Intro

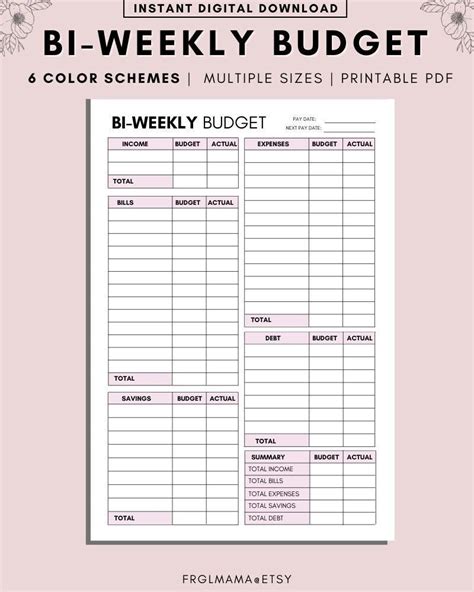

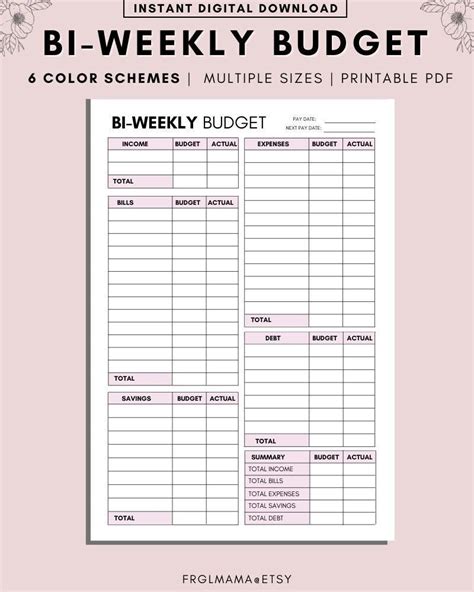

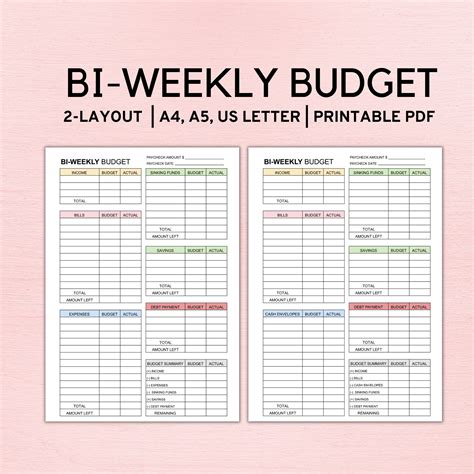

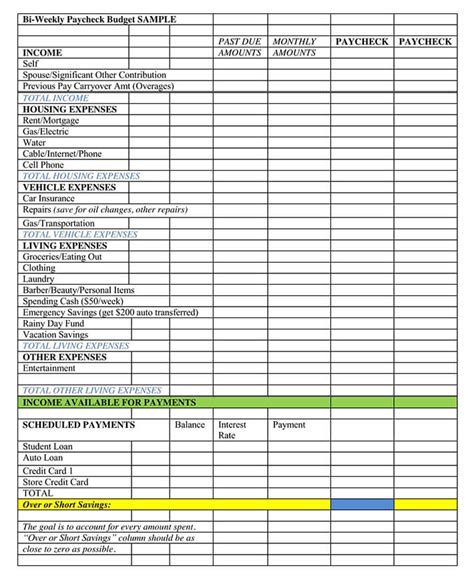

Streamline your finances with our biweekly budget template printable. Easily track income and expenses, and plan your money management with our customizable template. Perfect for payroll budgeting, this template includes columns for income, fixed expenses, and savings goals, helping you stay on top of your finances and achieve financial stability.

Are you tired of living paycheck to paycheck? Do you struggle to keep track of your expenses and stay on top of your finances? If so, you're not alone. Many people find it challenging to manage their money effectively, but with the right tools and strategies, you can take control of your financial situation and start building a more secure future.

One of the most effective ways to manage your finances is by using a budget template. A budget template is a pre-designed spreadsheet or worksheet that helps you track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your resources. In this article, we'll explore the benefits of using a biweekly budget template printable and provide you with some tips and strategies for getting the most out of this valuable tool.

Why Use a Biweekly Budget Template Printable?

Using a biweekly budget template printable can help you stay on top of your finances and achieve your financial goals. Here are just a few of the benefits of using this type of template:

- Simplifies budgeting: A biweekly budget template printable makes it easy to track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your resources.

- Helps you stay organized: By using a budget template, you can keep all of your financial information in one place, making it easier to stay organized and focused.

- Reduces stress: By taking control of your finances, you can reduce stress and anxiety and feel more confident and secure.

How to Use a Biweekly Budget Template Printable

Using a biweekly budget template printable is easy. Here are the steps to follow:

- Download and print the template: Start by downloading and printing the biweekly budget template printable. You can find many free templates online, or you can create your own using a spreadsheet program like Microsoft Excel.

- Enter your income and expenses: Next, enter your income and expenses into the template. Be sure to include all sources of income, as well as all of your regular expenses, such as rent/mortgage, utilities, groceries, and transportation.

- Identify areas for reduction: Once you have entered all of your income and expenses, take a close look at your budget to identify areas where you can cut back. Consider ways to reduce your expenses, such as by canceling subscription services or finding ways to save on groceries.

- Make adjustments and track your progress: Finally, make adjustments to your budget as needed, and track your progress over time. Use the template to monitor your spending and stay on track with your financial goals.

Tips for Using a Biweekly Budget Template Printable

Here are a few tips to keep in mind when using a biweekly budget template printable:

- Be realistic: When creating your budget, be realistic about your income and expenses. Don't underestimate your expenses or overestimate your income.

- Prioritize needs over wants: When allocating your resources, prioritize your needs over your wants. Make sure to cover essential expenses, such as rent/mortgage, utilities, and groceries, before spending money on discretionary items.

- Use the 50/30/20 rule: Consider using the 50/30/20 rule to allocate your income. This rule suggests that 50% of your income should go towards essential expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Benefits of Using a Biweekly Budget Template Printable

Using a biweekly budget template printable can have a number of benefits, including:

- Improved financial management: By using a budget template, you can take control of your finances and make informed decisions about how to allocate your resources.

- Reduced stress: By staying on top of your finances, you can reduce stress and anxiety and feel more confident and secure.

- Increased savings: By prioritizing your needs over your wants and allocating your resources effectively, you can increase your savings and achieve your long-term financial goals.

Common Mistakes to Avoid When Using a Biweekly Budget Template Printable

Here are a few common mistakes to avoid when using a biweekly budget template printable:

- Not tracking expenses: Failing to track your expenses can make it difficult to stay on top of your finances and make informed decisions about how to allocate your resources.

- Not prioritizing needs over wants: Failing to prioritize your needs over your wants can lead to financial stress and anxiety.

- Not regularly reviewing and adjusting the budget: Failing to regularly review and adjust your budget can make it difficult to stay on track with your financial goals.

Alternatives to Biweekly Budget Template Printables

If you're not comfortable using a biweekly budget template printable, there are a number of alternatives you can consider. Here are a few options:

- Spreadsheets: Consider using a spreadsheet program like Microsoft Excel to create a budget template.

- Budgeting apps: Consider using a budgeting app like Mint or You Need a Budget (YNAB) to track your income and expenses and stay on top of your finances.

- Pen and paper: Consider using a pen and paper to create a budget template. This can be a simple and effective way to track your income and expenses and stay on top of your finances.

Conclusion

Using a biweekly budget template printable can be a great way to take control of your finances and achieve your financial goals. By following the tips and strategies outlined in this article, you can get the most out of this valuable tool and start building a more secure financial future.

We hope this article has been helpful in explaining the benefits and uses of a biweekly budget template printable. If you have any questions or comments, please don't hesitate to reach out. We'd love to hear from you!

Biweekly Budget Template Image Gallery