Intro

Creating a budget can be a daunting task, but having a bi-weekly paycheck budget template in Excel can make it much more manageable. In this article, we will guide you through the process of creating a 5-step bi-weekly paycheck budget template in Excel.

Why Use a Bi-Weekly Paycheck Budget Template?

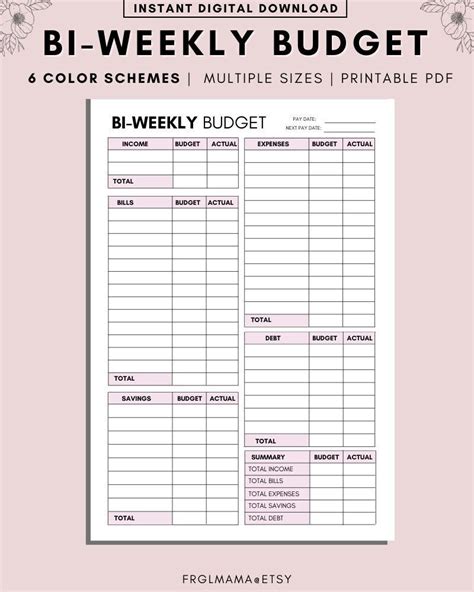

Using a bi-weekly paycheck budget template can help you manage your finances effectively. Since most people receive their paychecks bi-weekly, it makes sense to create a budget that aligns with this schedule. A bi-weekly budget template can help you track your income and expenses, make adjustments as needed, and ensure that you have enough money set aside for savings and debt repayment.

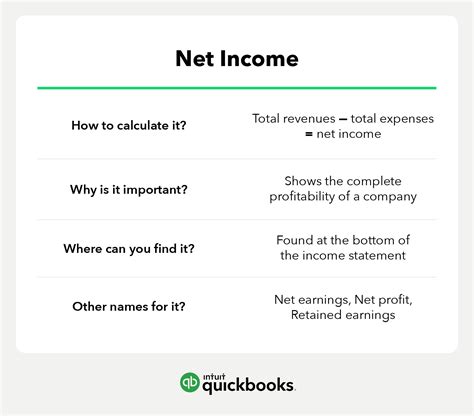

Step 1: Determine Your Net Income

The first step in creating a bi-weekly paycheck budget template is to determine your net income. This is the amount of money you take home after taxes and other deductions. You can find this information on your paycheck stub or by consulting with your HR department.

Calculating Net Income

- Gross income: $_______________

- Taxes: $_______________

- Other deductions (health insurance, 401(k), etc.): $_______________

- Net income: $_______________

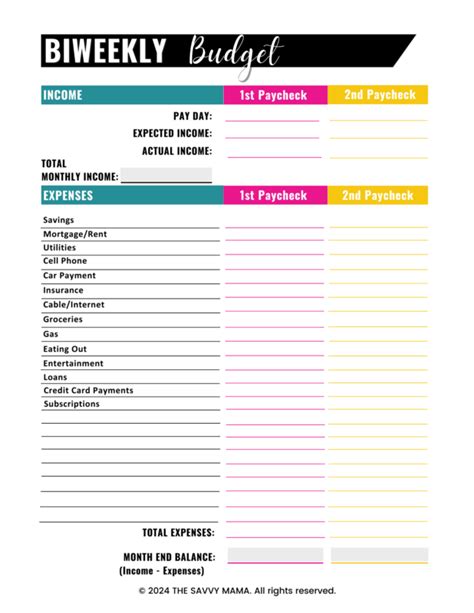

Step 2: Categorize Your Expenses

Next, you need to categorize your expenses. This will help you understand where your money is going and make adjustments as needed. Common expense categories include:

- Housing (rent/mortgage, utilities, etc.)

- Transportation (car loan/lease, gas, insurance, etc.)

- Food (groceries, dining out, etc.)

- Insurance (health, life, disability, etc.)

- Debt repayment (credit cards, loans, etc.)

- Entertainment (hobbies, movies, etc.)

- Savings (emergency fund, retirement, etc.)

Expense Categories and Estimated Costs

- Housing: $_______________

- Transportation: $_______________

- Food: $_______________

- Insurance: $_______________

- Debt repayment: $_______________

- Entertainment: $_______________

- Savings: $_______________

Step 3: Set Financial Goals

Now that you have a clear understanding of your income and expenses, it's time to set financial goals. What do you want to achieve with your budget? Do you want to pay off debt, build an emergency fund, or save for a down payment on a house? Write down your goals and prioritize them.

Short-Term Financial Goals (less than 1 year)

- Pay off credit card debt

- Build an emergency fund

- Save for a vacation

Long-Term Financial Goals (more than 1 year)

- Pay off student loans

- Save for a down payment on a house

- Retire early

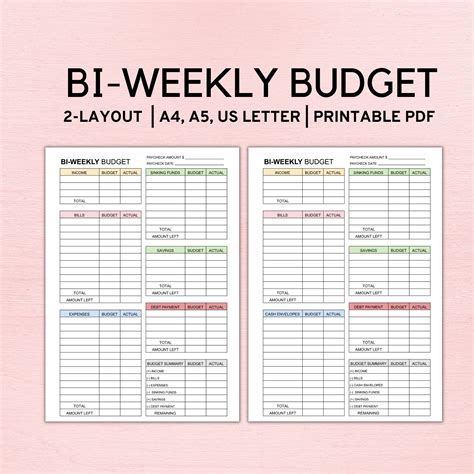

Step 4: Create a Budget Plan

Using the information from the previous steps, create a budget plan. Allocate your net income into each expense category, making sure to prioritize your financial goals. You can use the 50/30/20 rule as a guideline:

- 50% of net income goes towards necessary expenses (housing, utilities, food, etc.)

- 30% towards discretionary spending (entertainment, hobbies, etc.)

- 20% towards saving and debt repayment

Budget Plan Example

- Net income: $4,000

- Necessary expenses: $2,000 (50%)

- Discretionary spending: $1,200 (30%)

- Savings and debt repayment: $800 (20%)

Step 5: Track and Adjust

The final step is to track your expenses and adjust your budget plan as needed. Use a budgeting app or spreadsheet to monitor your spending and ensure you're staying on track. Make adjustments to your budget plan regularly to reflect changes in your income, expenses, or financial goals.

Tracking Expenses

- Use a budgeting app or spreadsheet to track expenses

- Review budget plan regularly (every 2-3 months)

- Make adjustments as needed

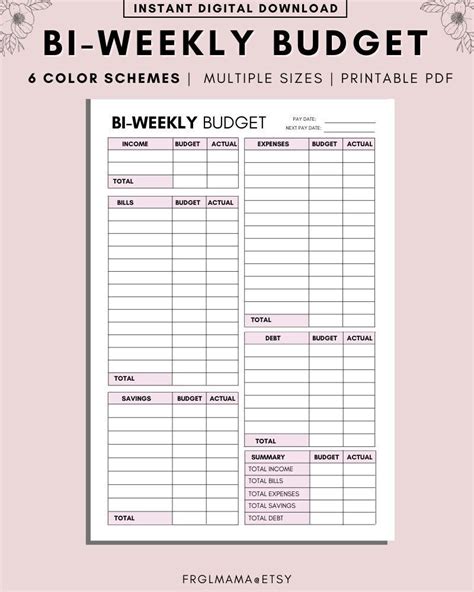

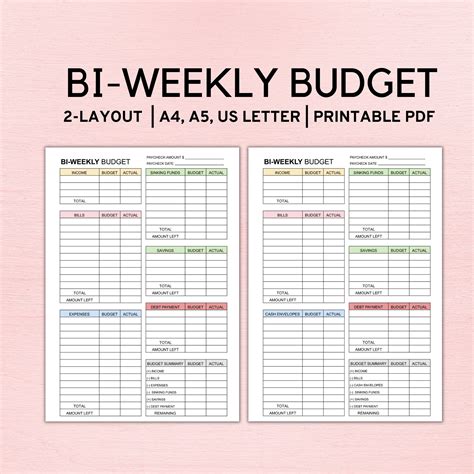

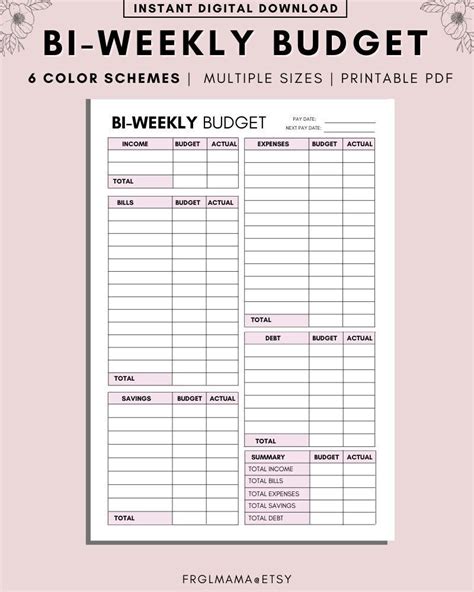

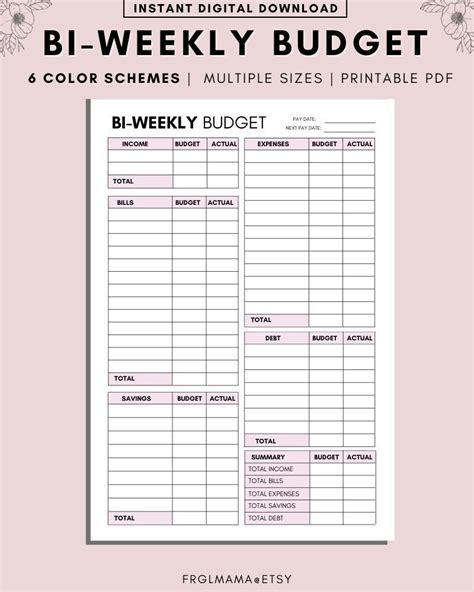

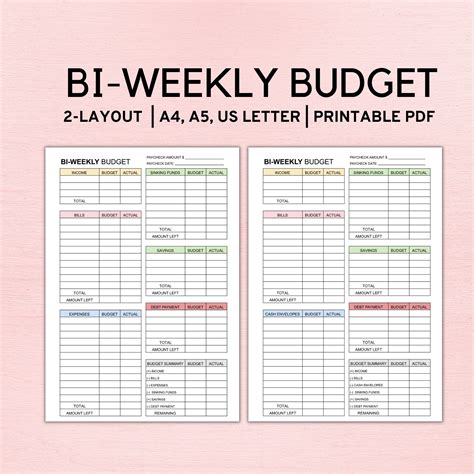

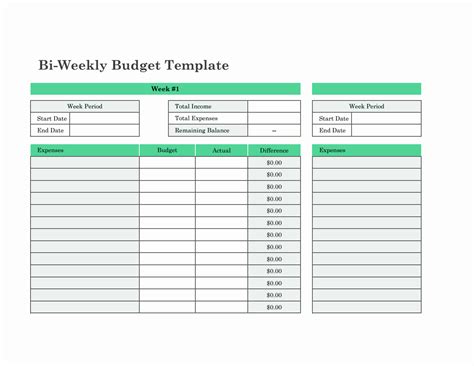

Bi-Weekly Paycheck Budget Template Excel Gallery

By following these 5 steps and creating a bi-weekly paycheck budget template in Excel, you can take control of your finances and achieve your financial goals. Remember to track your expenses and adjust your budget plan regularly to ensure you're staying on track.