Intro

Master the art of options pricing with our comprehensive guide on 5 ways to build a binomial tree model in Excel. Learn to estimate asset prices, calculate volatility, and forecast potential outcomes using lattice models. Discover how to create a binomial tree in Excel, including option pricing, risk-neutral probabilities, and node valuation.

The binomial tree model, also known as the binomial lattice model or Cox-Ross-Rubinstein (CRR) model, is a mathematical model used to price options and other financial derivatives. It's a powerful tool for analysts and finance professionals to estimate the value of complex financial instruments. In this article, we'll explore five ways to build a binomial tree model in Excel.

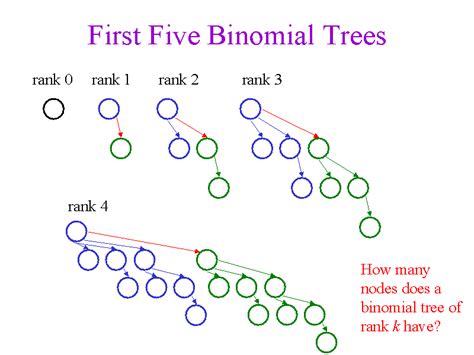

What is a Binomial Tree Model?

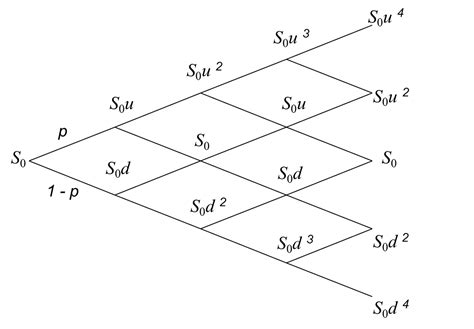

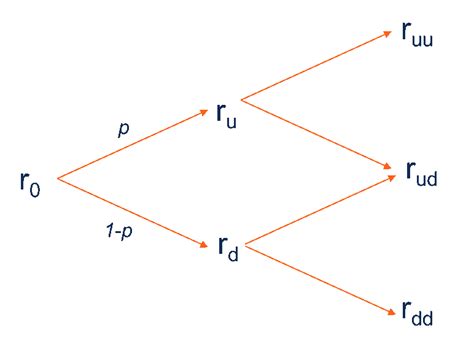

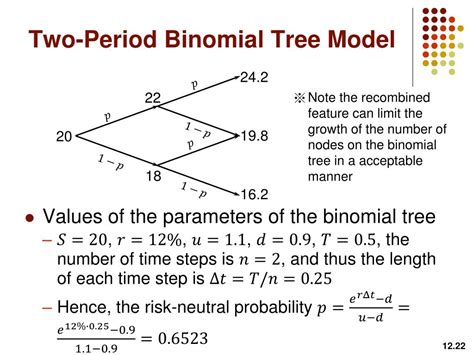

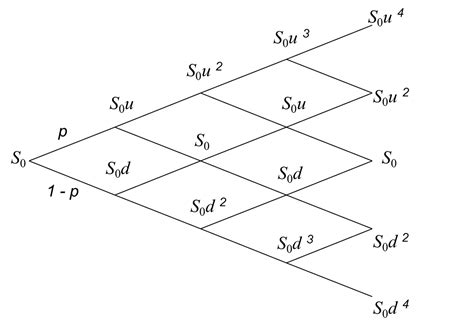

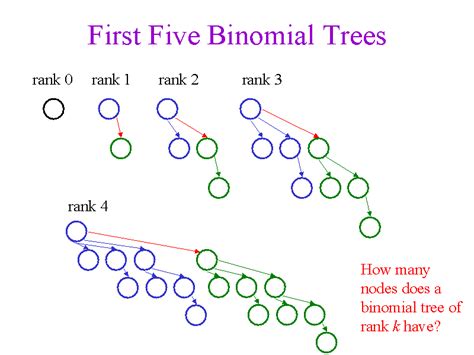

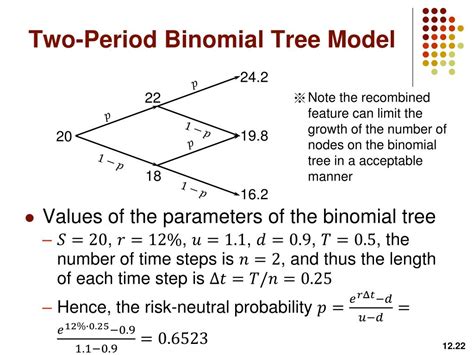

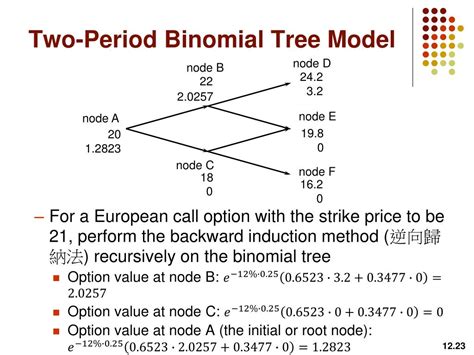

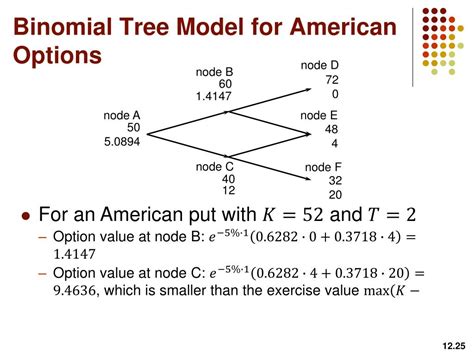

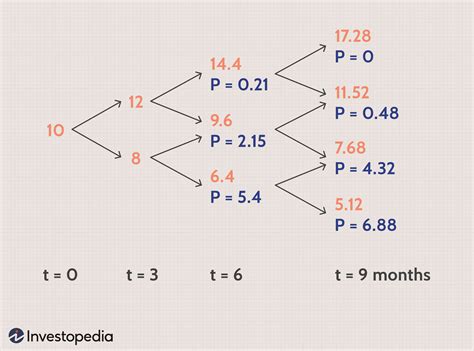

A binomial tree model is a discrete-time model that describes the evolution of the price of an underlying asset over time. The model assumes that the price of the asset can only move up or down by a certain percentage at each time step, resulting in a tree-like structure of possible prices. The model is widely used to price American and European options, as well as other exotic derivatives.

Why Build a Binomial Tree Model in Excel?

Excel is a popular choice for building binomial tree models due to its flexibility and ease of use. By building a binomial tree model in Excel, you can:

- Easily visualize the tree structure and price movements

- Quickly calculate option prices and sensitivities

- Analyze the impact of different parameters on option prices

- Create dynamic models that can be updated with new data

Method 1: Using Excel Formulas

One way to build a binomial tree model in Excel is to use formulas to calculate the price movements and option values. This method requires a good understanding of the underlying mathematics and can be time-consuming to set up. However, it provides a high degree of flexibility and customization.

To build a binomial tree model using Excel formulas, you'll need to:

- Set up a table to store the price movements and option values

- Use formulas to calculate the up and down price movements at each time step

- Use formulas to calculate the option values at each node

Method 2: Using Excel VBA

Another way to build a binomial tree model in Excel is to use Visual Basic for Applications (VBA). VBA is a programming language that allows you to create custom functions and automate tasks in Excel. By using VBA, you can create a binomial tree model that is more efficient and scalable than a formula-based approach.

To build a binomial tree model using VBA, you'll need to:

- Create a new module in the Visual Basic Editor

- Write code to define the binomial tree parameters and calculate the price movements and option values

- Use the code to create a binomial tree model in Excel

Method 3: Using Excel Add-ins

Excel add-ins are software programs that provide additional functionality to Excel. There are several add-ins available that can help you build a binomial tree model in Excel, including:

- Binomial Tree Model add-in by Excel-Formulas.com

- Option Pricing Model add-in by Derivative Valuation

To build a binomial tree model using an Excel add-in, you'll need to:

- Download and install the add-in

- Follow the instructions provided by the add-in to set up the binomial tree model

Method 4: Using Excel Templates

Excel templates are pre-built spreadsheets that provide a starting point for building a binomial tree model. There are several templates available online that can help you get started, including:

- Binomial Tree Model template by Vertex42

- Option Pricing Template by WallStreetMojo

To build a binomial tree model using an Excel template, you'll need to:

- Download the template

- Follow the instructions provided by the template to set up the binomial tree model

Method 5: Using Excel Macros

Excel macros are a series of automated tasks that can be recorded and played back to perform a specific task. By recording a macro, you can automate the process of building a binomial tree model in Excel.

To build a binomial tree model using an Excel macro, you'll need to:

- Record a macro that sets up the binomial tree model

- Edit the macro code to customize the model

Gallery of Binomial Tree Models

Binomial Tree Model Image Gallery

We hope this article has provided you with a comprehensive guide to building a binomial tree model in Excel. Whether you're a finance professional or a student, we encourage you to try out these methods and explore the world of option pricing and financial modeling. If you have any questions or comments, please feel free to share them below!