Intro

Understanding the Black Scholes Calculator Excel

The Black Scholes calculator Excel is a powerful tool used to calculate the theoretical value of a call option or a put option. Developed by Fischer Black, Myron Scholes, and Robert Merton in the 1970s, the Black Scholes model is a widely accepted method for pricing options. In this article, we will explore the Black Scholes calculator Excel, its importance, and how to use it.

What is the Black Scholes Model?

The Black Scholes model is a mathematical formula used to estimate the value of a call option or a put option. The model takes into account several factors, including the current stock price, strike price, time to expiration, risk-free interest rate, and volatility. By using these inputs, the model calculates the theoretical value of the option.

How to Use the Black Scholes Calculator Excel

Using the Black Scholes calculator Excel is straightforward. Here are the steps to follow:

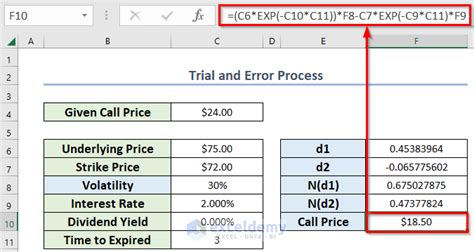

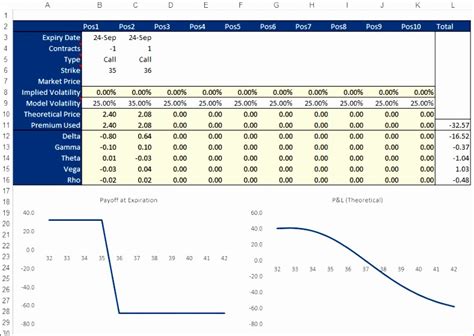

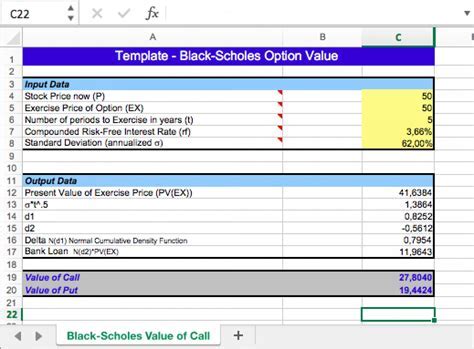

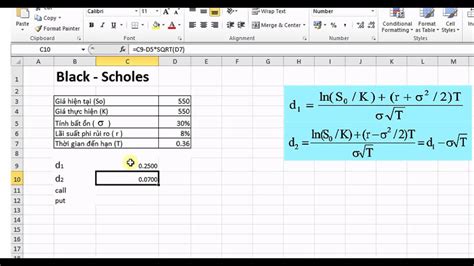

- Input the required data: Enter the current stock price, strike price, time to expiration, risk-free interest rate, and volatility into the calculator.

- Select the option type: Choose whether you want to calculate the value of a call option or a put option.

- Run the calculation: Click the "Calculate" button to run the Black Scholes model and obtain the theoretical value of the option.

Interpreting the Results

Once you have run the calculation, the Black Scholes calculator Excel will display the theoretical value of the option. This value represents the estimated worth of the option based on the inputs you provided.

Understanding the Black Scholes Formula

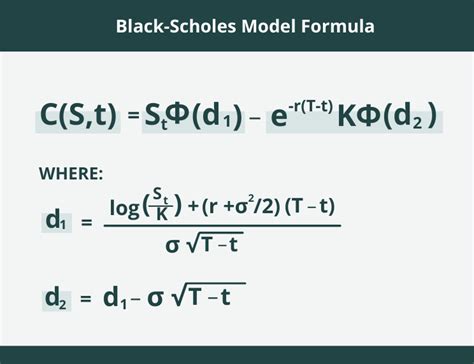

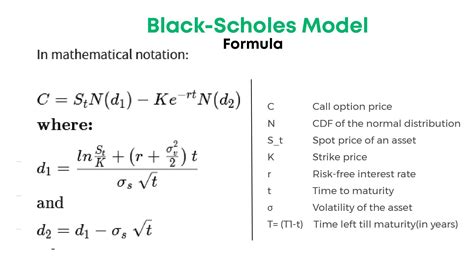

The Black Scholes formula is a complex mathematical equation that calculates the theoretical value of an option. The formula is as follows:

Call Option:

C = S * N(d1) - X * e^(-r*t) * N(d2)

Put Option:

P = X * e^(-r*t) * N(-d2) - S * N(-d1)

Where:

- C = call option price

- P = put option price

- S = current stock price

- X = strike price

- r = risk-free interest rate

- t = time to expiration

- N(d1) and N(d2) = cumulative distribution functions

Advantages of the Black Scholes Model

The Black Scholes model has several advantages, including:

- Easy to use: The model is relatively simple to understand and use, even for those without extensive mathematical knowledge.

- Widely accepted: The Black Scholes model is widely accepted as a standard method for pricing options.

- Accurate: The model provides accurate estimates of option values, assuming that the inputs are correct.

Limitations of the Black Scholes Model

While the Black Scholes model is a powerful tool, it has several limitations, including:

- Assumes constant volatility: The model assumes that volatility remains constant over time, which is not always the case.

- Ignores dividends: The model does not take into account dividend payments, which can affect option values.

- Does not account for interest rate changes: The model assumes that interest rates remain constant, which is not always the case.

Real-World Applications of the Black Scholes Model

The Black Scholes model has several real-world applications, including:

- Options trading: The model is widely used by options traders to estimate the value of options.

- Risk management: The model is used by risk managers to estimate the potential losses or gains from options positions.

- Derivatives pricing: The model is used to price other types of derivatives, such as futures and forwards.

Alternatives to the Black Scholes Model

There are several alternatives to the Black Scholes model, including:

- Binomial model: A discrete-time model that uses a binomial distribution to estimate option values.

- Finite difference model: A numerical method that uses finite differences to estimate option values.

- Monte Carlo simulation: A simulation-based method that uses random sampling to estimate option values.

Conclusion

The Black Scholes calculator Excel is a powerful tool for estimating the theoretical value of options. While the model has several limitations, it remains a widely accepted and widely used method for pricing options. By understanding the Black Scholes model and its limitations, traders and risk managers can make more informed decisions about options trading and risk management.

Black Scholes Calculator Excel Image Gallery

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below.