BAS amount.

- Location: BAS rates vary depending on the location, with areas having a higher cost of living receiving more BAS.

Managing Your BAS Effectively

To make the most of your BAS, it's crucial to manage it effectively. Here are some tips:

- Create a budget: Set aside your BAS for food expenses, and allocate it accordingly.

- Plan your meals: Cook meals in bulk and plan your shopping trips to reduce food waste.

- Use coupons and discounts: Take advantage of coupons, discounts, and promotions to stretch your BAS.

- Consider meal prepping: Preparing meals in advance can help you save time and money.

Common Mistakes to Avoid

When managing your BAS, it's essential to avoid common mistakes, such as:

- Overestimating food expenses: Be realistic about your food expenses to avoid overspending.

- Not budgeting: Failing to budget your BAS can lead to financial difficulties.

- Not taking advantage of discounts: Missing out on coupons, discounts, and promotions can result in wasted BAS.

BAS and Taxes

As mentioned earlier, BAS is a non-taxable allowance. However, it's essential to understand how BAS impacts your taxes. Since BAS is not subject to federal income tax, it will not be reported on your W-2 form. However, if you receive BAS, you may be eligible for other tax benefits, such as the Earned Income Tax Credit (EITC).

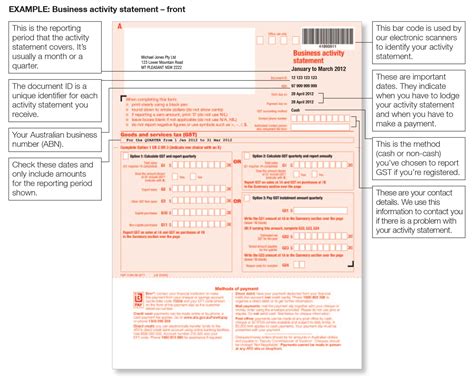

Reporting BAS on Your Taxes

When reporting your BAS on your taxes, keep in mind:

- BAS is not reported on your W-2 form.

- You may need to report BAS on Form 1040, Schedule 1.

- Consult with a tax professional to ensure you're reporting BAS correctly.

Conclusion and Next Steps

Understanding Basic Allowance for Subsistence is crucial for military personnel to manage their finances effectively. By grasping the concepts outlined in this article, you'll be better equipped to maximize your BAS and optimize your financial situation. Remember to calculate your BAS accurately, manage it effectively, and avoid common mistakes.

Basic Allowance for Subsistence Image Gallery

We invite you to share your thoughts on Basic Allowance for Subsistence in the comments below. If you found this article informative, please share it with your fellow military personnel to help them better understand BAS.