Intro

Simplify bill pay with Excel templates and streamline your finances. Discover 5 easy ways to automate and organize your bills, payments, and budgeting using pre-designed templates. Learn how to reduce financial stress and increase productivity with Excels bill pay solutions, including budget trackers, payment schedules, and invoice templates.

Keeping track of bills and managing finances can be a daunting task, especially for those who are not familiar with accounting or financial management. However, with the help of Excel templates, simplifying bill pay has become easier and more efficient. In this article, we will explore five ways to simplify bill pay using Excel templates, and provide a comprehensive guide on how to create and use these templates.

Understanding the Importance of Bill Pay Management

Managing bill payments is crucial for both individuals and businesses. Late payments can result in late fees, penalties, and even damage to credit scores. Furthermore, keeping track of multiple bills and due dates can be overwhelming, leading to missed payments and financial stress.

The Benefits of Using Excel Templates for Bill Pay

Excel templates offer a range of benefits for managing bill payments, including:

- Easy tracking of bills and due dates

- Automated calculations and reminders

- Customizable templates to suit individual or business needs

- Ability to generate reports and summaries

- Improved financial organization and planning

5 Ways to Simplify Bill Pay with Excel Templates

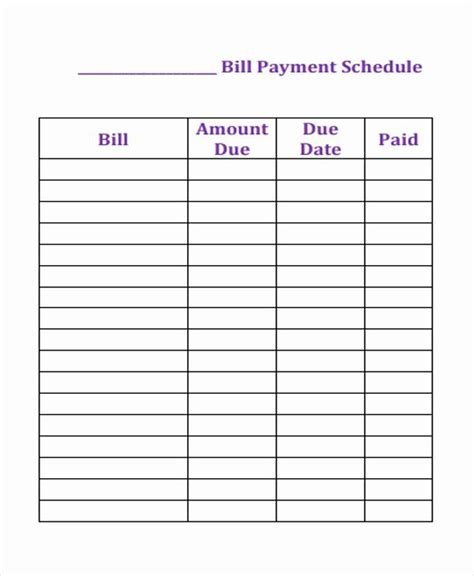

1. Create a Bill Tracker Template

A bill tracker template is a simple and effective way to keep track of bills and due dates. This template can be customized to include columns for bill name, due date, payment amount, and payment status.

To create a bill tracker template, follow these steps:

- Create a new Excel spreadsheet

- Set up columns for bill name, due date, payment amount, and payment status

- Enter the bill information and due dates

- Use conditional formatting to highlight overdue bills

2. Use a Budgeting Template

A budgeting template can help individuals and businesses track income and expenses, and make informed financial decisions. This template can be used to allocate funds for bill payments and ensure that there is enough money in the budget for all necessary payments.

To create a budgeting template, follow these steps:

- Create a new Excel spreadsheet

- Set up columns for income, fixed expenses, variable expenses, and savings

- Enter the budget information and allocate funds for bill payments

- Use formulas to calculate totals and percentages

3. Set Up Automatic Reminders

Automatic reminders can be set up using Excel templates to ensure that bill payments are made on time. This can be done using the "Reminder" function in Excel, which sends an email reminder to the user when a bill is due.

To set up automatic reminders, follow these steps:

- Create a new Excel spreadsheet

- Set up a column for due dates and reminders

- Enter the bill information and due dates

- Use the "Reminder" function to set up automatic reminders

4. Generate Reports and Summaries

Excel templates can be used to generate reports and summaries of bill payments, which can be useful for tracking financial progress and identifying areas for improvement.

To generate reports and summaries, follow these steps:

- Create a new Excel spreadsheet

- Set up columns for bill name, due date, payment amount, and payment status

- Enter the bill information and due dates

- Use formulas to calculate totals and percentages

- Use the "Report" function to generate reports and summaries

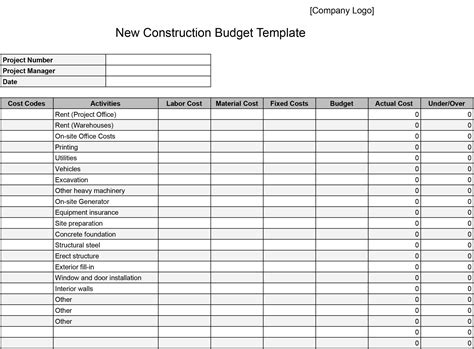

5. Customize Templates for Business Use

Excel templates can be customized for business use to track multiple bills and payments, and to generate reports and summaries for financial analysis.

To customize templates for business use, follow these steps:

- Create a new Excel spreadsheet

- Set up columns for bill name, due date, payment amount, and payment status

- Enter the bill information and due dates

- Use formulas to calculate totals and percentages

- Use the "Report" function to generate reports and summaries

Gallery of Bill Pay Templates

Bill Pay Template Gallery

Final Thoughts

Simplifying bill pay with Excel templates can save time, reduce stress, and improve financial organization. By following the steps outlined in this article, individuals and businesses can create customized templates to track bills, generate reports, and stay on top of finances. Whether you're a busy professional or a small business owner, Excel templates can help you streamline your bill pay process and achieve financial peace of mind.

We hope this article has provided you with valuable insights and practical tips on how to simplify bill pay with Excel templates. If you have any questions or comments, please feel free to share them below.