Discover top Navy Federal Credit Card options, featuring cashback, rewards, and low-interest rates, ideal for military personnel and families seeking financial flexibility and benefits.

The world of credit cards can be overwhelming, with numerous options available to consumers. However, for those affiliated with the military, veterans, or their families, Navy Federal Credit Union offers a range of credit card options that cater to their specific needs. With its reputation for excellent customer service, competitive rates, and exclusive benefits, Navy Federal Credit Union has become a go-to financial institution for many. In this article, we will delve into the best Navy Federal Credit Card options, exploring their features, benefits, and how they can help cardholders achieve their financial goals.

As a credit union, Navy Federal Credit Union is member-owned, which means that its primary focus is on serving its members rather than maximizing profits. This approach translates into more favorable terms, lower fees, and higher rewards for cardholders. Whether you're looking to build credit, earn cashback, or enjoy travel perks, Navy Federal Credit Union has a credit card that suits your lifestyle. From the Navy Federal CashRewards credit card to the Navy Federal GO REWARDS credit card, each option is designed to provide value and convenience to its members.

Navy Federal Credit Union's commitment to its members is evident in its credit card offerings, which are designed to meet the unique needs of military personnel, veterans, and their families. With its extensive network of branches and ATMs, cardholders can access their accounts and conduct transactions with ease, whether they're stationed domestically or abroad. Moreover, Navy Federal Credit Union's online platform and mobile app enable cardholders to manage their accounts, pay bills, and monitor their credit scores from anywhere, at any time. This level of convenience and support is unparalleled in the industry, making Navy Federal Credit Union the preferred choice for many military families.

Overview of Navy Federal Credit Card Options

Navy Federal Credit Union offers a diverse range of credit cards, each with its own set of benefits and features. The Navy Federal CashRewards credit card, for instance, offers 1.5% cashback on all purchases, with no rotating categories or spending limits. This card is ideal for those who want to earn rewards without the hassle of tracking categories or expiration dates. On the other hand, the Navy Federal GO REWARDS credit card offers 3x points on gas, 2x points on groceries, and 1x point on all other purchases, making it perfect for families with multiple vehicles or frequent travelers.

Types of Navy Federal Credit Cards

Navy Federal Credit Union offers several types of credit cards, including: * Cashback credit cards * Rewards credit cards * Secured credit cards * Business credit cards * Student credit cards Each type of credit card is designed to cater to specific needs and financial goals, ensuring that members can find the perfect card to suit their lifestyle.Benefits of Navy Federal Credit Cards

Navy Federal Credit Union's credit cards come with a range of benefits, including:

- Competitive interest rates

- No foreign transaction fees

- No balance transfer fees

- Exclusive rewards programs

- Travel insurance and assistance

- Identity theft protection These benefits are designed to provide cardholders with peace of mind, convenience, and value, making Navy Federal Credit Union's credit cards an attractive option for those looking for a reliable and rewarding credit card experience.

How to Choose the Right Navy Federal Credit Card

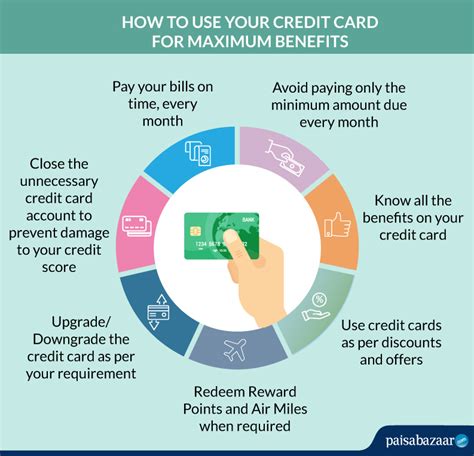

With so many options available, choosing the right Navy Federal Credit Card can be overwhelming. To make the decision easier, consider the following factors: * Your spending habits: If you spend heavily on gas, groceries, or travel, look for a card that offers rewards in those categories. * Your financial goals: If you're trying to build credit, a secured credit card may be the best option. * Your lifestyle: If you're frequently deployed or travel extensively, look for a card with travel perks and no foreign transaction fees. By considering these factors, you can find the perfect Navy Federal Credit Card to suit your needs and financial goals.Navy Federal Credit Card Rewards Programs

Navy Federal Credit Union's rewards programs are designed to provide cardholders with value and convenience. The Navy Federal CashRewards credit card, for instance, offers 1.5% cashback on all purchases, with no rotating categories or spending limits. The Navy Federal GO REWARDS credit card, on the other hand, offers 3x points on gas, 2x points on groceries, and 1x point on all other purchases. These rewards programs are designed to provide cardholders with flexibility and value, making it easy to earn and redeem rewards.

Earning and Redeeming Rewards

Earning and redeeming rewards with Navy Federal Credit Union is easy. Cardholders can earn rewards on every purchase, and redeem them for cash, gift cards, or travel. The Navy Federal Credit Union online platform and mobile app make it easy to track rewards balances, redeem rewards, and manage accounts. With no rotating categories or spending limits, cardholders can earn rewards without hassle or stress.Navy Federal Credit Card Interest Rates and Fees

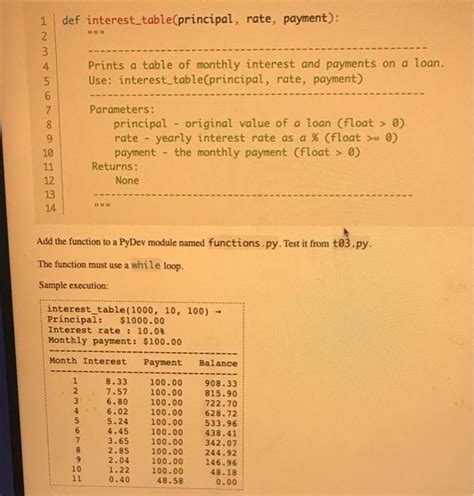

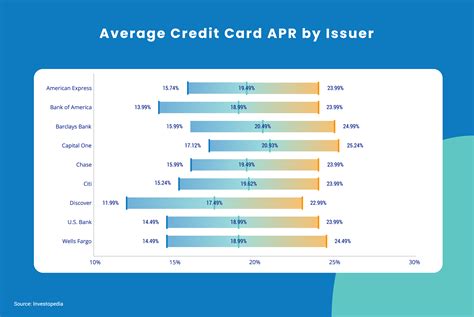

Navy Federal Credit Union's credit cards come with competitive interest rates and fees. The Navy Federal CashRewards credit card, for instance, offers a variable APR of 12.99% - 18.00% (Variable), with no foreign transaction fees or balance transfer fees. The Navy Federal GO REWARDS credit card, on the other hand, offers a variable APR of 13.99% - 18.00% (Variable), with no foreign transaction fees or balance transfer fees. These competitive interest rates and fees make Navy Federal Credit Union's credit cards an attractive option for those looking for a reliable and affordable credit card experience.

How to Avoid Interest Charges

To avoid interest charges, cardholders can pay their balances in full each month, or make timely payments. Navy Federal Credit Union's online platform and mobile app make it easy to track balances, make payments, and manage accounts. By avoiding interest charges, cardholders can save money and enjoy the benefits of their credit card without the hassle of debt.Navy Federal Credit Card Security and Protection

Navy Federal Credit Union's credit cards come with robust security and protection features, including:

- Identity theft protection

- Travel insurance and assistance

- Purchase protection

- Return protection These features provide cardholders with peace of mind, knowing that their accounts and purchases are protected.

How to Protect Your Account

To protect your account, cardholders can: * Monitor their accounts regularly * Report suspicious activity immediately * Keep their account information up-to-date * Use strong passwords and two-factor authentication By taking these steps, cardholders can protect their accounts and enjoy the benefits of their credit card without the risk of identity theft or fraud.Navy Federal Credit Card Customer Service

Navy Federal Credit Union's customer service is renowned for its excellence, with a team of dedicated professionals available to assist cardholders 24/7. Cardholders can contact customer service via phone, email, or online chat, and can expect prompt and helpful responses to their queries. Whether you're experiencing issues with your account, have questions about your credit card, or need assistance with a transaction, Navy Federal Credit Union's customer service team is always available to help.

How to Contact Customer Service

To contact customer service, cardholders can: * Call the customer service number * Email the customer service team * Use online chat * Visit a branch in person By contacting customer service, cardholders can get the help they need, when they need it.Navy Federal Credit Card Image Gallery

In conclusion, Navy Federal Credit Union's credit cards offer a range of benefits, features, and rewards that cater to the unique needs of military personnel, veterans, and their families. With competitive interest rates, no foreign transaction fees, and exclusive rewards programs, these credit cards are an attractive option for those looking for a reliable and rewarding credit card experience. Whether you're building credit, earning cashback, or enjoying travel perks, Navy Federal Credit Union has a credit card that suits your lifestyle. We invite you to share your thoughts on the best Navy Federal Credit Card options, and to explore the benefits and features of these credit cards in more detail. By choosing a Navy Federal Credit Card, you can enjoy the convenience, value, and support that comes with being a member of a reputable and member-owned credit union.