Intro

Take control of your finances with our 7 easy bi-weekly budget templates in Excel. Simplify budgeting and track expenses with these free, customizable templates. Perfect for personal or household budgeting, these templates incorporate budgeting categories, expense tracking, and financial goal setting, helping you manage your money effectively and achieve financial stability.

Are you tired of living paycheck to paycheck? Do you struggle to keep track of your finances and make ends meet? Creating a budget can be a daunting task, but with the right tools, it can be a breeze. In this article, we will explore the benefits of using bi-weekly budget templates in Excel and provide you with 7 easy-to-use templates to get you started.

Creating a budget is essential for managing your finances effectively. It helps you track your income and expenses, identify areas where you can cut back, and make informed financial decisions. With a bi-weekly budget template in Excel, you can easily manage your finances and stay on top of your spending.

One of the biggest advantages of using a bi-weekly budget template is that it helps you allocate your money more efficiently. Since you get paid every two weeks, you can plan your expenses accordingly. You can also use this template to prioritize your expenses, such as rent/mortgage, utilities, and groceries.

In this article, we will provide you with 7 easy-to-use bi-weekly budget templates in Excel. These templates are designed to help you manage your finances effectively and make the most of your money. We will also provide you with tips and tricks on how to use these templates to get the most out of them.

Why Use a Bi-Weekly Budget Template?

Using a bi-weekly budget template in Excel has several benefits. Here are some of the reasons why you should consider using one:

- Easy to use: Bi-weekly budget templates are easy to use and understand, even if you have no prior experience with budgeting.

- Customizable: You can customize the template to fit your specific needs and financial goals.

- Helps you prioritize expenses: With a bi-weekly budget template, you can prioritize your expenses and make sure you have enough money for essential expenses like rent/mortgage, utilities, and groceries.

- Reduces financial stress: Creating a budget can help reduce financial stress and anxiety.

- Helps you save money: By tracking your income and expenses, you can identify areas where you can cut back and save money.

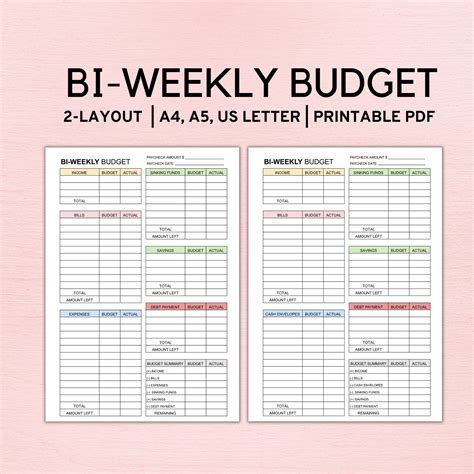

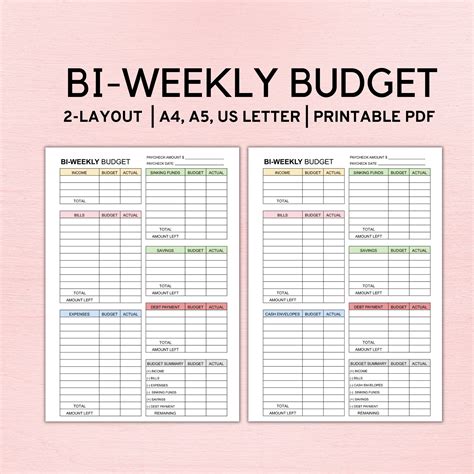

7 Easy Bi-Weekly Budget Templates in Excel

Here are 7 easy-to-use bi-weekly budget templates in Excel that you can use to manage your finances:

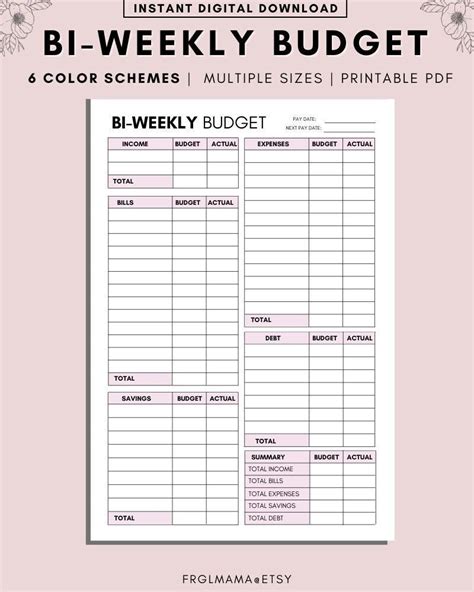

Template 1: Simple Bi-Weekly Budget Template

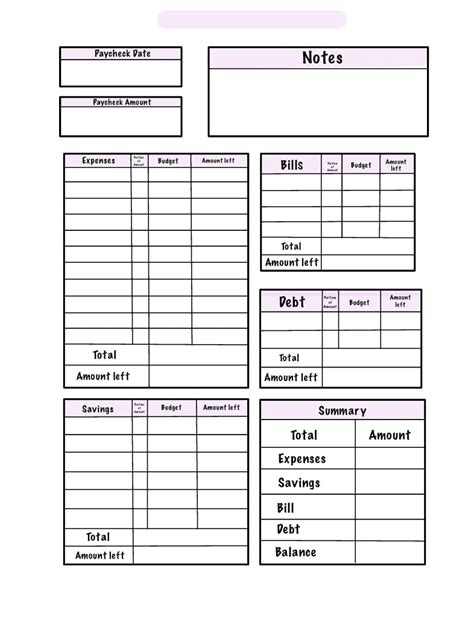

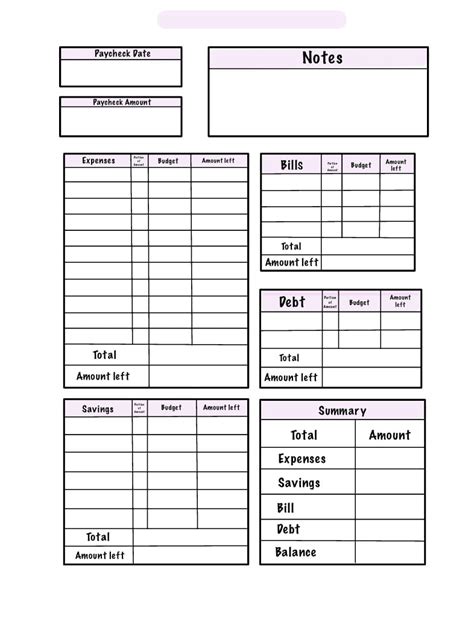

This template is perfect for those who want a simple and easy-to-use budget template. It includes columns for income, fixed expenses, variable expenses, and savings.

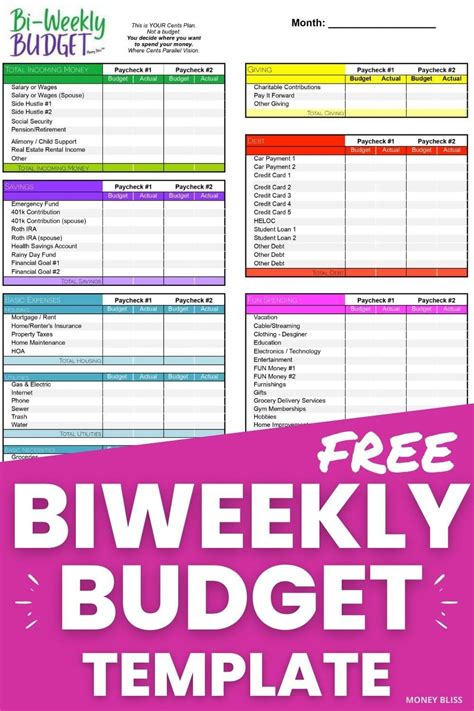

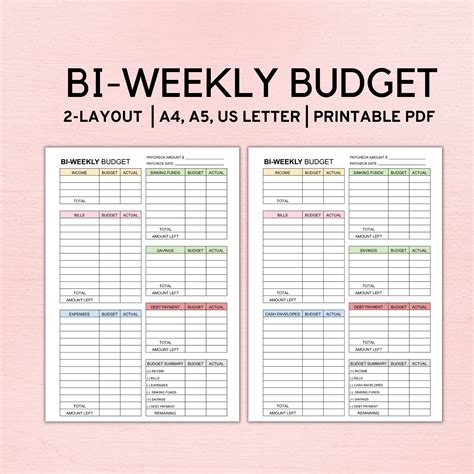

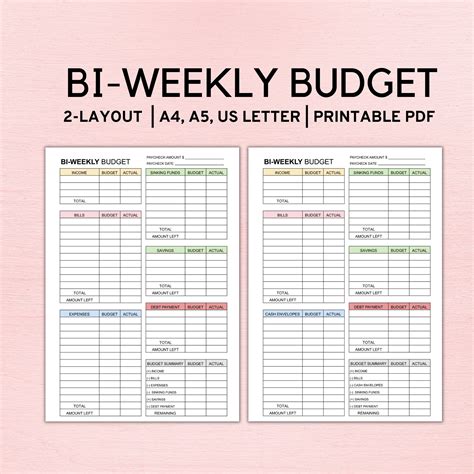

Template 2: Bi-Weekly Budget Template with Categories

This template includes categories for income, fixed expenses, variable expenses, and savings. It also includes a column for tracking expenses by category.

Template 3: Bi-Weekly Budget Template with Budgeting Goals

This template includes columns for income, fixed expenses, variable expenses, and savings, as well as a section for setting budgeting goals.

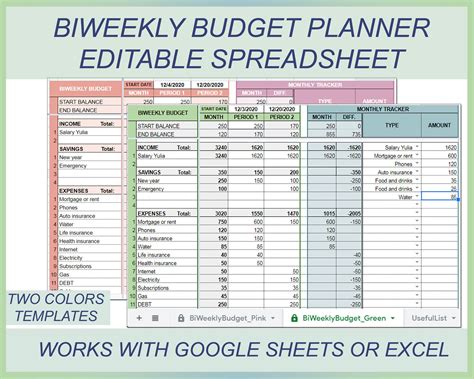

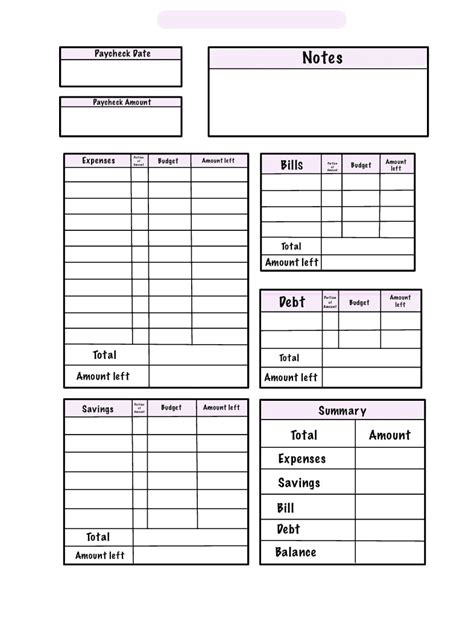

Template 4: Bi-Weekly Budget Template with Expense Tracker

This template includes columns for income, fixed expenses, variable expenses, and savings, as well as a section for tracking expenses.

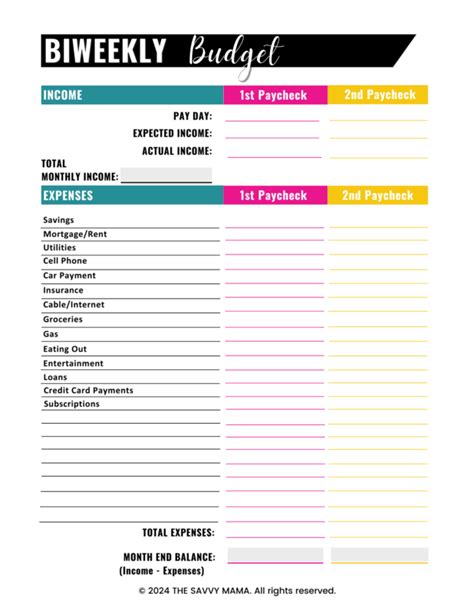

Template 5: Bi-Weekly Budget Template for Couples

This template is designed for couples who want to manage their finances together. It includes columns for joint income, joint expenses, and individual expenses.

Template 6: Bi-Weekly Budget Template for Students

This template is designed for students who want to manage their finances effectively. It includes columns for income, fixed expenses, variable expenses, and savings.

Template 7: Bi-Weekly Budget Template with Charts and Graphs

This template includes columns for income, fixed expenses, variable expenses, and savings, as well as charts and graphs to help you visualize your finances.

Tips and Tricks for Using Bi-Weekly Budget Templates

Here are some tips and tricks for using bi-weekly budget templates:

- Track your expenses: Make sure to track your expenses regularly to get an accurate picture of your spending habits.

- Prioritize expenses: Prioritize your expenses and make sure you have enough money for essential expenses like rent/mortgage, utilities, and groceries.

- Adjust as needed: Adjust your budget as needed to reflect changes in your income or expenses.

- Use formulas: Use formulas in Excel to automatically calculate your income and expenses.

- Review regularly: Review your budget regularly to make sure you are on track with your financial goals.

Gallery of Bi-Weekly Budget Templates

Bi-Weekly Budget Templates Gallery

Final Thoughts

Creating a budget is an essential step in managing your finances effectively. With a bi-weekly budget template in Excel, you can easily track your income and expenses, prioritize your expenses, and make informed financial decisions. We hope this article has provided you with the information and resources you need to create a budget that works for you.

We would love to hear from you! Do you have any favorite budgeting tips or tricks? Share them with us in the comments below.