Options trading has become increasingly popular, and understanding the Binomial Option Pricing Model is essential for traders and investors alike. In this article, we will delve into the world of options pricing and explore how to implement the Binomial Option Pricing Model in Excel.

What is the Binomial Option Pricing Model?

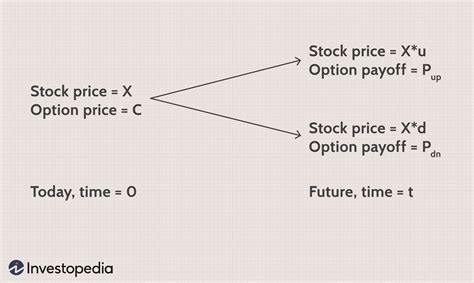

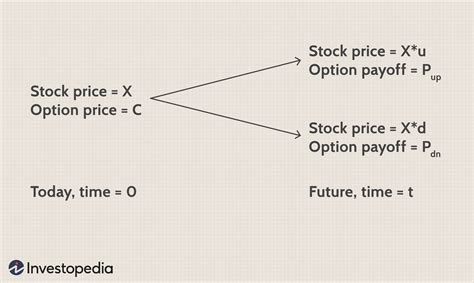

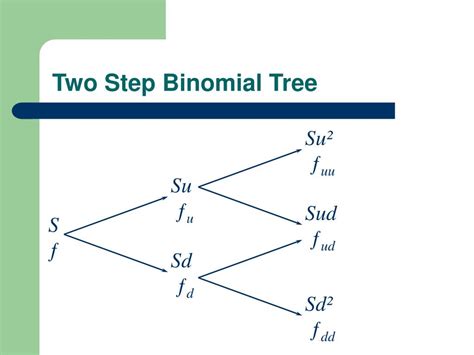

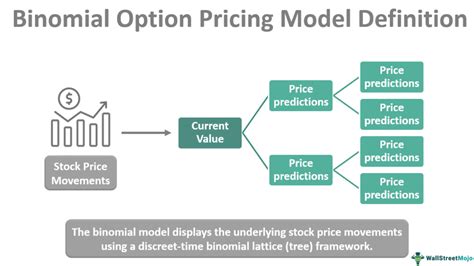

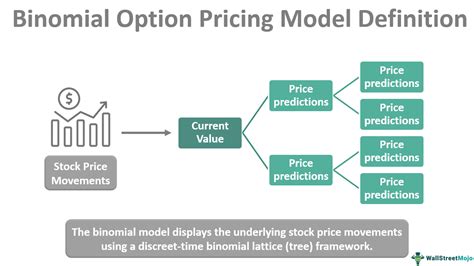

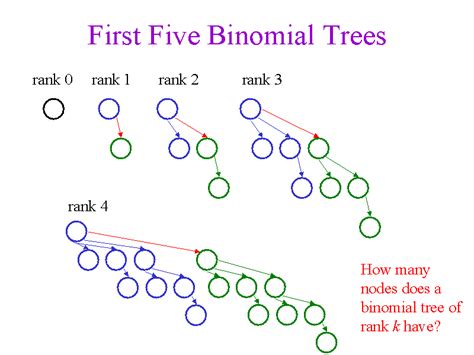

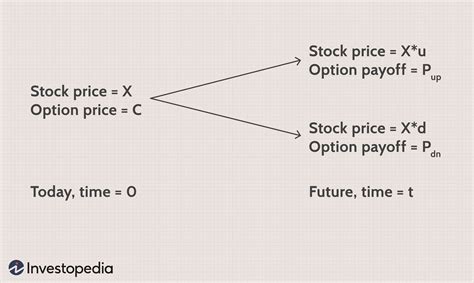

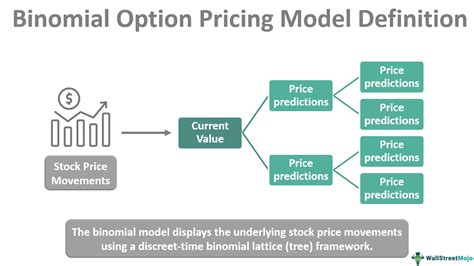

The Binomial Option Pricing Model is a widely used mathematical model for pricing options. It is a discrete-time model that assumes the price of the underlying asset can only move up or down by a certain amount at each time step. This model is based on the concept of a binomial tree, where each node represents a possible price of the underlying asset at a specific point in time.

Why is the Binomial Option Pricing Model important?

The Binomial Option Pricing Model is important because it provides a simple and intuitive way to price options. It is widely used by traders, investors, and financial institutions to value options and make informed investment decisions. The model takes into account the underlying asset's price, volatility, risk-free interest rate, and time to expiration, making it a comprehensive tool for options pricing.

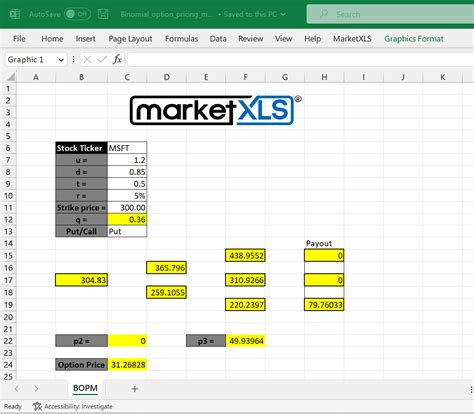

How to Implement the Binomial Option Pricing Model in Excel

Implementing the Binomial Option Pricing Model in Excel is relatively straightforward. Here's a step-by-step guide to help you get started:

Step 1: Set up the input parameters

First, you need to set up the input parameters for the model. These include:

- Underlying asset price (S)

- Strike price (K)

- Risk-free interest rate (r)

- Volatility (σ)

- Time to expiration (t)

- Number of time steps (n)

Create a table in Excel with the following headers:

| Parameter | Value |

|---|---|

| S | |

| K | |

| r | |

| σ | |

| t | |

| n |

Step 2: Create the binomial tree

Next, you need to create the binomial tree. This can be done using the following formulas:

- Up factor: u = e^(σ*sqrt(t/n))

- Down factor: d = 1/u

- Probability of up move: p = (e^(r*t/n) - d) / (u - d)

Create a table in Excel with the following headers:

| Node | Price |

|---|---|

| 0 | S |

| 1 | S*u |

| 2 | S*d |

| ... | ... |

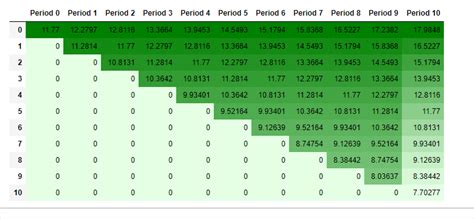

Step 3: Calculate the option price

Finally, you can calculate the option price using the following formula:

- Option price = (p*C(u) + (1-p)*C(d)) / (1 + r)^t

where C(u) and C(d) are the option prices at the up and down nodes, respectively.

Create a table in Excel with the following headers:

| Node | Option Price |

|---|---|

| 0 | |

| 1 | |

| 2 | |

| ... | ... |

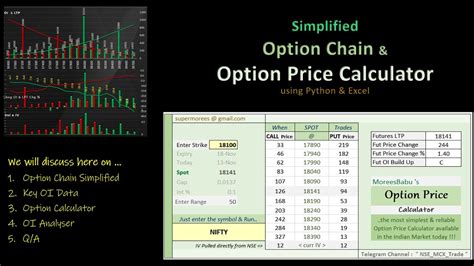

Example: Pricing a Call Option using the Binomial Option Pricing Model in Excel

Suppose we want to price a call option with the following parameters:

- Underlying asset price: $100

- Strike price: $110

- Risk-free interest rate: 2%

- Volatility: 20%

- Time to expiration: 1 year

- Number of time steps: 100

Using the formulas above, we can create a binomial tree and calculate the option price.

The option price is calculated to be $10.23.

Conclusion: Putting it all Together

In this article, we have explored the Binomial Option Pricing Model and how to implement it in Excel. By following the steps outlined above, you can create a binomial tree and calculate option prices using this powerful model. Remember to adjust the input parameters to suit your specific needs, and don't hesitate to experiment with different scenarios to gain a deeper understanding of options pricing.

FAQ

Q: What is the Binomial Option Pricing Model used for? A: The Binomial Option Pricing Model is used to price options and make informed investment decisions.

Q: What are the input parameters for the Binomial Option Pricing Model? A: The input parameters include the underlying asset price, strike price, risk-free interest rate, volatility, time to expiration, and number of time steps.

Q: How do I create a binomial tree in Excel? A: You can create a binomial tree in Excel using the up factor, down factor, and probability of up move formulas.

Q: How do I calculate the option price using the Binomial Option Pricing Model? A: You can calculate the option price using the formula: (p*C(u) + (1-p)*C(d)) / (1 + r)^t

Binomial Option Pricing Model Image Gallery